Economic projections and political uncertainty should be supportive of higher gold prices with or without a recession, while silver could see weakening demand from its largest sectors, according to the latest precious metals report from analysts at Heraeus.

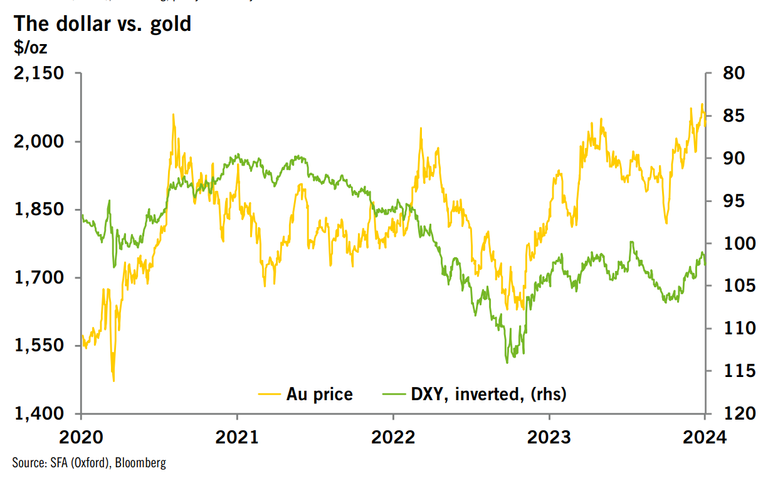

“The baseline economic outlook is generally bullish for gold,” they wrote. “There is a lingering risk of a recession in the US at some point this year. The US yield curve inversion is narrowing, and recessions do not usually start until after short-term yields have fallen back below the long-term yield. If and when a recession becomes apparent, the Fed can be expected to cut rates, likely weakening the dollar and benefitting the dollar gold price.”

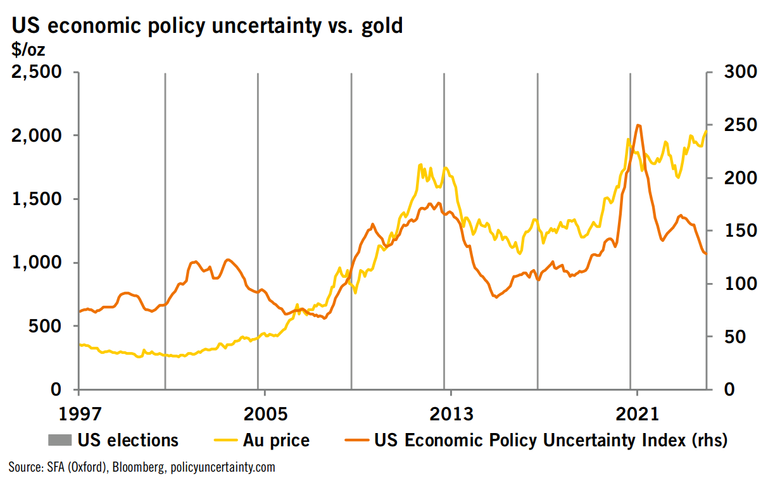

The analysts noted that 2024 will be a massive election year not only in the United States but across the world, and the 76 countries going to the polls represent approximately 40% of global consumer gold demand.

“India and the US are the largest gold-consuming countries that will see a general election, with a combined demand of 655 tonnes through Q3’23,” they said. “Arguably most important for gold is the US presidential election, given the effect that a change in leadership and government policy direction can have on the dollar and global macroeconomics.”

Heraeus pointed out that gold has tended to make gains ahead of U.S. elections. “Since 2000, gold has moved 3.14% higher in the three months leading up to an election month,” they said. “By comparison, the average change in the gold price over any given three-month period is just +1.8%.”

The analysts believe that uncertainty surrounding economic policy could increase as the election draws closer, which would likely boost gold prices. “The gold price has diverged from a measure of US economic policy uncertainty since 2021, rising as the index has fallen,” they noted. “Historically, as the index has begun to rise rapidly, so has the gold price. Greater uncertainty in 2024 stemming from both recession risk and a possible Trump re-election could see the gold price move higher.”

Looking at the near-term outlook, the analysts expect gold prices to follow their historical pattern of appreciation in January, supported by Chinese demand ahead of the Lunar New Year, even though gold is down year-to-date. “Overly dovish bets on the Fed’s rate-cutting path before the Christmas holiday have been moderated by the release of the Fed’s December meeting minutes last week that showed a more conservative stance,” they said. “Gold’s current correction may take the price further towards $2,000/oz.”

Turning to silver, Heraeus wrote that “Many of the bullish drivers for gold also apply to silver,” but they expect that these will be tempered by weaker industrial demand for the gray metal. “So far in January, silver has been materially underperforming gold,” the analysts said. “The Au:Ag ratio has shot up to 89, the highest since March 2023, indicating that at present silver’s bullish drivers are losing the battle.”

The analysts see downside risks for both industrial and jewelry demand this year after global silver demand fell by 10% in 2023. Industrial demand “could be lower again this year if photovoltaic installations slow following the surge in 2023 and other industrial applications see a decline,” they wrote, while “jewelry demand is unlikely to strengthen in 2024.”

Heraeus expects India to outperform the global economy, which could provide a “bright spot” for jewelry demand. “The risk is the price sensitivity of these consumers, and if the price of silver remains relatively elevated (above ~$22/oz), demand could be limited and unable to again meet 2022 levels of >5,100 tonnes,” they cautioned.

Silver prices underperformed gold once again last week, losing nearly 3%, while gold lost only 1%. At the time of writing, spot gold was trading at $2,030.01 per ounce, down 0.77% on the session, and spot silver last traded at $23.11, down 0.36%.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.