Traditional investments have been focused on generic company stocks (especially U.S. and European/Japanese stocks), and fixed-income securities such as bonds, especially investment-grade bonds. Hence, the safe, boring 60/40 stock/bond portfolio, which has long been a staple of financial advice.

There is a whole universe of “alternative” investments, which can potentially offer much higher returns. I have long been interested in high-yielding securities such as business development companies (BDCs) like ARCC, high yield (“junk”) bonds, bank loan funds like VVR, and a whole zoo of real estate investment trust (REIT) common and preferred stocks. I have written about these high-yielders here and here. One can ramp up the reward (19% current yield) and the risk by investing in funds like ECC and OXLC which deal with collateralized loan obligations (see Financial Alchemy: Collateralized Loan Obligations (CLOs) Transform Junk Loans into Investment Grade Securities).

All of these are securities which are traded on major stock exchanges, are subject to some level of federal agency (S.E.C) oversight, and can be purchased through any brokerage. However, there are yet more asset classes like private equity which are not readily available through Fidelity or Schwab. I became especially aware of these at the end of 2021 when it was publicized that a number of universities had achieved returns of some 50% that year. Their secret sauce was alternative investments, especially private equity ventures. We noted in 50% Endowment Returns Driven by Private Equity Investments: How Rich Universities Get Richer (But You Can, Too) that we peons could have likewise doubled our money in 2021, if we had bought Blackstone (BX) stock on January 1 and sold it in December 2021 (BX stock fell heavily in 2022, and still has not fully recovered its late 2021 high). BX and similar companies (e.g. ARES, APO, BAM/BN) focus on various alternative investments. Their shares are available at your broker, but the share prices are heavily dependent on price/earnings ratios, which in turn depend on the emotions of the investing public. Also, the managements of these funds siphon a large fraction of the profits into their own pockets, leaving less for public shareholders.

There are all kinds of funds which cater to high-net-worth individuals and institutions, which will take your money and invest it. In many cases, there is a minimum investment of say $100,000, and a requirement that individuals meet some minimum threshold for income or liquid assets. Also, you may have lock up your money for up to five years, and have to enter into a formal partnership agreement, leading to the dreaded K-1 form at tax time.

Hedonova Investment Fund

With all that preamble, I would like to briefly describe yet another way to access the alternative investing space. There are a number of funds that allow small investors to participate in unconventional ventures, some of which I will mention in later posts. The fund I will focus on here is called Hedonova. Hedonova is an SEC-regulated fund that simplifies access to alternative assets.

Compared to some of its competitors, it is diversified, transparent, and convenient. It also happens to be extremely profitable, at least so far.

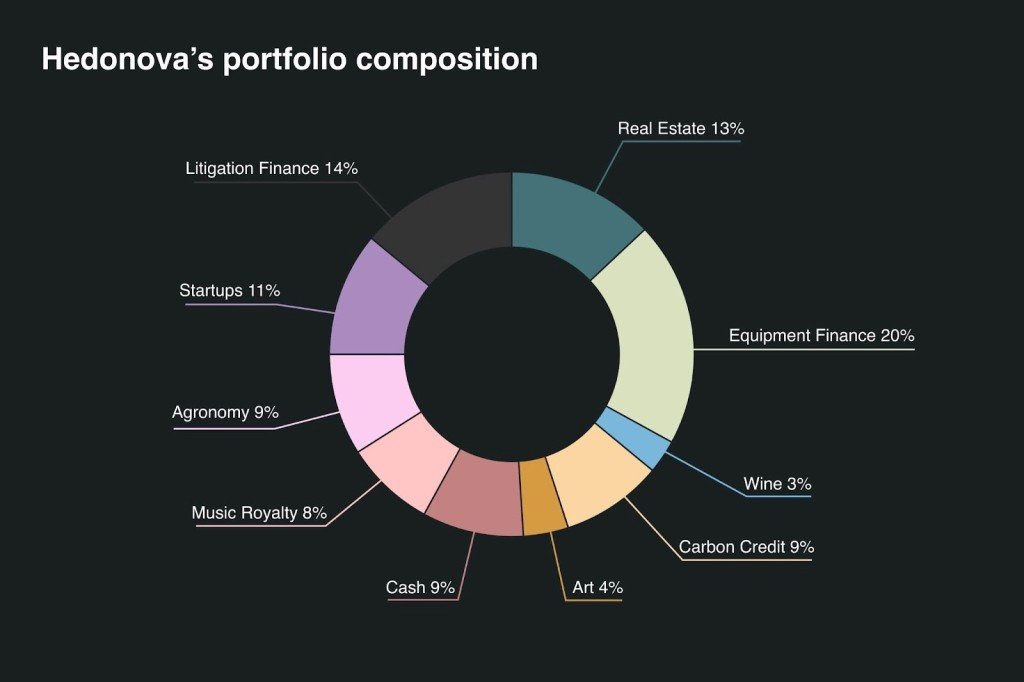

Their Portfolio page lists the classes of assets, with a pull-down description of each category:

Re Equipment Financing:

Large companies must often invest in expensive equipment upfront to conduct or expand their business… “ most companies prefer to lease their equipment instead. Hedonova invests in special purpose vehicles that purchase the machinery and rent it out to companies.” (This sort of investment would fall under the “private credit” category).

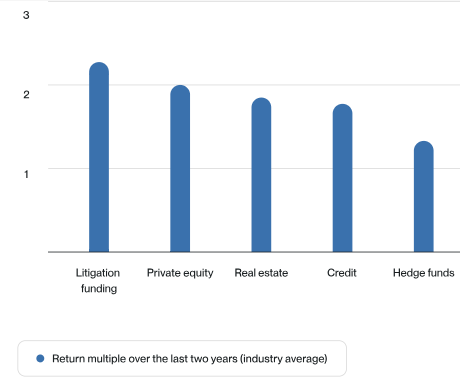

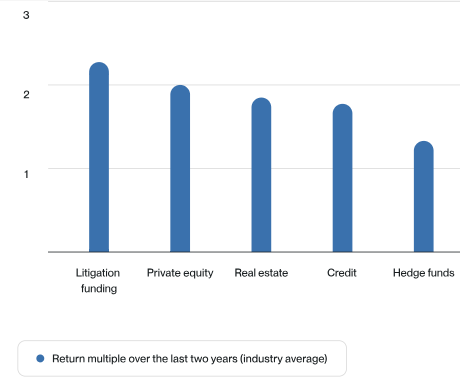

And re Litigation Finance: “We offer funding to law firms for fighting commercial lawsuits, enabling us to participate in the distribution of settlement money.” According to the chart below, it is common for an investment in litigation finance to double (!), though that investment may take a couple of years to play out.

The Hedonova portfolio is nicely diversified, from equipment finance and litigation and real estate, through venture capital plays, down to small investments in art and wine. The principals seem to really know what they are doing, and I get the impression that at some level they are having fun flexing their financial smarts. They have a very strong international reach, doing ventures all over the globe. To be able to swoop in and do a say $20 million deal anywhere on short notice is a big advantage.

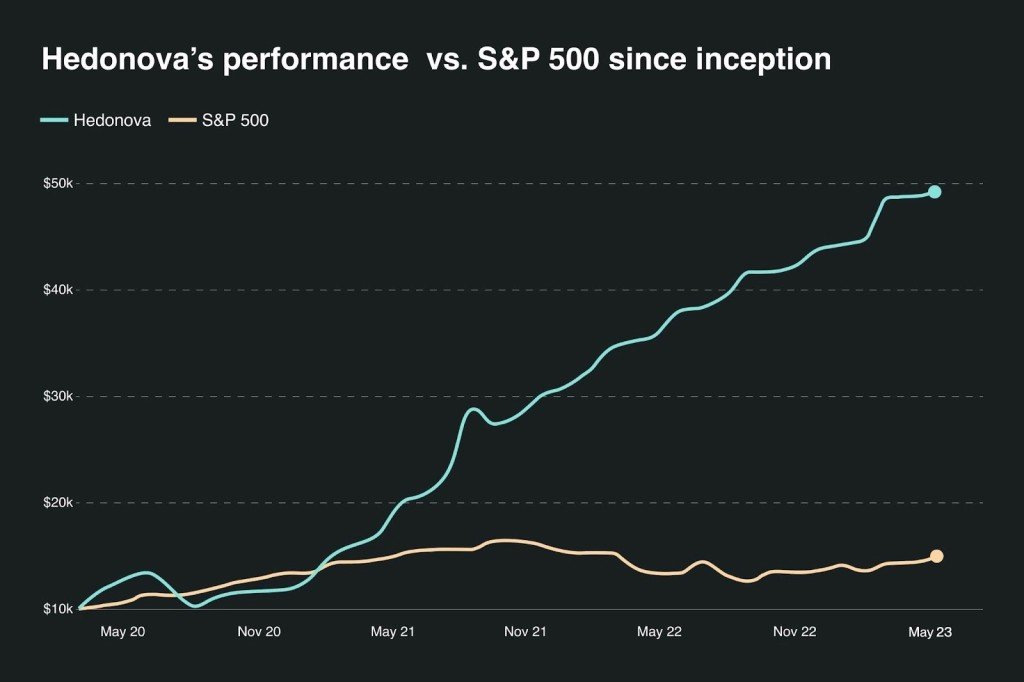

Here is a chart of the fund’s performance since its inception in January 2020; it is up far, far, more than the S&P 500 stock index:

Hedonova’s performance (final value 546) vs S&P 500 (final value 146), January 2020-September 2023. Initial values=100.

In addition to investing in the Hedonova master fund, investors are periodically invited to participate in specific ventures. For instance, Hedonova had the opportunity to take possession of a shipload of nickel at a refinery dock in Indonesia and sell it in Amsterdam for a higher price. I put a few shekels into this venture and made something like a 12% (from memory) return in around three months. Sweet. I am way up in my investment in the general fund, as well.

The company is audited, and while all investment decisions are made by Hedonova, its actual monies are held by the suitably-stodgy Northern Trust. Thus, this seems to me to be a trustworthy enterprise. The fees charged by management are 1% of total assets and 10% of the profits. This is exactly half of the traditional 2 + 20 charged by venture capital funds, so this is quite reasonable.

For the initial investment, I think there is some “Know Your Customer” validation procedure and wiring instructions. After that, you can transfer money in and out from a bank account. You can place a withdrawal anytime but it will take up to 80-90 days, which is understandable for a venture fund. Also, I was told that the tax treatment is a simple 1099 form.

Hedonova is just one of many ways to participate in the wild, wonderful world of alternative investments. This fund has a number of advantages which are mentioned above. It has worked out well for me, so I wanted to share about it for readers here on the EWED blog. As usual, investors should do their own due diligence before committing any funds.

(Boilerplate: Nothing in this post should be taken as investment advice to buy or sell any security or fund.)