(Kitco News) The correlations between Bitcoin and other assets broke down last year, indicating that Bitcoin may be evolving to behave less like high-risk speculative stocks and more like gold, according to Fidelity.

In their recently published 2024 Look Ahead, Chris Kuiper, Director of Research at Fidelity Digital Assets, noted that one year ago, they saw strong correlations between digital assets like Bitcoin on the one hand and rates and risk assets on the other.

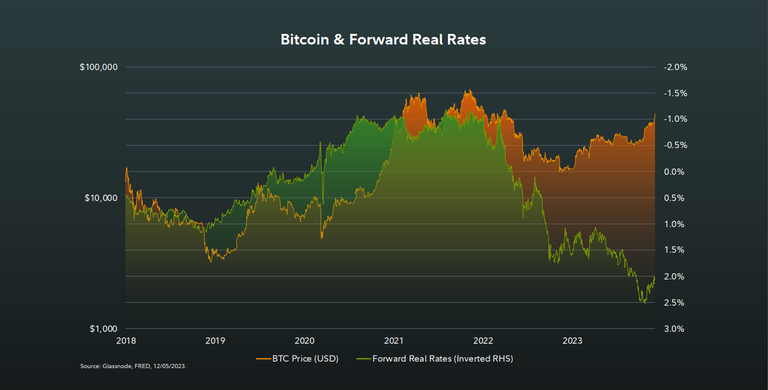

“Starting with rates, we noted that there was a high inverse correlation to the price of bitcoin and real interest rates as declining rates all throughout 2020 and into 2021 were accompanied by a rapid increase in bitcoin’s price,” Kuiper said. “This inverse correlation held in 2022 when real interest rates rapidly rose, and bitcoin subsequently tanked. This seemed to make sense because bitcoin is a non-cash-producing asset, so, on a relative basis, it looks more attractive during low and negative real rate environments and less attractive in higher rate environments.”

However, Kuiper said that over the past year, markets witnessed “a complete decoupling of this relationship” as real rates continued to rise, while bitcoin not only maintained its value, but rallied strongly. “Could this be due to an idiosyncratic event, such as the anticipation of a spot ETP?” he asked. “Perhaps. But we do not think so, because gold has also been showing similar behaviors recently.”

“We can only speculate as to what these real asset markets may be saying, but one possible explanation is that both bitcoin and gold are saying that the bond market may be wrong or that both assets are sniffing something else out, such as the United States’ increasingly large and structural fiscal deficits,” he wrote. “Perhaps the bitcoin market may be anticipating more debt monetization by the Federal Reserve in the future, or anticipating rate cuts, given that our research shows that bitcoin’s price is highly correlated not to consumer price inflation, but rather inflation in the money supply itself and various liquidity metrics.”

The other correlation that Kuiper said crumbled in 2023 is the one between Bitcoin and other digital assets and traditional risk assets like stocks. “While investors and traders previously treated digital assets like ‘growth stocks on steroids’ due to the correlation between them, it seems they have realized that bitcoin may be different,” he said. “We think there will still likely be a sizeable cohort that continues to put bitcoin and digital assets in their ‘high-risk bucket’ when investing, but over time, we think that bitcoin will return to its previous noncorrelated state because its value proposition is very different from high growth equities.”

Historically, bitcoin and gold haven’t been correlated over the longer term, but recently both have rallied together. “However, bitcoin has rallied much higher, leading us to wonder: if investors are flocking to real assets and continue to do so, will the narrative shift to bitcoin as ‘gold on steroids’?” Kuiper asked.

Kuiper pointed to a number of factors that are limiting the supply of Bitcoin in the market, which have, in turn, helped boost its price, and which could continue contributing to constrained supply throughout the year.

“The first is that the amount of illiquid coins, or Bitcoin, that have not moved in more than a year, has reached another all-time high of 70%,” he said. “The second is that bitcoin has been taken off exchanges, with the number of coins (not dollar amount) declining nearly 30% from the previous peak.”

He noted that the recent crypto winter may have served to strengthen hodlers’ grip on their BTC, even after the leading crypto made major gains. “Even in the face of a 160%+ rally in bitcoin (at the time of writing in mid-December), we have not observed these long-term and illiquid coins moving in response to the price to take profit,” Kuiper said. “Of course, it remains to be seen if further price increases induce some thawing of coins in cold storage, but so far, it appears that these holders are holding out for higher prices.”

His conclusion is that the nature of Bitcoin and digital asset adoption is evolving as the market matures. “With each cycle, more coins have moved to stronger hands, or those with much more conviction and/or longer investment time horizons,” Kuiper wrote. “We think that this will also continue to play into that strong foundation upon which 2024 will be built.”

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.