-

Earnings Per Share (EPS): Reported at $0.48, slightly above the estimated $0.47.

-

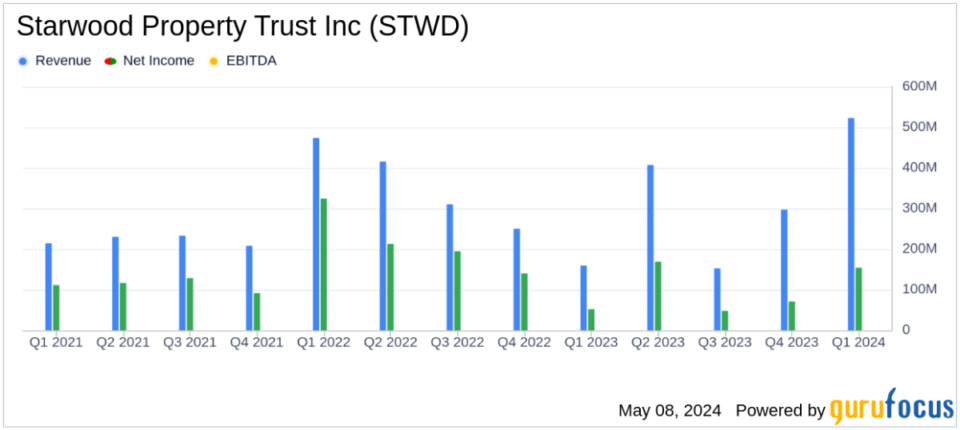

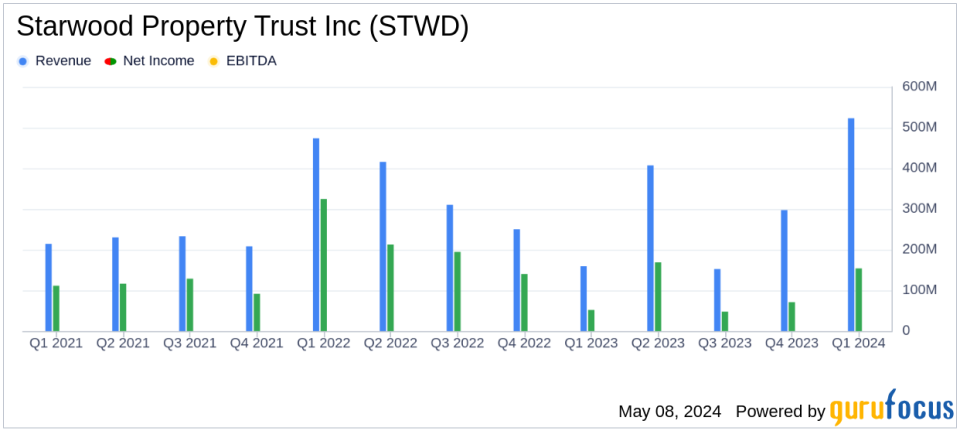

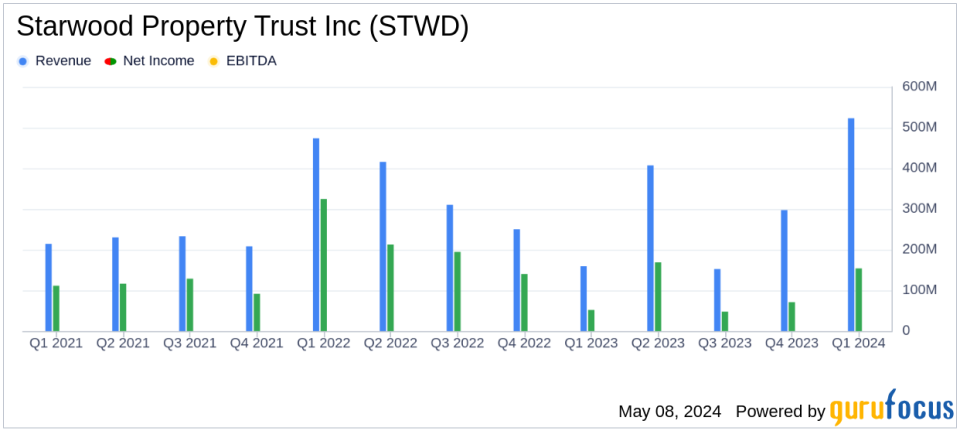

Net Income: Achieved $154.3 million, surpassing the estimate of $151.41 million.

-

Revenue: Total revenue reached $523.09 million, falling below the estimated $541.00 million.

-

Liquidity: Increased to a record $1.5 billion, indicating strong financial health and operational flexibility.

-

Dividend: Paid a quarterly dividend of $0.48 per share, aligning with the reported EPS.

-

Major Transactions: Issued $600 million of Senior Unsecured Sustainability Notes and sold Master Lease Portfolio for $387 million, enhancing capital structure and asset liquidity.

-

Book Value: Reported an undepreciated book value per share of $20.69, reflecting asset value and financial stability.

On May 8, 2024, Starwood Property Trust Inc. (NYSE:STWD) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported quarterly GAAP earnings of $0.48 per share, slightly above the analyst estimate of $0.47. Distributable Earnings (DE) were $0.59 per diluted share, indicating robust underlying performance.

Company Overview

Starwood Property Trust Inc., an affiliate of the global private investment firm Starwood Capital Group, is a leading diversified finance company focusing on real estate and infrastructure sectors. With a primary engagement in commercial and residential mortgage loans, the company manages a significant portfolio valued at over $26 billion.

Financial Highlights

The company’s net income for the quarter stood at $154.3 million, with significant contributions from the sale of its Master Lease Portfolio which generated net gains of $90.8 million. This strategic divestiture not only bolstered the earnings but also highlighted the company’s adeptness in asset management and value realization.

Revenue for the period was reported at $523.08 million, primarily driven by interest income from loans and investment securities. This figure aligns closely with the estimated revenue of $541 million projected by analysts. The company’s adept management of its loan portfolio and investment activities underpins its stable revenue streams.

Strategic Developments

During the quarter, STWD issued $600 million of Senior Unsecured Sustainability Notes due in 2029, marking a significant milestone as the first such issuance in the industry in over two years. This issuance, being 7x oversubscribed, underscores strong market confidence in the company’s financial health and strategic direction. Additionally, the company enhanced its liquidity to a record $1.5 billion, providing substantial financial flexibility to capitalize on future growth opportunities.

Operational and Segment Performance

Starwood Property Trust operates through various segments, including Commercial and Residential Lending, Infrastructure Lending, Property, and Investing and Servicing. The Commercial and Residential Lending segment remains a major revenue contributor, showcasing the company’s strength in core commercial lending activities complemented by residential lending, special servicing, and other operations.

Management’s Perspective

“We continue to navigate this dynamic market landscape with our low leverage multi-cylinder business. This quarter, we monetized our Master Lease Portfolio, highlighting the success we have had in creating value from our owned property assets,” commented Barry Sternlicht, Chairman and CEO of Starwood Property Trust.

Looking Forward

The company’s strategic initiatives, including the recent capital raise and portfolio optimization, are set to enhance its operational capabilities and financial robustness. With a strong liquidity position and a diversified portfolio, Starwood Property Trust is well-positioned to leverage opportunities across its business lines and deliver sustained value to its shareholders.

For detailed financial schedules and further information, stakeholders are encouraged to view the supplemental earnings schedules available on the company’s website under the Investor Relations section.

Explore the complete 8-K earnings release (here) from Starwood Property Trust Inc for further details.

This article first appeared on GuruFocus.