(Kitco News) – Gold kicked off the week at high levels as it traded near $2,050 per ounce, buoyed by the Middle East conflict’s safe haven demand and stubborn market sentiment that rate cuts are coming sooner rather than later.

But as the shortened holiday week rolled onward, a steady diet of hawkish central bank comments and the absence of any energy boosts from geopolitics weakened investors’ appetite for the yellow metal.

The latest Kitco News Weekly Gold Survey showed institutional experts and retail traders moving into near-perfect alignment in their expectations for gold prices next week, with a plurality of each predicting gains for the precious metal, while the majority now see stagnation or a slide.

“I am bearish on gold for the coming week,” said Colin Cieszynski, chief market strategist at SIA Wealth Management. “With treasury yields on the rise and the US Dollar strengthening, gold continues to face a moderate headwind.”

Mark Leibovit, publisher of the VR Metals/Resource Letter, said he can’t bet against gold next week given the current environment. “With a $2700 intermediate upside target, going to give Gold the benefit of the doubt, especially since my overall market analysis is negative and the press is ignoring World War III which is clearly underway,” he said.

Marc Chandler, Managing Director at Bannockburn Global Forex, said that with the additional conflict premium failing to materialize, interest rates and economic news will provide price direction next week.

“Gold is finishing the week near the middle of the week’s range,” Chandler said. “The high was set on Monday near $2058.60 and the low was recorded in the middle of the week slightly below $2002. Geopolitics and the broadening of conflict in the Middle East (including Pakistan vs. Iran) seemed to have less impact than I had imagined.”

He noted that 2-year and 10-year Treasury yields gained around 20 basis points this week. “The dollar surged in the first half of the week, coinciding with heavier gold trading,” he said. “As the trending market gave way to consolidation, the yellow metal stabilized. I do not think the US interest rate adjustment is complete, but next week’s focus is on the first look at Q4 US GDP and three central bank meetings (BOJ, ECB, and the Bank of Canada).”

Sean Lusk, co-director of commercial hedging at Walsh Trading, said gold is losing support at current levels, and he believes a break below $2,000 per ounce “can happen really easily here.”

While he expects the U.S. economy to face additional headwinds as we get deeper into 2024, right now there’s nothing to give equities pause.

“From the economic data we’re seeing so far, there’s just nothing here that’s cause for concern one way or the other,” Lusk said. “Without something major entering into the market, due to a war breaking out or some uneasiness or lack of confidence that things are going to remain the status quo, which we’re not seeing… The market is just ignoring a lot of geopolitical concerns that you would have thought would have more of a presence and be a factor for prices here, and it really hasn’t.”

Lusk said the drivers of gold’s recent rallies are fading, and the seasonal bid will soon run its course. “Usually at this time, mid-December to Valentine’s Day, we see big physical demand, buying of gold by world jewelers and everybody else. Physically, it’s been one of the more friendly times where we’ve seen good reactions and good outcomes. A rally in mid-February, then they take it all back.”

“This year’s a little different,” he said. “But nobody’s talking about what’s going on in Eastern Europe, hardly, anymore. Israel-Gaza seems contained for now, you have these Iranian proxies that are creating some havoc, shutting down the Red Sea and everything else, but does it really matter?”

“I’d be a little worried up here if I was long gold.”

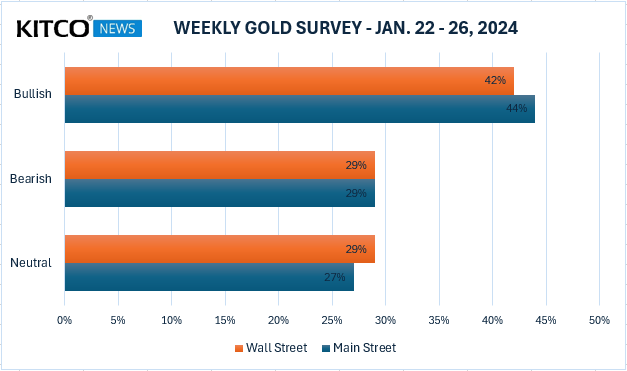

This week, 14 Wall Street analysts participated in the Kitco News Gold Survey, and they showed that the bullishness of last week had waned considerably. Six experts, or 42%, expected to see higher gold prices next week, while four analysts, representing 29%, predicted a drop in price, and another four, the remaining 29%, were neutral on gold for the coming week.

Meanwhile, 150 votes were cast in Kitco’s online polls, and this week retail traders mirrored the views of the experts almost exactly. 66 retail investors, representing 44%, looked for gold to rise next week. Another 44, or 29%, expected it would be lower, while 40 respondents, or 27%, were neutral on the near-term prospects for the precious metal.

While investors will closely watch the simmering conflict in the Middle East which continues to heat up without as yet boiling over, central bank rate decisions will once again take center stage next week with three major monetary policy decisions on the docket.

The Bank of Japan is expected to maintain its dovish stance and negative interest rates on Monday, followed by the Bank of Canada rate decision on Wednesday, which is anybody’s guess. Thursday morning will see the European Central Bank’s rate announcement, which could provide the greatest risk for the U.S. dollar and gold next week.

Markets will also receive U.S. Flash PMI data on Wednesday, advance Q4 GDP, durable goods, and new home sales on Thursday, and the Core PCE, personal income and spending report on Friday.

“It’s going to be interesting, because, just from a technical point of view, we’ve got a mix of signals going on right now,” said Darin Newsom, Senior Market Analyst at Barchart.com. “The trend on the weekly chart is still down. So what does this tell me? That we’re going to see some of the money come out of the idea of safe-haven.”

Newsom said this doesn’t mean that everything around the world will suddenly get better, “but it’s possible that we start to see investment money grow a little more comfortable and move out of commodities, including safe haven markets.”

He noted during the interview that the S&P 500 was on the verge of setting a new all-time high, which it did later on Friday afternoon, and said this would also pull investment away from precious metals.

“I think we’re going to continue to see a flow of money out of commodities, and that would include gold,” he said. “Now, gold might be one of the last ones where we see money move out because there is so much uncertainty in the world. But that being said, the weekly chart still looks down. If it can’t build a short-term uptrend off of that low this week near $2,000, it blows through it next week.”

“Eventually we are going to extend this third wave of a three-part downtrend beyond the previous low of $1,987.90, with the next target down at $1,960.80 on the Feb contract.”

Newsom said that before we get to the end of January, he expects the April contract to set new lows as well. “From a purely technical point of view, if we take out the previous low of $2,007.40, then $1,980 will be the next target for the April contract.”

Newsom said that while $2,000 per ounce is a nice round number, he doesn’t think that algorithms are actually looking at it. “They’re watching moving averages, volumes and volatility, these kinds of things,” he said. “Eventually, they’re going to look over at those other investment opportunities. I feel like there’s more opportunity there.”

“We’re climbing into new territory, new high territories, and gold might have run its course for now,” he said. “Money just switches channels.”

For his part, Adrian Day, President of Adrian Day Asset Management, believes gold can build off of this week’s consolidation to post fresh gains next week. “We had retracement, now gold can move up again,” Day said.

James Stanley, senior market strategist at Forex.com, has switched from bear to bull for next week. “I went with down last week as there was an early-build of bearish structure, and that did pan out, to a degree,” he explained. “But bears failed to test below $2k in spot and a falling wedge formation has built. Those are bullish, and combined with a lack of testing below $2k, I think that we’ll see a push higher next week.”

Stanley said the big question is “where bears show up for resistance; I’ve got levels at 2059, 2075 and 2082.”

And Kitco Senior Analyst Jim Wyckoff still expects gold prices to trade higher next week. “Higher as bulls gained some momentum late this week, to suggest follow-through strength early next week,” he said.

Spot gold is currently up 0.31% on the day but has lost 1% during the week, last trading at $2,028.44 per ounce at the time of writing.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.