The Financial Intelligence Agency (AIF) has built seven typologies about the possibility of money laundering in the country, emphasizing that all cases have been sent to law enforcement bodies and are the ones that confirm whether or not we are dealing with a criminal offense.

The typologies built for 2023 include different cases, but the real estate sector dominates again. However, this is not the only one.

AIF brings to attention cases of circulation of suspicious values ??in the banking system by non-residents and in countries considered risky, misuse of accounts and unjustified benefits by professionals or suspicions of activities related to corruption.

AIF in the annual report of last year underlines that a total of 4 temporary blocking orders were issued for bank accounts, in a total value of about 1,178,350 EUR, which were seized by decision of the Prosecutor’s Office or the Court to the extent of 93%.

Typologies according to AIF

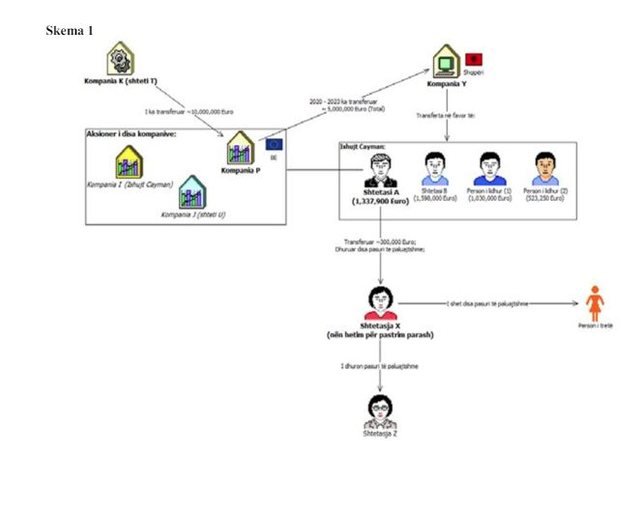

Typology 1 – Circulation of suspicious values ??in the banking system by non-residents and countries considered risky

In 2020, citizens A and B, originating from a country in Europe and residing in the Cayman Islands (tax haven country), have registered company Y in Albania.

During the period 2020 – 2023, company Y, has benefited from a series of transfers to the bank account in our country, amounting to a total of 5 million EUR. These funds were sent by company P, to the country of origin of citizens A and B, owned by the aforementioned citizen A who also owns other businesses in the Cayman Islands.

The stated purpose of the inward transfers is ‘for logistical and operational services’, provided by company Y, to a company located in a North African country (T).

Further analysis of the data shows that the funds sent to the account of company Y in our country are then transferred to the personal accounts of partners A and B, of the company or of related persons, in their country of residence (Cayman Islands ), with description ‘for professional services’ provided by the latter.

From the available information, it turned out that citizen A (one of the partners of company Y) knows Albanian citizen X, who was under investigation for the criminal offense of ‘Cleaning the proceeds of a criminal offense or criminal activity’.

Citizen A donated some real estate to citizen X and previously in the period 2017-2020, he sent her funds worth about 300,000 EUR, to her personal and business accounts.

This business was only active for a few months during 2020, with no real activity before going into passive status. This fact raises doubts that the purpose of creating this business was only channeling funds.

Verifications were carried out for citizen X, from which it was found that a few months later: – She sells the immovable property donated by citizen A to a third person; – A significant part of the funds received by citizen A invests in the purchase of other real estate (apartment, unit, garage, etc.) which she then donates to a family member (citizen Z).

From the further analysis of the companies involved, it was found that: · Company Y does not develop economic activity at the address declared in the CKB. Another commercial entity that provides financial and legal consulting services operates there, with which a service contract for the provision of headquarters has been concluded; · There is only one employee, the administrator, citizen B; · Declare sales to companies sending funds (such as company P) and purchases to partners A, B and their related persons; · The company also issues self-invoices, but then cancels most of them.

Company Y, at the end of 2023, suspends its activity indefinitely. · Company P has generated the funds transferred to Albania from a commercial entity located in country T, in North Africa, with the description ‘liquidation of liabilities’ in a total of 10 million EUR of which 5 million EUR as mentioned above above are channeled in our country. For the above, taking into consideration:

· High transfers arriving at the account of a newly established company in our country from non-resident citizens and the unclear purpose of the transfers;

· Doubts regarding the real activity carried out in Albania by the company; · Further transfer of these funds to a “tax haven”;

· The connection of one of the partners with a citizen under investigation for the criminal offense of ‘Cleaning the proceeds of a criminal offense.

The case has been sent for further investigation to law enforcement bodies.

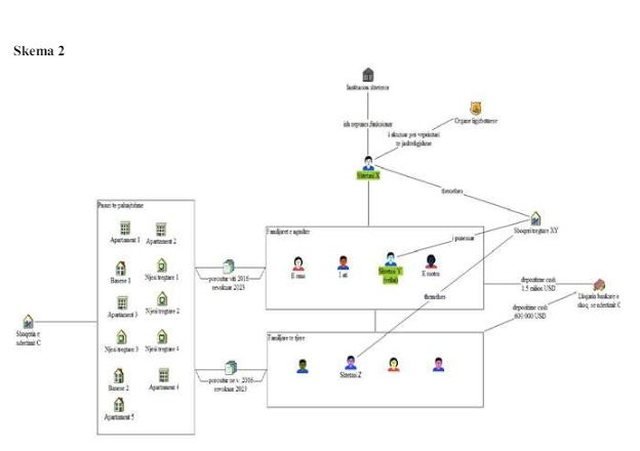

Typology 2 – Concealment, change of ownership of real estate by a person, former civil servant, accused of involvement in criminal activity

Citizen X, an official in a state institution, was arrested in 2023 for abuse of office and possible links to organized crime. During the investigations of the law-enforcement bodies, cases of possible abuse of office were found, committed over the years by citizen X, from which he is suspected to have benefited from large sums of money.

AIF has carried out verifications from which it turned out that for a period of 7 years, citizen X and his close family members (mother, father, brother, sister) have signed purchase contracts investing in real estate such as service units and apartments with a total value of approx. 1.5 million USD, near the same construction company C. It is noted that the order contract concluded by citizen X and his wife was worth less than its real value and to some extent justifiable compared to the legal source of income his.

From the detailed financial analysis, it was found that the values ??for ordering the assets were paid by citizen X and his family members during the period 2015 – 2018 through a series of deposits that fluctuate in the values ??of 5,000–30,000 USD.

The funds were deposited to the bank account of construction company C, in a second level bank in the country, with frequencies, dates or times that matched or approximated each other. The source for the funds invested in real estate is declared as business income and income obtained from emigration.

From the verifications on his businesses, it turned out that in 2010, citizen X, together with 3 other citizens, founded the trading company XY with the object “import – export of food products, industrial and investments in the field of construction, etc.” After a period of several years, citizen X sells his share of shares to one of the partners, citizen Z, with whom he also has family ties. The brother of citizen X, citizen Y, is also connected to this business in an administrative role.

As far as family members are concerned, it turns out that only the brother has newly registered a Natural Person subject. The income earned from these businesses is minimal, but the turnover as a whole is also low. From the further analysis carried out for other members of the family circle of citizen X, including citizen Z, it has been found that in the same period they concluded contract contracts with the same construction company C, in total value of about 600,000 USD, as well paid in advance, in the same period, with deposits in the bank account of my building society at the same bank as citizen X, where they declared the income secured by immigration as a source.

From the verifications, no income is found to justify any of the investments made in real estate by this citizen and his family members. In the first quarter of 2023, it was observed that citizen X and his immediate family members (mother, father, brother, sister) have signed successive revocation contracts of these order contracts.

For the above taking into consideration:

· Investigations into criminal activity of former civil servants;

· Investments in real estate, in significant values ??through the signing of order contracts, family-wise, consecutively, with the same construction company;

· Payment in cash and with the same frequency, at the same time, in the same banking institution by family members and citizen X;

· Unjustified source of income for investments made;

· Request for the revocation of property contracts during the investigation period, in order to avoid their seizure.

The case was sent to law enforcement for further investigation. For this case, blocking orders were issued by the AIF, which were accompanied by seizure decisions by the Prosecutor’s Office.

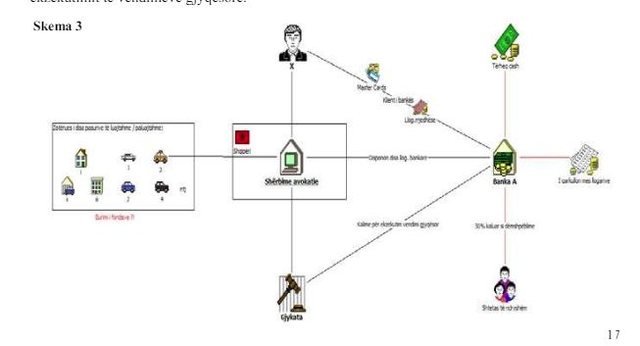

Typology 3 – Misuse of accounts and unjustified benefits by professionals (Lawyers)

Citizen X, a lawyer by profession, has been practicing his activity since 2010, registered as a natural commercial person. From the analysis of the transactions carried out by the subject, it was noticed that in the period January – May 2023, several transfers in significant amounts totaling about 150 million Lek arrived in his account.

Further analysis showed that within a period of 7 years, about 1.5 billion Lek were transferred to the subject’s account. The funds have been sent by various state institutions, enforcement offices and insurance companies, for the execution of several judicial decisions for compensation issued by various courts, for third parties (his clients). Regarding the way these funds were used, it was established that citizen X has transferred them from business accounts to his individual account, where, in addition to withdrawals, a significant part of the funds is used for the purchase of luxury goods abroad, purchase of movable assets /real estate, for the purchase of bonds and only 30% of the funds go to third parties in order to execute court decisions.

From the verification of the subject’s data in the tax system, it turned out that he did not declare sales invoices for the services provided in the last 5 years. For the above taking into consideration:

High turnover of funds benefited from the execution of court decisions for compensation of third parties both in the accounts of the natural person subject and in the individual accounts of the lawyer;

· Withdrawing these funds or transferring them to other accounts, losing track of their use;

· High investments in movable property (luxury vehicles) and real estate for the individual use of the lawyer himself, raising reasonable suspicions that we are dealing with embezzlement of funds.

· The entity does not declare sales invoices for the last 5 years;

The case was sent to law enforcement for further investigation.

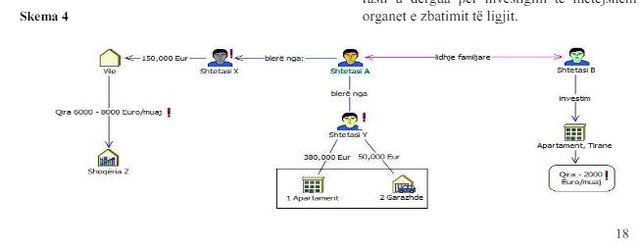

Typology 4 – Investments in real estate by persons suspected of involvement in criminal activity

Citizen A together with citizen B (family connection) from 2020 onwards have invested considerable sums in real estate, in some of the most expensive areas in coastal areas and in the capital. Specifically, in 2020 citizen A invests the amount of EUR 150,000 in real estate of the type ‘villa’ in a coastal area. Negative findings result for the selling party as an individual involved in property affairs.

Regarding the financing of this investment, it turns out that citizen A received a loan in the amount of EUR 80,000 from bank F and the rest was paid in cash. This property was then leased to a company Z, with a monthly rental payment of EUR 6,000 – 8,000. Based on the above, where for such a short period the return on investment is not normal, doubts arise that the real value paid for the purchase of the property may be higher, or the leasing relationship may be used as a means of transferring funds. from company Z, citizen A.

From further verifications, citizen A two years later, made another investment, buying a unit and two garages worth EUR 430,000, again in an area where the market price is higher compared to other areas. At the same time, this citizen received a loan from bank D, in the amount of 210,000 EUR, to finance the above investment. In addition to the above, it turns out that citizen A has signed several contracts for the sale of movable assets, according to which he sold vehicles at prices ranging from 25,000 – 35,000 EUR, for which we do not have information on the financing of their purchase. In addition to the above, it turns out that citizen A has signed several contracts for the sale of movable assets, according to which he sold vehicles at prices ranging from 25,000 – 35,000 EUR, for which we do not have information on the financing of their purchase.

From the analysis of the profile of citizen A, it is observed that:

– There is only one private activity with the object of activity: repairing bicycles, with an annual income of about 5 million Lek;

– There are frequent entries and exits at the border crossing points, among others, with citizens with criminal records, convicted of drug trafficking. His relative, citizen B, also turns out to have bought an apartment worth 180,000 EUR in the last two years, which he does not justify with the declared income he has only from employment.

For the above taking into consideration:

· Investments in real estate, which appear to have been purchased below the real value and suspicions that the differences may have been paid in cash;

· The use of loans in this case looks like a cover for money laundering;

· Suspicious connections with persons with criminal records;

· Low income, mainly from employment or activity that, based on the object of the activity, does not justify the high profits declared;

The case was sent to law enforcement for further investigation.

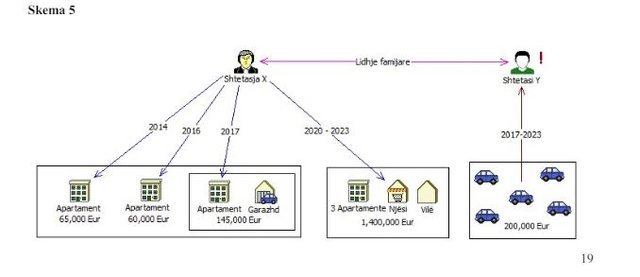

Typology 5 – High investments in real estate with an unknown source of funds by a person exercising a public function

Citizen X, during the last 10 years, has made a high number of investments in real estate, while it turns out that she has been employed in a public function only since 2018. The first investments by citizen X in the purchase of real estate were made in 2014 – 2018, in the amount of EUR 270,000, during which time she was not in employment.

Further verifications show that her close relation, citizen Y, is a person suspected of being involved in narcotics trafficking. Also, after 2018, when citizen X registered her private activity, with a public character, she continued with investments in real estate. Specifically, during 2020 – 2023, he bought service units, apartments and villas, apparently at a price lower than the real market price, which reach a total value of 1.4 million EUR.

In addition to the above, it turns out that citizen X also sold a vehicle worth EUR 120,000 for which we do not have information on the financing of the purchase. From the financial analysis, related to the source of income used for the purchase of real estate, there are continuous cash deposits in the bank accounts of citizen X and transfers from the account of the private entity that she owns to her personal account. Regarding the declarations for the profits of the activity for the period 2018 – 2023, the declared values ??fluctuate from 5.- 25 million Lek per year, which in total, from the date of its registration, do not exceed the value of 750,000 EUR.

From the verifications for the citizen Y (a close relation of the citizen X), it turns out that during the period 2017 – 2023, he signed contracts for the sale of movable assets as a selling party in values ??that reach up to 90,000 EUR. In total, from these sales he has benefited around 200,000 EUR. This citizen does not appear to have a known legal source of funds to justify these transactions.

For the above taking into consideration:

· Investments in real estate, which are not justified by previous employment or income from the activity; ·

· Close ties with persons suspected of being involved in criminal activity, before and during the exercise of public office;

The case was sent for further investigation to the law enforcement bodies

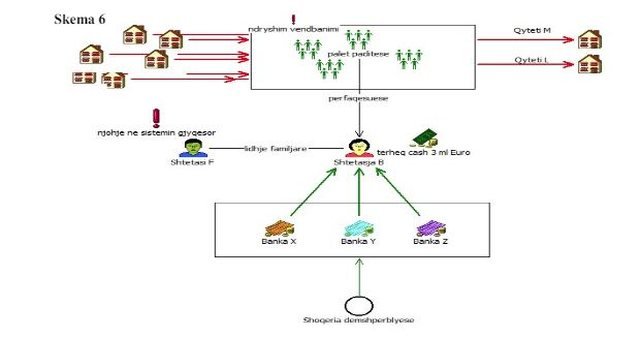

Typology 6 – Suspicions of activities related to corruption

Citizen B, in the period 2019-2023, has been the legal representative of several citizens, in court proceedings with the object of compensation for property and non-property damages. These court processes have always been held in two cities (M, L), a fact which initially seemed a coincidence. With the further analysis of the data, it turned out that the plaintiff parties changed their place of residence in order to file the lawsuit.

From the available data, it turned out that citizen B is a family relation to citizen F, with a public function in the judicial system. Between the citizen B and the plaintiff parties, the relevant agreements were concluded according to which the funds benefited from the compensation would be transferred to the bank account of the citizen B, at banks X, Y, Z. All procedural and judicial actions were carried out by the representative of the plaintiff parties, citizen B.

From the analysis of the bank accounts of the citizen B, it is noticed that after the crediting of the funds, they are followed by their withdrawal, with the declaration ‘giving them to the beneficiaries’. The explanation given for these withdrawals is related to a personal choice of the beneficiary citizens, to stay out of the banking system, for reasons of insecurity. The total withdrawals reach EUR 3 million.

From the available data, reasonable doubts arose that the citizens receiving the funds may often not be aware of the real amount received.

For the above taking into consideration:

· The high values ??withdrawn, obtained for the compensation of third parties, for which there are doubts about the way of their use;

· Fictitious changes of residence of the plaintiff parties;

· The channeling of these court cases by the legal representative, related to compensation, only in two judicial institutions;

The case was sent to law enforcement for further investigation.

Typology 7 Investments in real estate below market value

Citizen A since 2018 has carried out a high number of real estate transactions in various residential areas of the capital (Zone 1, 2 and 3). From further verifications, it turned out that a large part of the investments were made in cooperation with citizen B, a person previously known by AIF for questionable investments in real estate and involvement in a structured criminal group.

During the financial analysis, it was evident that most of the investment in real estate is concentrated in the years 2019 – 2022, specifically: · Citizen A, has bought from various individuals several properties in Zone 1 with a total area of ??17,000 m2 and at a price of 6 EUR/m2, this price lower than the real market price;

Citizen A, in cooperation with citizen B, have invested in Zone 2 by purchasing from different individuals an area of ??about 25,000 m2 with prices ranging from 5 – 215 EUR/m2, in which there are changes in the purchase price of assets within the same area .

The total value of the purchased assets reaches about 1. million EUR. In 2022, citizens A and B have sold some of the above assets with a total area of ??about 30,000 m2, in favor of company X, at a price of 120 EUR/m2, for a total value of 3.6 million EUR, apparently at an abnormally high price higher than the purchase price. In addition to transactions with real estate, citizen A is involved from 2018 in several loan contracts as a lender to company F and its partner citizen E in a total value of 440,000 EUR, where the latter (citizen E) is suspected of abuse of funds public. Citizen A, it turns out, has a registered commercial activity for several years and is a person associated with several companies established in recent years in partnership with third citizens, among them citizen D, a person with criminal records due to involvement in criminal activities. For the above taking into consideration:

· The high number of real estate transactions accompanied by doubts about the real value of these assets;

· Significant differences in the values ??of contracts for real estate in the same areas, or prices reflected in notarial acts of very low value (even 4 EUR/m2);

· Connections with persons with precedents or suspects of criminal activity;

The case was sent to law enforcement for further investigation.