Many investors know physical gold is in demand for jewellery and acts a store of value during market uncertainties and currency devaluations. It also offers low correlation with other asset classes and provides a hedge during periods of high inflation.

The Morningstar Quantitative Research Team has analysed this issue in detail in a recent report.

Here are their conclusions.

Types of Mining Stocks

There are four types of companies involved in the precious metals ecosystem and four areas of activities: 1) exploration and development; 2) mining and production (M&P); 3) extraction, refining, investments, royalty, and streaming; and 4) equipment and services.

Some 47% of these companies are actively involved in precious metals exploration and development, while another 41% are associated with mining and production activities.

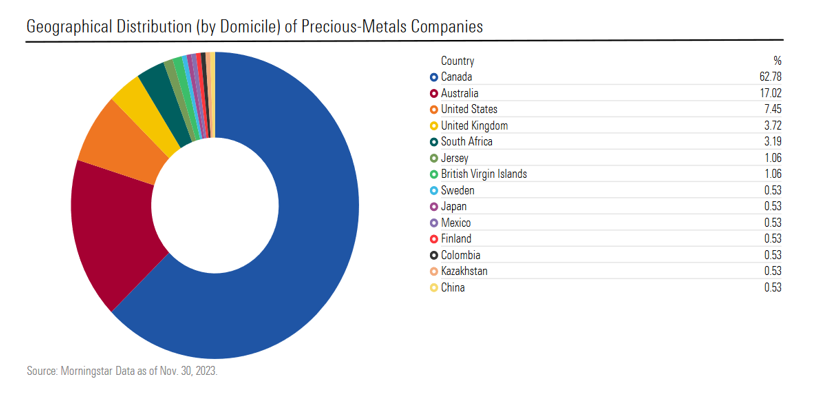

Many investors may expect mines to be located in developing markets. But precious metals companies are mainly concentrated in Canada and Australia because of the availability of raw materials, as well as their long history of exploration and production.

Mines, But No Moats

Most of the companies in this ecosystem do not possess economic moats due to the uncertainty around successful exploration, its geological challenges, and the significant environmental impacts. And the companies do not have pricing power and face challenges around fuel costs, labour shortages, and volatile commodity prices.

Mining is capital intensive and has a low return on capital. It is unlikely that companies will generate economic return more than cost of capital barring materially high gold prices. These challenges prevent the establishment of robust economic moats.

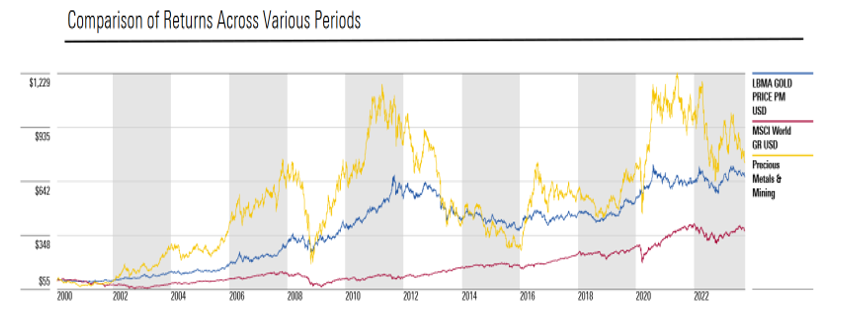

Exceptional Returns, But Also Volatility

Still, as a group the precious metals companies have generated exceptional returns in the long run. During bull markets, these companies can deploy their operating leverage to maximise profits. However, their volatility during periods of market turbulence may put off potential clients from owning the stocks in their portfolios.

Correlation, Inflation

What about correlation with other assets? There is a fair level of correlation between precious metal stocks and commodities, US real estate investment trusts, and equity market returns. But the low correlation with fixed income and negative correlation with the dollar index does offer some respite here.

The connection with inflation is illustrated in the following graph, which shows the 12-month rolling correlation between US core inflation and a precious-metals equity basket over the last five years. The horizontal line indicates the historical correlation average from 2000 to 2023. The basket performed well during the coronavirus pandemic as correlations started falling. But during the bear market of 2022, correlations started to improve (i.e. became less negative), resulting in an increase in the precious metals basket returns.

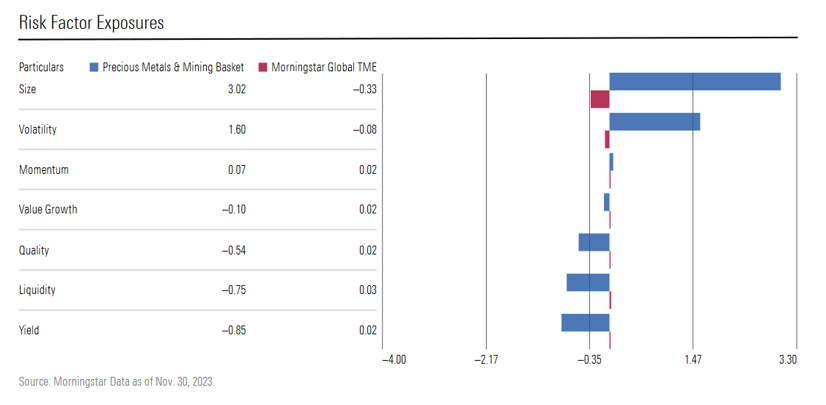

Owning precious metals miners has benefits but also brings risks. What’s obvious is the sector is overexposed to small-cap and highly volatile companies, but liquidity, quality, and yield remain areas of opportunity. Given these factors, they may have a place in portfolios.

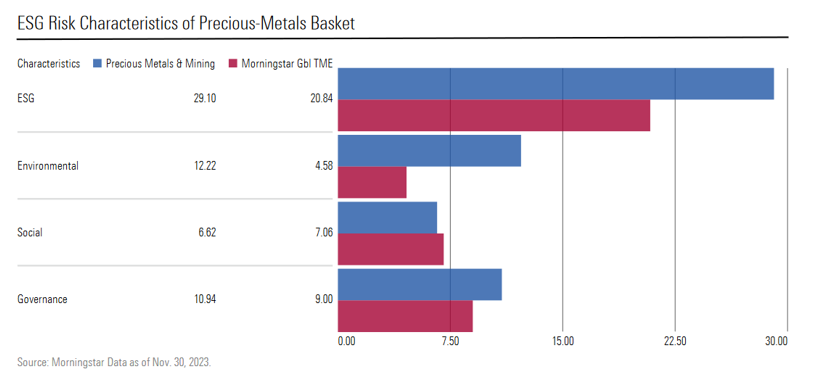

These companies also have ESG issues. As can be seen in the following chart, the precious metals basket has higher risk scores relative to broad equity markets.

Mining Valuations Stretched?

There are clearly challenges with valuations with precious metals. Return of equity (ROE) and return on invested capital (ROIC) being lower than broad markets and price/earnings ratios also seem too high. The higher P/E suggests that investors are willing to pay more for the future growth potential, capitulating on rising prices of precious metals, despite their current lower profitability compared with the broader market.

The low return can be attributed to the capital-intensive nature of the mining industry, which is triggered by challenges in managing cost structures and exploration costs due to the scarce availability of these metals. In addition, risks of volatile commodity prices, geopolitical issues, and regulatory ecosystems further impact profit margins.

Read more: why one company is bullish on bullion and the case for holding gold next year

Read more: why one company is bullish on bullion and the case for holding gold next year