The occupancy rate in APAC was at 88% during the quarter.

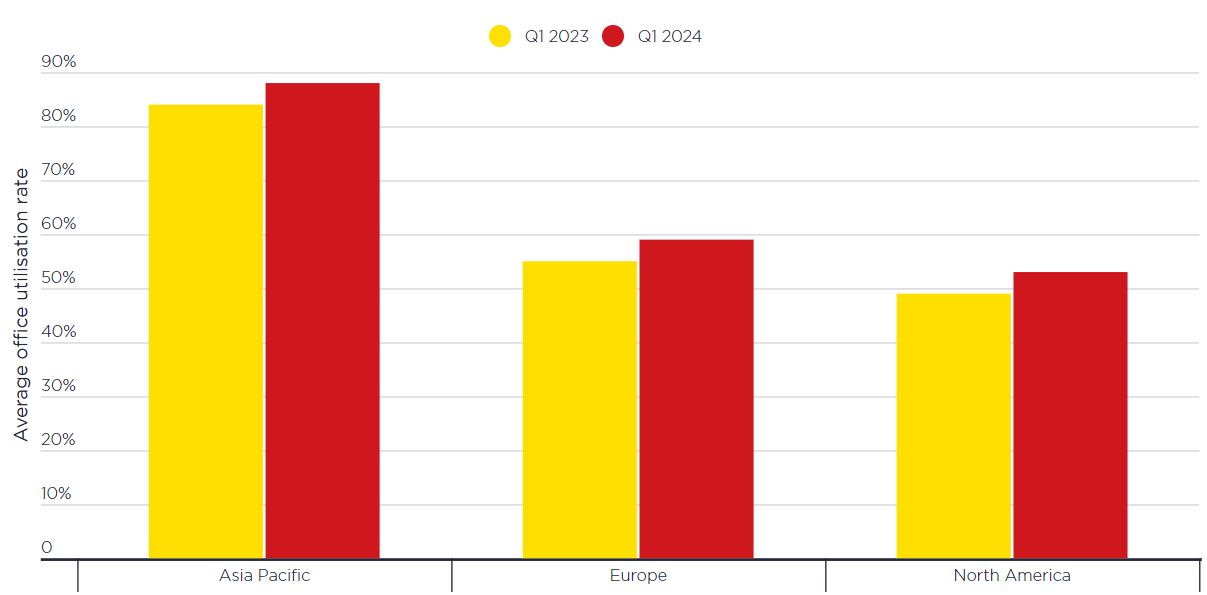

Savills World Research shares that office occupancy rates in Asia Pacific are the highest at an average of 88% in Q1/2024, followed by Europe at 59%. North America lags at 53%, with US cities such as San Francisco and Los Angeles still below 50% occupancy.

These rates have increased from a year ago. Then, office occupancy rates in Asia Pacific were 84%, Europe 55% and North America 49%. (see table 1)

Singapore’s office occupancy rate has held steady at 94% for Q1/2024 vs Q1/2023.

Table 1: Average office utilisation rate by region

Source: Savills Research

Post-pandemic, there seems to be a structural shift in the office market in recent years, which reflects the broader recalibration of workforce priorities and lifestyles – alongside pressing environmental, social and governance (ESG) concerns.

This means that owners have decisions to make. Owners who are confident in the appeal of their well-located stock will still need to innovate to appeal to workers. On the other hand, some will need to give their space a second life and repurpose to optimise value.

Both these options underline a strong need to meet high environmental standards to remain relevant with occupiers as well as comply with growing regulations, especially during tough economic times.

Alan Cheong, Executive Director, Research & Consultancy, Savills Singapore comments, “The occupancy level for Grade A CBD offices in Singapore is likely to remain high for the foreseeable quarters ahead. Although some companies are adopting hybrid and workplace solutions to optimise space usage, thereby reducing their office footprint, for this and next year, the average supply of new Grade A office buildings coming on stream from 2024 to 2027 is about 660,000 sq ft (net floor area), just below the 10-year average of 696,000 sq ft (2014 to 2023). While Grade A office rents and occupancies may hold up well, it is the lower grade and/or older buildings that may bear the brunt of the new office space usage by tenants. For the latter, they may have no choice but to undergo extensive refurbishment or complete redevelopment.”

Although the debate about the changing office is global, its impact is anything but uniform. Cultural differences, housing costs, commuting expenses and social norms influence a dynamic landscape across Europe, Asia and the Americas.

Places where there is intergenerational living and smaller homes such as in China and Hong Kong, drive people into the office. Meanwhile, in Japan, traditional working models coexist with flexible arrangements due to high commuting costs, and younger generations are embracing this flexibility.

In Europe, the cultural preference for face-to-face interaction and collaboration sees people in Germany and France mainly staying in the office.

Circumstances are different in the US where attendance rates are the lowest globally. Companies strive to “earn the commute” through amenity-rich offices and perks, as commuting time and house prices are key factors for many workers who have relocated to more affordable areas and larger houses during the pandemic.

Thus, these companies have created spaces that resonate with employees’ needs such as wellness and professional development to act as a magnet to attract and retain talent.