The massively reduced number of property sales in 2023 has led to a buyers’ market of falling prices in most areas of France, according to a new industry report.

The French housing market has not crashed and is not collapsing, affirms the February 2024 report by the national federation of real estate agents (FNAIM), which groups 12,000 agents throughout the country. However, the market is much slower than in previous years and now favours buyers rather than sellers.

In a previous report on property prices, notaire data indicated that there had been a 21% drop in sales between November 2022 and November 2023 with only 885,000 sold, compared to 1.2m sold over the previous year.

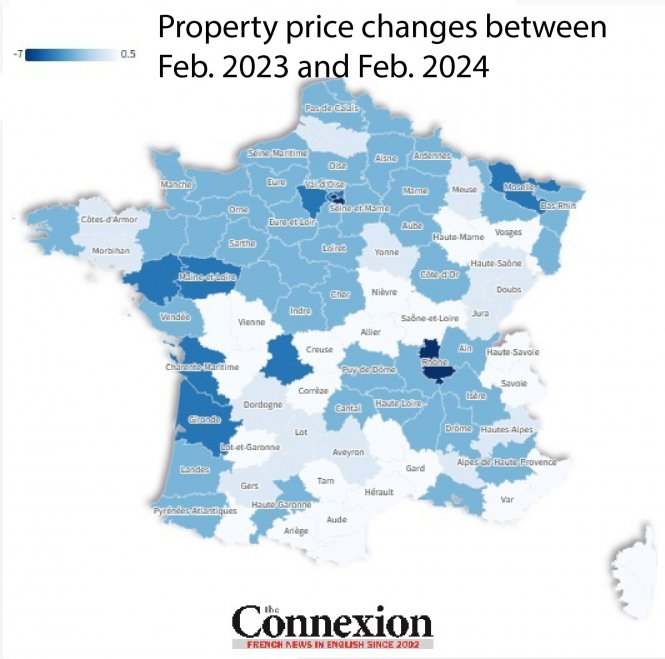

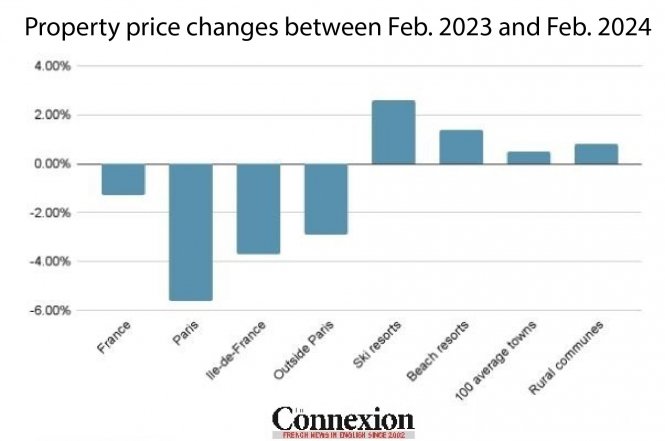

The new report suggests that the drop in sales continued – but at a slower rate in January 2024, with 10% fewer sales registered compared with January 2023. Falling prices are now the norm in most areas of France:

Prices fall more in cities and larger towns

Outside of Paris, property prices have fallen most in Lyon (-6.1% in a year), Nantes (-7.1%) and Bordeaux (-4.9%). The FNAIM report explains this as being due to the high prices in these larger towns and cities leaving buyers more exposed to higher mortgage rates.

|

Town / city |

Three month change (%) Dec. 2023 to Feb. 2024 |

One year change (%) Feb. 2023 to Feb. 2024 |

|

Paris |

-1.7 |

-5.6 |

|

Marseille (Bouches-du-Rhône) |

0.5 |

-1.4 |

|

Lyon (Rhône) |

-2.1 |

-6.1 |

|

Toulouse (Haute-Garonne) |

-1.5 |

-1 |

|

Nice (Alpes-Maritimes) |

0.3 |

2.1 |

|

Montpellier (Hérault) |

-0.2 |

-0.7 |

|

Bordeaux (Gironde) |

-2.6 |

-4.9 |

|

Rennes (Ille-et-Vilaine) |

-1.6 |

-4.1 |

|

Toulon (Var) |

-1.1 |

-1.7 |

|

Nimes (Gard) |

-1.7 |

2 |

|

Clermont-Ferrand (Puy-de-Dôme) |

-2.6 |

-5 |

|

Brest (Finistère) |

0.8 |

0.8 |

|

Perpignan (Pyrénées-Orientales) |

-1.1 |

1.5 |

|

Orleans (Loiret) |

0.0 |

-1.9 |

|

Caen (Calvados) |

0.1 |

-3.4 |

|

Nancy (Meurthe-et-Moselle) |

-0.9 |

-4.7 |

|

Avignon (Vaucluse) |

0.3 |

-7.5 |

|

Frejus (Var) |

0.2 |

2.8 |

|

Nantes (Loire-Atlantique) |

-3.2 |

-7.1 |

However, property prices in both ski and beach resort towns are proving more resistant:

End of post-Covid price ‘euphoria’

The current drop in prices should be considered to be a “readjustment of the rising prices post-Covid”, which the FNAIM report says were driven by “euphoria” that led to a sellers’ market.

However, it anticipates that the drop in prices will stabilise in the coming months due to the combined effects of falling sales – resulting in more available properties – and more favourable interest rates.

Read more:

Can bank loan pay for notaire home purchase fees in France?

Which foreign nationalities buy the most property in the Paris area?