The National Infrastructure Commission (NIC) has analysed why the UK has a decades-long record of overspending on major infrastructure and identified ways to cut 10-25% of outturn cost.

In Cost drivers of major infrastructure project in the UK, the NIC has provided insight on the main reasons projects such as High Speed 2 (HS2), Hinkley Point C and Crossrail run way over time and budget, resulting in them hitting the headlines for the wrong reasons.

It found that the UK has particularly poor record on delivering nuclear power stations, high speed rail and rail electrification because of cost challenges, but delivery in other sectors has not been significantly different to international projects. However, the NIC states: “the UK has a ‘long tail’ of poorly performing projects which could learn from those which have been delivered successfully in the UK or internationally”.

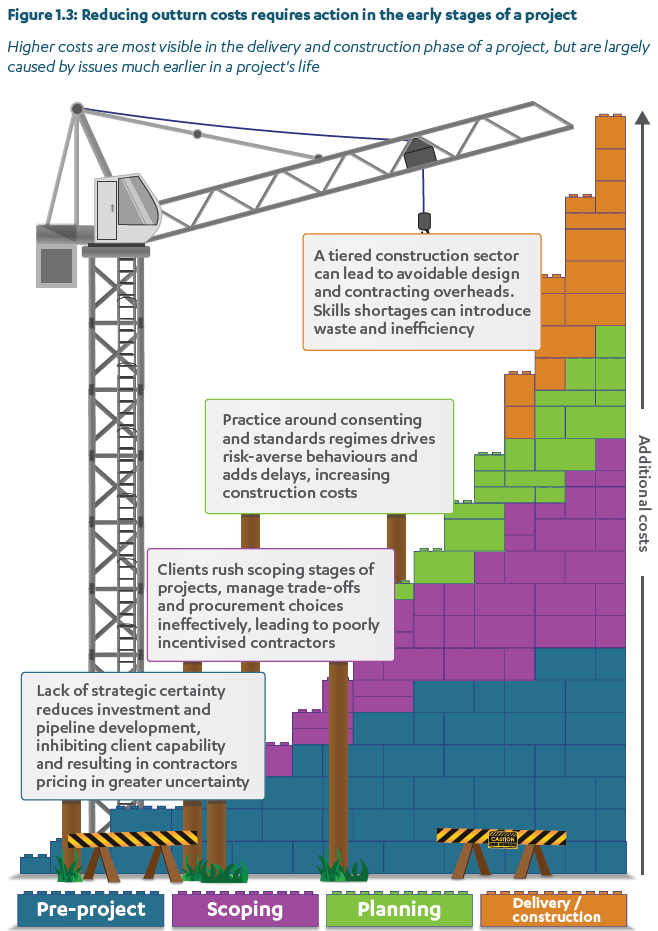

It has outlined four main stumbling blocks in the delivery of major infrastructure in the UK.

Lack of clear strategic direction

Underlying the issues is the “lack of strategic clarity and stability including the failure to commit long term funding in a long term infrastructure strategy” – a problem that has been exacerbated recently, but has existed for decades, according to the NIC.

“Government has not been able to identify, with a single voice, what the most important infrastructure projects are to achieve its goals and then to ensure it is collectively working to deliver them on time and to budget,” it adds.

It further attests that short-term funding settlements have “harmed confidence, providing little clarity on funding beyond the end of a spending period”. This has resulted in a “significantly more volatile” record of investment in infrastructure compared to other countries.

It also homes in on the UK’s water and energy sectors, saying: “In regulated utilities, a failure to provide a long term trajectory for network enhancements beyond five year price review cycles has held back investment in much needed and large scale infrastructure like new reservoirs.”

It accepts that longer term pipelines are now being drawn up in water and energy, but the lack of one for so long “means the supply chain is having to adjust to a burst in demand which will exacerbate costs”.

Client and sponsorship challenges

The NIC underscores the importance of infrastructure clients and sponsors in the success of projects. However, in the UK – while there have been some “exemplar clients” – recent large sector public sector projects have seen clients faced with a lack of clarity in their role in relation to that of the sponsoring department and HM Treasury, the NIC found.

“Public sector clients report that they would welcome more robust and in-depth challenge while pushing against institutional structures that confound the client’s decision-making authority and the sponsor’s enabling role in the system,” it adds.

The report goes on to say that “in the public sector there can be further issues with poor retention of client expertise and a failure to create an environment in which specialist client skills can be learned and honed”.

Further issues identified include that “rigorous analysis of the trade offs between outcomes and budget sometimes does not happen before budget announcements” and “risk-averse procurement practices are often prioritised ahead of activities like effective early engagement with contractors that are proven to reduce the risk of cost overruns”.

“This can mean project costs escalate as trade offs between desired outcome and cost are not made, or are made at later stages, requiring expensive changes and wasted effort,” the NIC adds.

Inefficient consenting and compliance

The new report reiterates the NIC’s previous messaging that “the consenting and compliance of projects is overly complex, and adds unnecessary costs and uncertainty”. It says that there is evidence that the complexity of the system is causing delays which add cost but don’t improve outcomes.

“Within the system there is a lack of clarity on what standards projects need to meet to mitigate their impacts on the built and natural environment,” it states. “This leads to risk aversion from clients or developers who fear legal challenges and as a result choose increasingly conservative mitigations which, though addressing opposition from scheme opponents, can drive up costs significantly.”

Further, the NIC says that at a system level there are government agencies which issue permits or request mitigation measures for the infrastructure’s impact but have little incentive to consider the impact of these proposals on the project’s cost.

Constrained supply chain

The three issues highlighted above have compounded the issues in the supply chain, with the construction industry not having invested appropriately in its capacity for the future, according to the NIC.

It says that while the UK construction sector is “highly skilled and high performing” and has developed best practices that are adopted overseas, these best practices are not being systematically applied in the UK.

Additionally, there is a long-term productivity challenge that has stemmed from the financial crisis.

“The fragmentation and small size of firms is a key factor in this challenge, and industry must invest in skills and productivity improvements,” the NIC says. “But it will be enabled to do so by a government which provides a clear strategic direction, and creates a favourable investment environment, and by clients reflecting the value of innovation in their commercial decisions.”

The benefits of overcoming these issues

The NIC says “there is nothing inherent within the infrastructure projects the UK must deliver that would prevent it becoming ‘best in class’ and across most types of infrastructure there are already exemplars within the UK”.

The issue remains that cost of delivery must be brought down and this must not be looked at as the top line cost but at the individual issues that add up to the spiralling sums. “If poorer performing projects learnt lessons from the best performing projects, average unit costs could be reduced,” the report states.

It attests that: “The total value of potential cost reductions through changes ranging from better consenting and optimising design through to construction efficiency is large. Studies, such as those by Arup and by Expedition Engineering, have found the outturn costs of some projects could be reduced by as much as 20-40%, through improving the efficiency and effectiveness across the project lifecycle.”

The NIC accepts that not all infrastructure projects will be able to achieve cost reductions this drastic, but it suggests that by addressing the four main issues above, “outturn cost reductions of between 10-25% are achievable, compared to situations where projects are left to overspend by the levels that they typically do”.

It suggests that more than half of the available outturn cost savings can be achieved in the pre-construction phase. The graphic below provides a simple overview to the areas where outturn cost can be reduced, according to the NIC.

The NIC’s full report can be found here.

Future of the NIC

This week HM Treasury has confirmed that it will go ahead with plans to merge the NIC with the Infrastructure and Projects Authority (IPA) into a new body National Infrastructure and Service Transformation Authority (Nista), which will launch by May 2025.

Secretary to the Trasury Darren Jones MP said the introduction of Nista will “strengthen the oversight of the delivery of government infrastructure plans”. It will do this by combining the NIC’s strategic excellence and the IPA’s expertise in delivery into one organisation, Jones explained.

Like what you’ve read? To receive New Civil Engineer’s daily and weekly newsletters click here.