India’s EV charging infrastructure has undergone significant transformation in recent years, with rapid increases in both battery charging and battery swapping stations nationwide. Sales of electric vehicles (EVs) soared to over 1.5 million in 2023 from around 160,000 in 2019, marking an increase of nearly 10 times in just four years. Similarly, the expansion of public charging stations has been remarkable; from merely 451 public chargers in 2021, the number escalated to more than 13,000 by the end of 2023 to 16,000 by March 2024, according to the Bureau of Energy Efficiency (BEE).

This number of public chargers could potentially reach up to 30,000 as more private operators begin to register their charging stations on the BEE portal, feels Preetesh Singh, Specialist – CASE and Alternate Powertrains at Nomura Research Institute (NRI). In this article, he shares exclusive insights into the development of EV charging infrastructure in India.

The existing landscape of EV charging station deployment

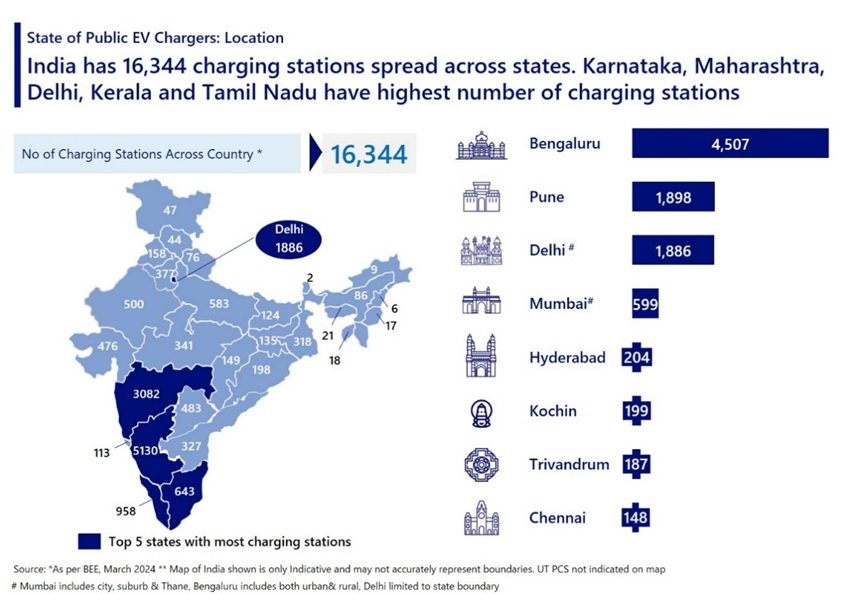

While the overall number of charging stations has been on the rise, the geographic distribution could still be improved. Delhi, notorious for its severe air pollution, was one of the initial cities to undertake substantial pilot projects for charging infrastructure and accounted for about 25% of all public charging stations by the end of 2022. By the end of 2023, Pune had surpassed Delhi with the highest number of public charging stations. However, by the close of 2023, Pune took the lead in the number of public charging stations. By March 2024, Bangalore had surpassed Pune with approximately 4,500 public charging stations, positioning Karnataka as the state with the most stations. Other southern states, such as Andhra Pradesh and Kerala, also saw considerable growth, indicating an expansion of infrastructure across these regions.

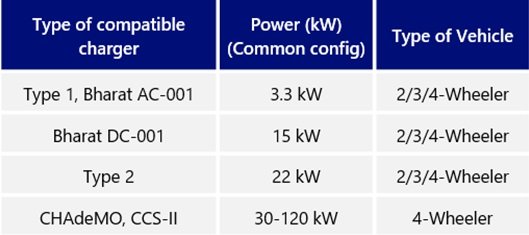

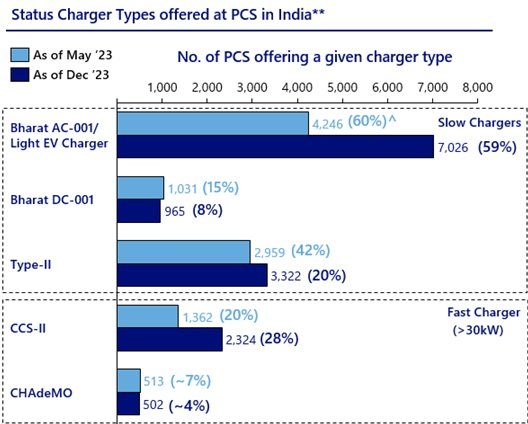

In terms of charger types, Bharat AC-001/Light EV Chargers are the predominant choice at public charging facilities, with 59% of all stations equipped with at least one such charging gun. These units are particularly well-suited for smaller vehicles such as 2Ws and 3Ws. Although they can charge passenger cars and light commercial vehicles (LCVs), their charging speed makes them more ideal for 2Ws and 3Ws.

Additionally, Type-II AC chargers, which provide a power output ranging from 7.2 to 22 kW, are increasingly being used for 3Ws and 4Ws due to their higher power capabilities.

For fast charging needs, particularly for 4Ws, the CCS2 configuration has become the standard among most automobile manufacturers in India. This is reflected in the data from BEE, which shows that approximately 20% of the country’s charging stations featured at least one CCS-2 gun in May 2023. By December 2023, this figure had risen to 28%, demonstrating a growing agreement among OEMs and Charging Point Operators (CPOs) to develop a standardized, interoperable charging solution for 4W passenger vehicles. On the other hand, the presence of CHAdeMO-type chargers has slightly decreased in terms of absolute numbers.

With the majority of slow chargers providing a single gun per charger and fast chargers equipped with two guns per charger, the ratio of EVs to charging points in India has increased to between 120 and 150:1, significantly deviating from the international standard of 10:1. However, when these figures are examined in the context of actual charging patterns among Indian users, they appear less concerning.

An often-overlooked element is the specific use cases like last-mile delivery services that depend significantly on captive charging infrastructure. Similarly, 4W EV fleets have embraced a high adoption rate where captive charging remains the preferred method of charging. Most personal 2Ws are charged at home, and remarkably, more than 80% of charging for personal 4Ws also occurs at home.

This indicates that the true requirement for public charging stations is not fully reflected by simply adopting global benchmarks on the number of chargers per EV from countries with advanced EV markets. Yet, the development of charging infrastructure in residential complexes within urban settings could challenge this predominance of home charging as numbers grow, making the expansion of public charging infrastructure essential to support ongoing EV adoption.

Accessibility, payment options, and challenges with charging infrastructure

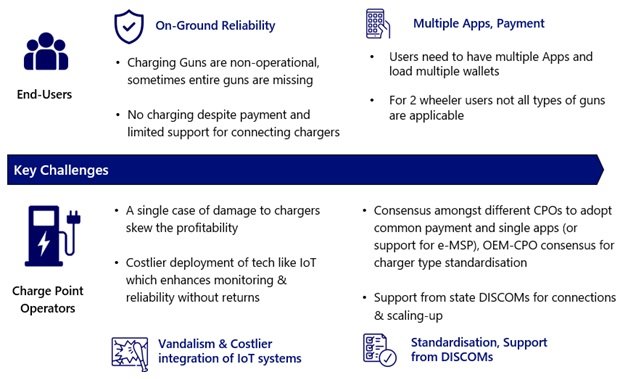

Initially, one of the primary challenges for users was locating charging stations, as this often required navigating multiple apps. However, as the installation of charging stations by various CPOs expands and diversifies across the country, the issue of discoverability becomes less pressing.

EV consumers can generally be categorized into commercial fleet users, frequent intra-city drivers, and those who often travel inter-city. It is predominantly the inter-city travellers who encounter the most significant difficulties in locating charging points. For most users, the real challenge lies in the availability and reliability of these charging points. Issues range from finding an available charging slot to difficulties in connecting to the charger and initiating the charge, with severe cases involving malfunctioning or poorly maintained equipment due to vandalism at unmanned stations.

Payment for charging also poses a challenge; users must preload funds into e-wallets designated for specific CPOs to initiate charging. Given India’s robust digital payment infrastructure, such as UPI, adopting a uniform UPI system across CPOs could simplify the payment process immensely. This would enhance interoperability across different charging networks, facilitating seamless transactions for users at any station.

Hardware interface interoperability and standardization challenges

Another significant challenge is the standardisation and interoperability of hardware interfaces. In India, stakeholders have a growing consensus to adopt CCS2 for 4Ws, aligning with global practices. However, this standard is vulnerable to disruption should major OEMs choose alternative charging technologies or new global OEMs enter the Indian market with different standards. For two and three-wheelers, the absence of a common charging standard further complicates the expansion of charging infrastructure.

Standardization issues extend beyond fixed charging stations to include battery swapping stations. Though there was an initial governmental push to standardize these technologies, industry players have called for more flexible regulations to accommodate the emerging market. Nonetheless, as the number of users, particularly among commercial 2W and 3W operators, continues to rise, there will be an increasing demand for standardization to facilitate broader adoption.

These complexities highlight the dynamic and evolving landscape of India’s EV charging infrastructure, underscoring the need for continued innovation and regulatory support to foster sustainable growth in this vital sector.

Way forward

As India’s EV market continues to expand, the importance of scaling up the charging infrastructure, especially in densely populated urban areas, cannot be overstated. The number of charging stations needs to increase, but it is equally important to sensitize EV users about best practices for charging. Comprehensive training and additional support from state governments are essential to accelerate the development of charging infrastructure, addressing the diverse needs across different regions and ultimately driving India’s sustainability ambitions forward. This multifaceted approach will not only support the current EV market but also prepare it for future growth, ensuring that the charging infrastructure can keep pace with the increasing number of EVs on India’s roads.

Special thanks to Athul Nambolan, Senior Consultant and Chirag Jakhar, Consultant at Nomura Research Institute (NRI) for their extensive contribution to this analysis.

This article was first published in EVreporter May 2024 magazine.

Also read: India’s electric vehicle ecosystem | Policy updates in Mar 2024

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.