By Mark Pruner

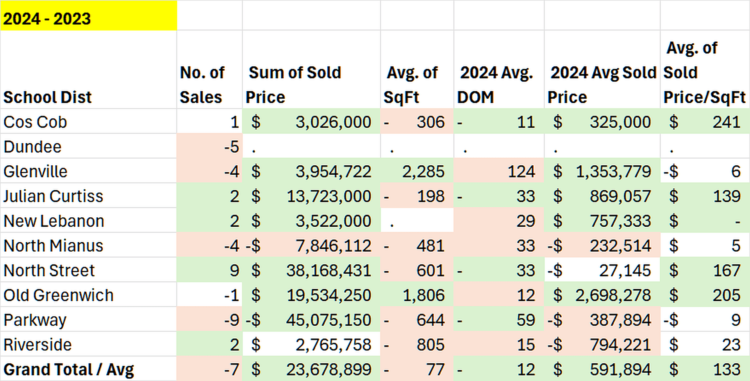

Prices have taken a big jump in the first quarter of this year compared to the first quarter of last year. Our average price is up from $3.13 million last year to $3.72 million or an increase of 19.8%. In the last 50 years, we have only seen that rapid a price rise twice. However, these price changes are not evenly spread throughout the town. Some parts of town are seeing bigger increases, and some parts of town actually are seeing price decreases from last year. Overall, our sales are down 8.3% from last year, but once again some school districts are seeing sales increases, while others are seeing sales drops of greater than the town average.

Before I go on too far, I should explain, that I am using the elementary school districts as a convenient way of talking about different parts of the town. Neither the RTM districts, nor several of the GMLS subdivisions are that useful when look at price changes by neighborhoods, since they often cover multiple neighborhoods. An example of this is the GMLS district South of the Parkway which covers everything south of the Merritt to north of the Post Road.

I’m also not saying that a particular elementary school is making a significant difference in single family home prices in a particular area. Yes, some people select their neighborhoods by what public elementary is there, but only about a third of the families in Greenwich have children in the public schools and even a smaller percentage of families have children going to a public elementary school.

On flip side, our high quality schools, both public and private, do play a significant factor in house prices, it’s just there is no good way to tease out just how much. In summary, I’m using the school districts as an approximation for particular neighborhoods. Going forward, I’m just going to refer district and drop the school part, e.g., the Dundee district.

When you look at the overall sales numbers, two districts standout so far. The North Street district saw the number of sales jump from 14 sales last year to 23 sales in the first quarter of this year. The Parkway district saw sales drop from 20 sales last year to 11 sales this year. The curious thing is that these two districts are adjacent to each other and you wouldn’t think you would see such differences, but not only is Greenwich made up of a lot of neighborhoods from a real estate viewpoint it is made up of a lot of micro-neighborhoods. The Assessor uses 63 different micro-neighborhoods when determining assessments.

When you at a map of the sales in these two districts, you see that most of the Parkway districts sales are along the Merritt Parkway, both north and south. The North Street district sales are concentrated more to the eastern side of the district on and around Stanwich Road. The slower sales in far backcountry may be due to fading memories of Covid and a lessening in demand of large houses on large lots. Don’t, however, rule out that many of our larger house sales have moved later in the year as many fewer finance companies pay big all-cash bonuses at the beginning of the year.

For the sales on the eastern side of the North Street district, along Stanwich Road, may be a reaction to the major jump in prices that we have seen so far this year. Stanwich Road which doesn’t have a Merritt Parkway entrance has seen lower prices than we see along Lake Avenue and Round Hill which both have Merritt Parkway entrances. With many people getting to work from home several days a month, the need for ready access to a Merritt Parkway entrance isn’t as necessary as before. On the west side of town, we see this effect along Riversville Road, another road with a Merritt Parkway entrance.)

Like the Parkway district, the North Mianus district has also saw a drop in sales, where sales are down 57% from last year. This dramatic drop is a classic example of the law of small numbers. The North Mianus actual number of sales has dropped only only 4 houses from 7 sales in the first quarter of 2023 to 3 sales so far this year. If you are in the North Mianus district, I wouldn’t worry too much as we’ve already had 3 additional sales so far in April and we have 8 contracts waiting to close.

Just about every district has seen a significant increase in the average sales price, with the Old Greenwich district being the standout here. In Old Greenwich the average price jumped from $2.05 million in the first quarter of 2023 to $4.75 million in the first quarter of this year, while the number of sales dropped from 9 sales last year to 8 sales this year. This 132% jump in prices is primarily a change in the mix of what is selling, but it’s not the only factor.

In Old Greenwich, we only have 8 houses on the market in Old Greenwich and 6 of those 8 are over $3.8 million, so the odds are if a house sales in Old Greenwich it will be above the town-wide average price. The reason we see this skew to the high end is that anything that comes on under $3 million moves very quickly. Of the 17 sales and pending contracts in Old Greenwich, 16 of the 17 went to contract in less than 25 days. As a result, the median days on market in Old Greenwich has dropped substantially from last year.

Interestingly, the average days on market for an Old listing is actually up 17% from last year. How can that be? It’s that pesky 17th sale that didn’t sell in less than 25 days. The house at 36 Shore Road finally sold after being on the market for 587 days. If you are making an important decision, such as pricing your house for sale or even determining if now is the right time to sell, it pays to look behind the numbers.

You can see the same thing in the Parkway district where the average days on market dropped from 166 days on market last year to 107 days on market. Once again, a few listing queens that have been on the market for quite awhile skew the numbers and these long term listed sales skewed the market more last year than this year. In the early stages of a hot market, the days on market actually go up as these listing queens, that no one wanted in a slower market with more inventory, finally go to contract.

As noted above you also this in a very low inventory market, many of the listings that haven’t sold have been on the market for quite awhile and once again skew the numbers higher. A low days on market is always a sign of a hot market, but in some cases high days on market doesn’t mean it is a slow market, you have to look behind the numbers.

The big question is how long this low income, fast appreciating market can last. Given that even if we triple our present inventory, we would still have below average inventory, I wouldn’t look for a quick turnaround.

Mark Pruner is a principal in the Greenwich Streets Team at Compass Connecticut. He can be reached at 203-817-2871 or mark.pruner@compass.com.