Around 620,000 ounces of palladium were replaced by platinum in 2023 vs 385,000 ounces in 2022, according to the World Platinum Investment Council’s (WPIC) November estimate. In 2024, the WPIC sees the substitution at 700,000 ounces.

“Based upon our current forecast of palladium moving to surplus from 2025, we expect palladium to begin to be substituted for platinum from that point,” said Edward Sterck, head of research at the WPIC.

Substitution of platinum for palladium or the other way round is a slow process. It mostly occurs on new vehicle models and typically only 15% of vehicles produced a year are new models, Sterck said.

Platinum and palladium are effectively interchangeable in gasoline autocatalysts, which account for 80% of total palladium demand. Consultancy Metals Focus estimates total palladium and platinum demand at 9.7 million ounces and 8.1 million ounces, respectively.

“We are already seeing substitution slowing down or in some cases stopping,” said Nikos Kavalis at Metals Focus, adding that the process would eventually reverse.

“It won’t be an overnight change, as autocatalyst designs can happen a long time before cars actually come off the production line.”

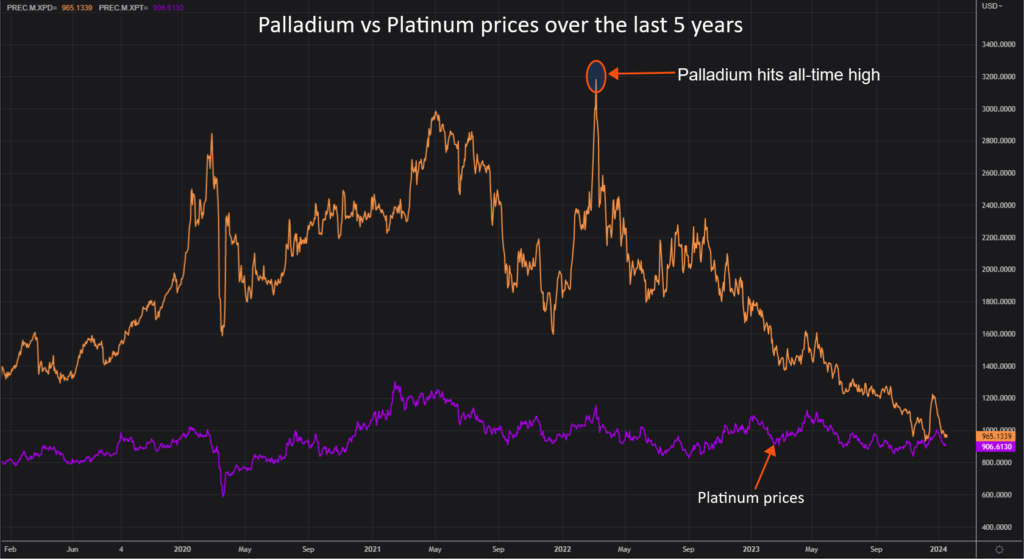

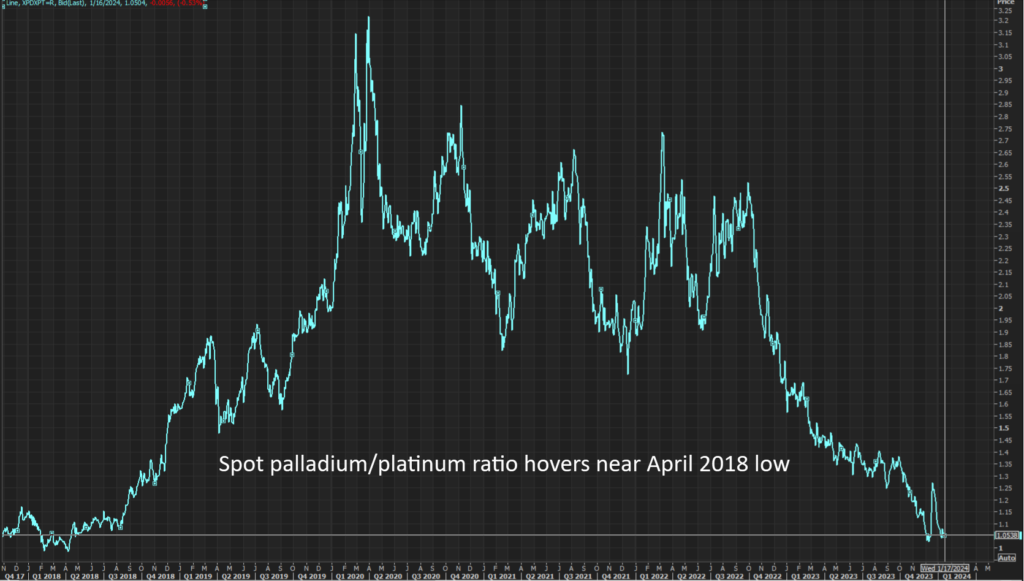

Palladium prices currently trade at a $50 an ounce premium to platinum prices compared with $700 a year ago.

The spread between them of less than 20% makes the research and development aimed at platinum for palladium substitution less attractive, said a source at a major platinum and palladium miner.

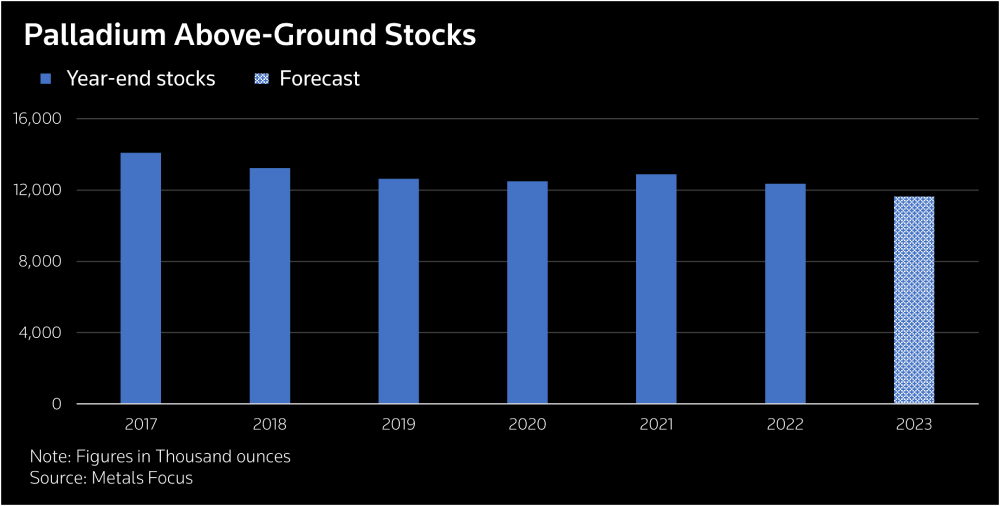

This eases the pressure on palladium but it is not enough to lift prices as accumulated stocks at fabricators and manufacturers are still large and fundamental long-term factors – the spread of EVs and recycling activity – are still present, he added.

Metals Focus estimates above-ground palladium stocks at 11.6 million ounces in 2023.

(By Brijesh Patel and Polina Devitt)