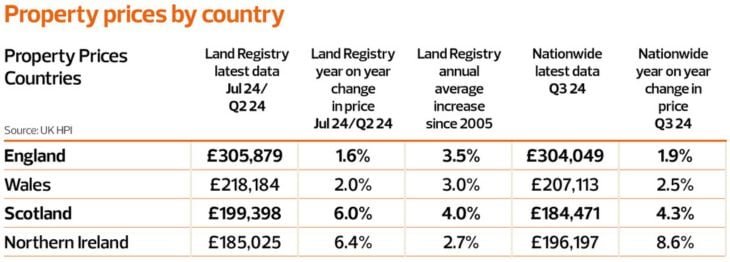

The regional report suggests that Scotland and Northern Ireland are doing well this year in terms of regional property prices.

For Scotland, there does appear to be a good short-term uplift in prices (year on year) and long-term (back to 2005), with prices rising annually at 4% vs. 3% inflation and year-on-year prices at 6%, so performing better than the ‘norm.’

Northern Ireland is interesting, though, as performance year on year may look good, but in the long term, prices still lag behind inflation – as far back as 2005, so buyers are still getting a good ‘deal’ while for sellers, it will depend on when they bought the property.

Part of the reason for better price performance in Wales, Scotland, and Northern Ireland is that they tend to be more affordable than parts of England – and it’s in areas where affordability is easier that are tending to see improved rises.

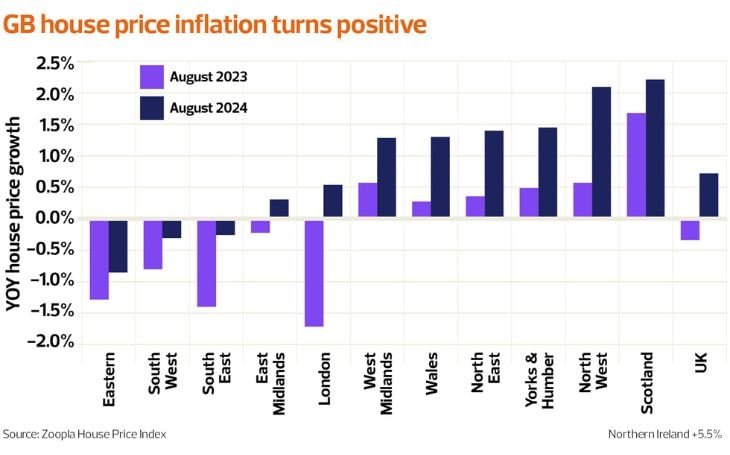

Of course, it’s important to remember that some of the rises year on year are actually prices ‘recovering’ from the falls seen in the last 18 months.

For regional property prices in Scotland, Wales and Northern Island, we monitor Halifax and E.surv.

Local expertise for each country is essential when looking at how the property market is performing. This is especially the case in the likes of Scotland and Wales where areas are as diverse as the English Regions.

Summary from the indices of the Welsh housing market

“House prices in Wales also recorded strong growth, up +4.4%, compared to the previous year, with properties now costing an average of £224,119.”

Summary from the indices of the Northern Ireland housing market

“Northern Ireland continues to record the strongest property price growth of any nation or region in the UK, rising by +9.7% on an annual basis in September. The average price of a property in Northern Ireland is now £203,593.”

Summary from the indices of the Scottish housing market

“Scotland saw a more modest rise in house prices, where a typical property now costs £205,718, +2.1% more than the year before.”

E.surv – Gentle market recovery builds

“On an annual basis, Scotland’s average house price has risen steadily but modestly for six consecutive months and stood at more than £225,000 in July, 1.9% higher than a year ago.

“Eighteen local authorities experienced rising prices in the month. Prices in two local authorities – East Renfrewshire and West Lothian – hit new market highs. This is becoming something of a regular habit for West Lothian, as local prices have reached fresh peaks in three of the last four months.

“Several other authorities – Angus, Moray and Glasgow – are within touching distance of prices setting new record highs. Uniquely, Angus has reported monthly price increases for seven consecutive months.”

“At a local authority level, the market saw increases in 15 areas, and, with the onset of a new government, we expect market sentiment will further improve. The new government has already said it is supportive of the existing mortgage guarantee scheme which has been used to good effect in Scotland. Confidence will likely be further buoyed as the Bank of England begins to cut its base rate in the coming months.”

Regional property prices tracking

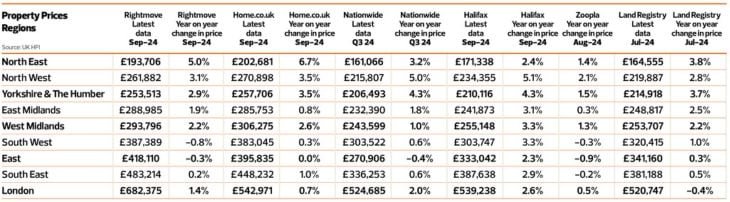

As the table shows below, most indices are reporting rises in most regions this month – with Zoopla showing the least regions ‘recovering’ – with the South West, East and South East seeing prices down year on year. As in our country analysis, bar London, which is a very individual market, it’s areas that tend to be more affordable that are seeing rises.

The top performing region, according to Home.co.uk, is the North East, typically England’s cheapest region, with a 6.7% rise recorded. Rightmove isn’t far behind, suggesting prices are up here by 5%, with the rest of the indices showing rises of around 3%.

The top performing region, according to Home.co.uk, is the North East, typically England’s cheapest region, with a 6.7% rise recorded. Rightmove isn’t far behind, suggesting prices are up here by 5%, with the rest of the indices showing rises of around 3%.

The region struggling the most according to the indices seems to be the East – with a 0.9% fall according to Zoopla – while other indices show the South West to see the biggest fall (Rightmove). This is likely caused by areas where people need a mortgage more and have been hit harder than the likes of London, as I expect they have fewer cash buyers.

Commentary on the regional property price performance

Zoopla – House price inflation is improving but still sluggish

“Increased sales activity is supporting modest price rises rather than causing any acceleration in home values. Affordability remains a constraint on house price growth, especially in southern England. Annual UK house price inflation is +0.7%3, up from -0.3% a year ago. House price growth will continue to increase in the coming months.

“House prices are lower than they were a year ago in the South West, South East and East of England. Across all other areas of Great Britain, house price growth is higher than a year ago, with prices up to 2.2% higher. Home values in Northern Ireland are 5.7% higher, having under-performed the rest of the market in recent years. London prices have registered the biggest turnaround over the last year, moving from annual price falls of -1.7% a year ago to modest price gains of +0.5% today.”

“Our regional house price indices are produced quarterly, with data for Q3 (the three months to September) indicating that most regions saw a pickup in annual house price growth.

“Northern Ireland remained the best performer by some margin, with prices up 8.6% compared with Q3 2023. Scotland saw a noticeable acceleration in annual growth to 4.3% (from 1.4% in Q2), while Wales saw a more modest 2.5% year-on-year rise (from 1.4% the previous quarter).

“Across England overall, prices were up 1.9% compared with Q3 2023. Northern England (comprising North, North West, Yorkshire & The Humber, East Midlands and West Midlands), continued to outperform southern England, with prices up 3.1% year-on-year. The North West was the best performing English region, with prices up 5.0% year-on-year.”

“The North West once again recorded the strongest house price growth of any region in England, up by +5.1% over the last year, to sit at £234,355.

“London continues to have the most expensive property prices in the UK, now averaging £539,238, up +2.6% compared to last year. This is still some way below the capital’s peak property price of £552,592 set in August 2022.”

“Prices have been a little more subdued across most of England and Wales, with annual price inflation negative in all regions except for the North West and prices falling by more than three months earlier. Southern England continues to trail other areas, and the South West stands out for having seen a particularly sharp reverse.”