By Mark Pruner

The GOOD NEWS

First, the good news: the total volume of sales over $5 million in Greenwich increased by $180 million, rising from $688 million in 2022 to $868 million in 2023. A significant portion of this increase can be attributed to the highest sale ever in Greenwich and in all of Connecticut – Copper Beech Farm. This 50-acre property sold for $138,830,000, breaking its own record of $120,000,000 set in 2014. Even excluding this record sale, our high-end sales were still up by $41 million in what was a down year for sales in most of the rest of the market.

High-end Sales Volume Goes Up

For sales over $5 million, we had 94 sales in 2023, the same number as in 2022. However, our highest sale in 2022 was “only” $17.6 million, followed by a $12.8 million sale. In 2023, we had 5 sales over $15 million and 7 sales higher than the second-highest sale in 2022 of $12.8 million. It was a good year for asset reallocation.

Lots of Sales over List Price

In other good news, our market continued to be hot, though with little fuel. Over half of the sales in 2023 went for the full list price or over the list. We also had 167 out of 526 sales go to a non-contingent contract in 15 days or less. Of those 167 contracts that went to a binding contract in 15 days or less, 148 had no contingency in the contract.

Lots of Contracts Being Signed Quickly

Of the 19 buyers that did have a contingency in their contract and then went non-contingent in less than 15 days, the odds are high that most of those contingencies were non-monetary. These contingencies could be a title easement that needed clarification or a P & Z question that was crucial. Still, the smart buyer wanted to get it under contract instead of waiting for their attorney to get the answer before contract signing.

If you are looking to buy in this market, you need to bring cash or be underwritten pre-approved on your mortgage application. Alternatively, you can be one of those people who just aren’t concerned about losing their 10% down payment (which is what happens when you don’t have a mortgage contingency and can’t get the funds to close).

Prices Mostly Go Up in 2023

Prices continued to rise in 2023. Our median price per square foot went from $669/sf in 2022 to $705/sf in 2023, an increase of 5.4% in a year when sales were down 17%. Our median sales price also went from $2.45 million in 2022 to $2.50 million in 2023, an increase of 2.0%. On the flip side, our sales price to assessment ratio went down from 1.92 to 1.89, a decline of 1.6%. Since the assessment ratio for property in Greenwich is 70%, and the reciprocal of that is 1.42, it means that 2023 prices are up 33% (=1.89/1.42) from the last revaluation date of October 1, 2021. The bottom line is that price changes continue to increase, just not as strongly as they did during the Covid years.

THE NOT-SO-GOOD NEWS

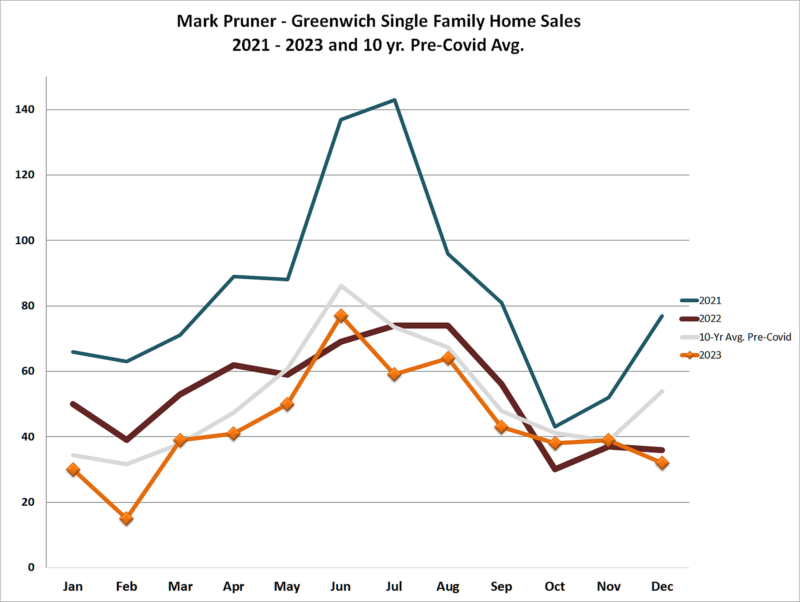

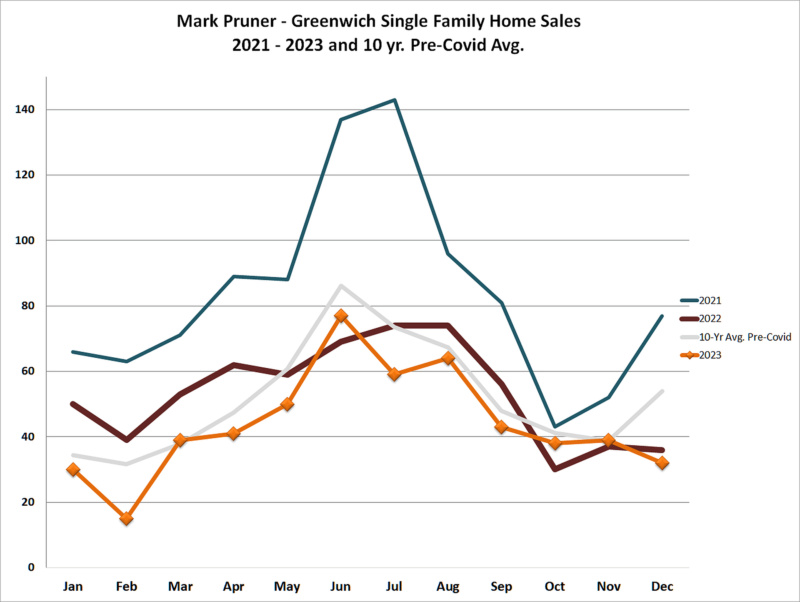

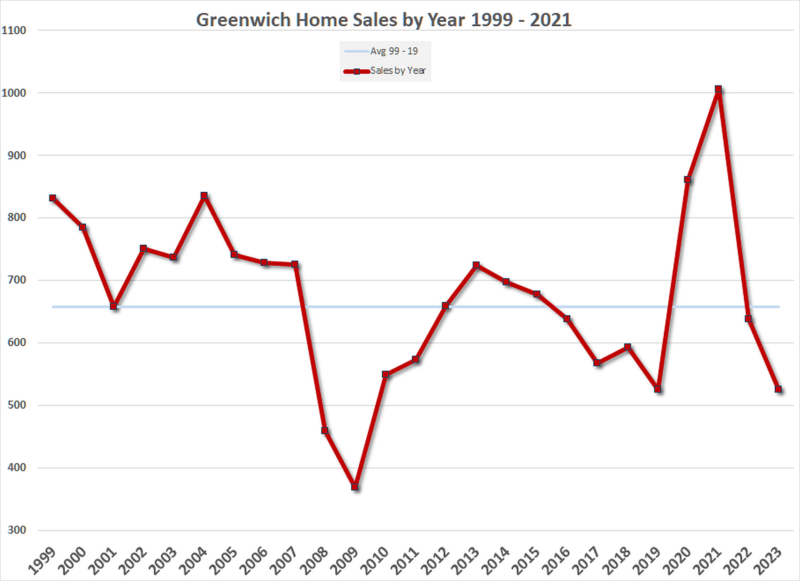

Sales of single-family homes in Greenwich were down by 111 houses or 17%. We went from 637 sales last year to only 526 sales this year. This is also down 20% from our 10-year, pre-Covid average of 658 annual sales.

The total sales volume went from $1.94 billion in 2022 to $1.87 billion last year, a drop of 3.6%. The high number of high-end sales helped keep our total volume from dropping even more. Had we not tied last year for the third-highest number of sales over $5 million this century and also seen a 33% increase in sales over $10 million, we would have had an even bigger drop.

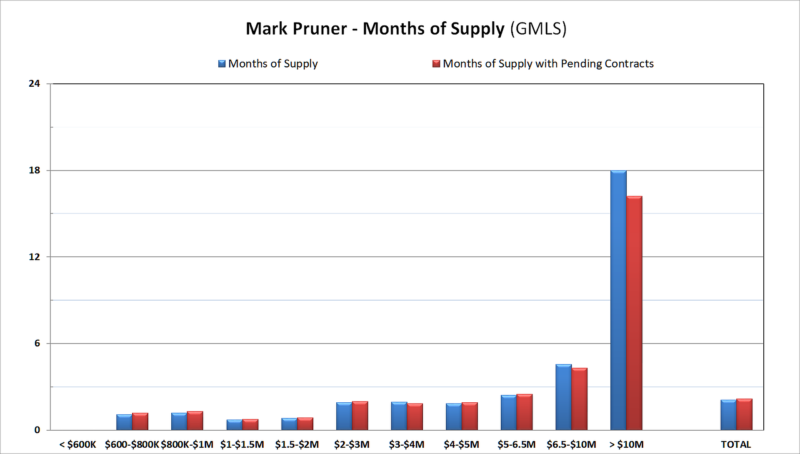

Months of Supply in Super-Sellers Range

It’s clear that the drop in sales is not from a lack of demand. When you look at months of supply, we are under 2 months of supply all the way up to $5 million. From $5 – 6.5, we only have 2.4 months of supply, and only over $10 million do you have a buyer’s market with 18 months of supply. Even at the ultra-high end, over $10M, we are still way down from the 29.3 months of supply that we had at the end of 2022. You could argue that the reason we had such good high-end sales in 2023 is that we actually had something to sell. Even there, however, our inventory is down with only 41 houses active above $5 million compared to 52 high-end houses last at the end of 2022.

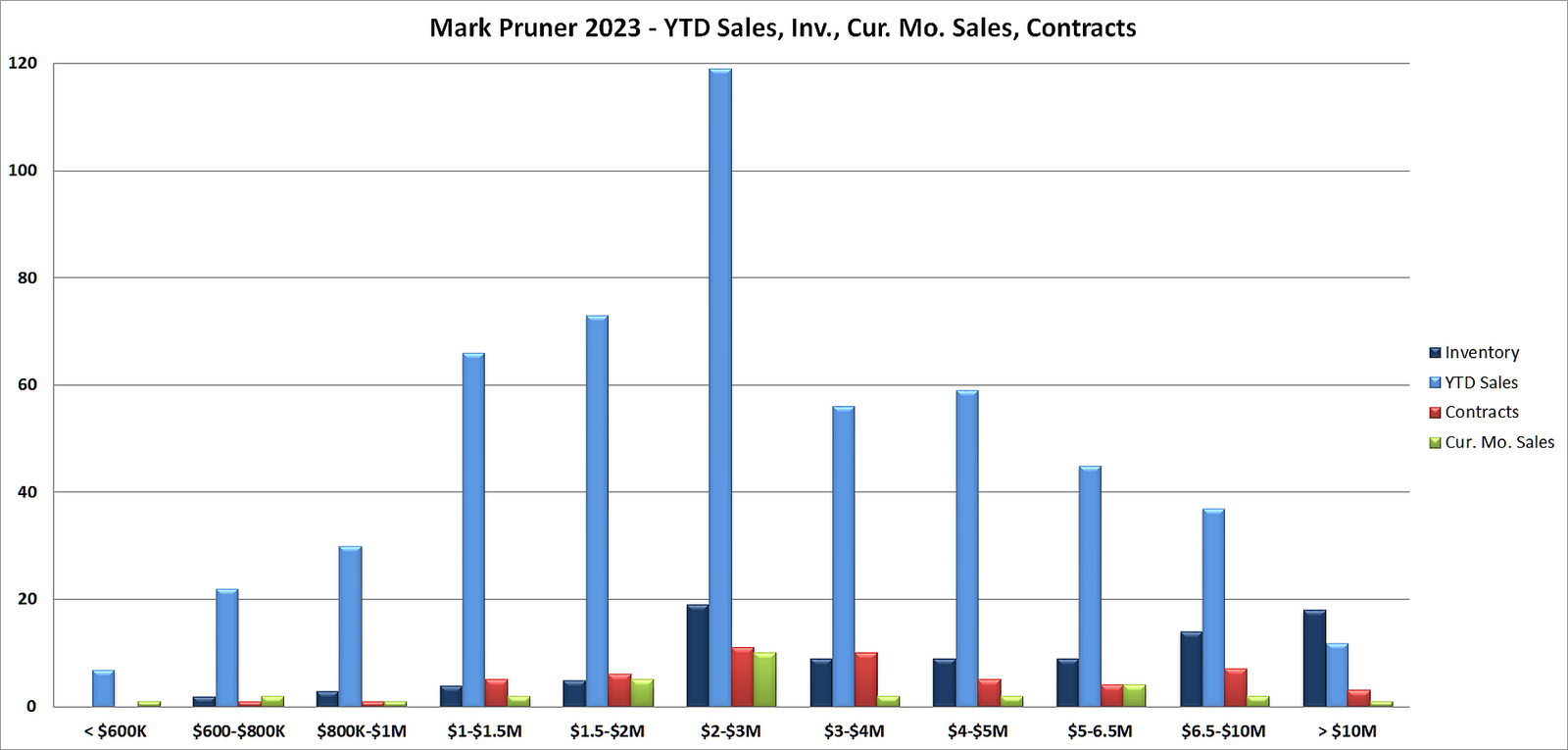

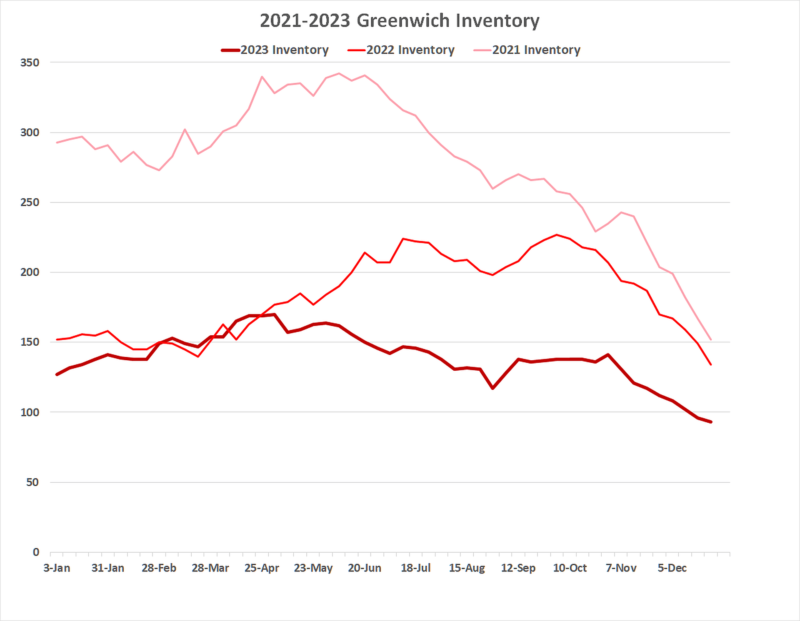

Heart of the Market Saw the Biggest Inventory Drop

The place where we saw a real decline in sales is the heart of our market from $1 million to $4 million. In that price range, we were down by 109 sales. At year-end, we only had 37 listings in that price range, which is down 16 listings from year-end 2022. Note these are year-end numbers, and when you look at the average inventory for the whole year, you can see how much more inventory we had in 2022 compared to 2023. In 2022, we had an average of 183 listings to sell each week. In 2023, we only had a weekly average of 140 houses to sell. Compare this to 2019 when our weekly average of inventory was 605 listings.

Higher Interest Rates are a Minor Factor in Reduced Inventory in Greenwich

Some people are saying that higher interest rates have locked sellers in because they couldn’t afford a new house at today’s inventory and hence are not putting their present houses on the market. This may be true in some parts of the country, but it doesn’t appear to be the case here in Greenwich.

Number of Listings Better than Inventory Shows

Covid caused a real drop in our inventory, but inventory is only a one day snapshot of listings at the end of the month. As houses went to contract faster, we saw more houses that were publicly listed but were never counted in the monthly inventory numbers. Houses would come in the first week of the month, and by the third week, they would already be under contract, so they were counted in the end-of-month inventory.

As mentioned above, 167 houses went to a binding contract in less than 15 days, and few of these were actually counted in inventory. It is not quite as competitive a market as months of supply would show, but it’s still very, very competitive for houses that are new or like new. For houses that are not so new and need work, the market is definitely weaker because people are more reluctant to fix up houses, particularly young families.

Fixer-Uppers Are Seeing Lower Demand with Inflation a Significant Factor

If you’ve never done a major renovation, there are a lot of things that you need to get right to make sure that your renovation is the best for your family. Every week our team at Greenwich Streets recommends architects, contractors, landscapers, and land use experts.

Another major, and more recent factor, in buyers being reluctant to take on major renovations is the increase in the cost of the work. Inflation costs for labor and materials have gone up substantially more than general inflation. Most of our best builders are still swamped with work and find it tough to find good people and continue to battle supply shortages of luxury fixtures and appliances. The good builders are ordering high-end kitchen appliances months in advance.

Houses are also more complex, and what was a luxury a decade or two ago is now commonplace, must-have items. Features like heated bathroom floors and sophisticated house controls that can be operated from your cell phone are becoming the norm in luxury houses.

Construction Costs Up and Contractors Very Busy

With higher interest rates, higher construction costs, and more “standard” features, costs of renovations have gone up. I always tell my buyers to look at their first-year costs when planning their budget. The cost of the house is usually the biggest part, but other first-year costs are also higher and becoming a greater percentage of the total first-year costs. This means even in a tight market like we have now, pricing those houses that need work at competitive list prices is key.

If the higher interest rates were causing the drop in inventory and locking people in, you would expect that the lower end of the market, where most people need a mortgage, would see the biggest decline in demand. In Greenwich, it is just the opposite. We have more houses listed over $10 million than we have under $2 million. The lower the price, the more competition for what does come on.

Appreciation, Inheritance and Investment Strategies Bolstering the Market

We have downsizers who have decades of appreciation in their present house, leaving them with plenty of money to pay all cash for a smaller house or condo. We also have the great inheritance going on as baby boomers are passing on decades of accumulated wealth to their children. I’m often amazed by how much cash many young buyers have.

It’s not just inheritance money; it is also good investment strategies. Greenwich attracts some of the best investment managers in the world, and many of these people are younger with some real innovative ideas. None of these groups is that concerned about interest rates, since they are likely paying all cash.

Buy a $1M House First to Buy a $4M House

Another growing group of buyers are first-time owners in Greenwich, who bought several years ago. As noted, the sales price to assessment ratio is up 33% since our last revaluation date of 10/1/21. It wouldn’t be unheard of for someone to buy a house for, say, $1 million in 2019 and fix it up with, say, $250,000 of improvements that create the large kitchen with an open floor plan that the house didn’t have.

Let’s say their mortgage is $800,000 on their $1 million purchase, and their house is now worth $1.6 million, giving them $800,000 in equity. If they use the full $800,000 in equity to make a 20% down payment, they could now buy a $4,000,000 house.

Even better, with their basis of $1.25 million (purchase cost plus renovations), they pay no taxes on their $350,000 in gain. While most people aren’t stepping up that big, many of the buyers that we are seeing at open houses were people who bought a few years ago and are looking to upsize as their income, wealth, and family size have grown.

What about 2024?

So, what will 2024 bring? Let’s really hope it’s more inventory. It’s not likely to be lower prices because even if we double or triple the 92 listings we have now, we will still have low inventory and very likely lower interest rates. The best thing you can do as either a buyer or a seller is to be prepared and then move quickly when the opportunity presents itself.

Stay tuned…

Mark Pruner is one of the principals of the Greenwich Streets Team at Compass Connecticut. He can be reached at 203-817-2871 or mark.pruner@compass.com.