(Kitco News) – Demand for gold is likely to ease with the approach of summer, while silver prices may be poised to play catch-up, according to the latest precious metals report from strategists at Heraeus.

“Following the typically strong gold-buying season in the first two months of the year in China due to Lunar New Year demand,” the month of March and Q2 tends to see lower consumer demand, the analysts wrote in the report.

“Over the last 10 years, Chinese consumer gold demand in Q2 has declined by an average of 21% quarter-on-quarter,” they said. “Implied demand was particularly strong to start the year, indicated by 10-year highs in Chinese gold imports from Hong Kong. This may suggest that with no notable events likely to boost demand in Q2 ’24, a quarter-on-quarter drop could be larger – particularly if new record gold prices begin to crimp appetite for bullion.”

Fewer weddings and festivals in India during this period, which tend to boost gold purchases in the world’s second-largest consumer gold market, could also spell lower demand in March and April.

“Local market premiums have already begun to fall, a result of high dollar gold prices, though it is possible they will stay depressed in the short term as demand falls off,” they said. “Indian gold imports and demand, however, are expected to begin to pick up in the lead-up to the Akshaya Tritiya in early May as wholesalers restock in anticipation of the auspicious festival, which tends to boost the local market premium over the LBMA price.”

After losing 1% over the course of last week, spot gold is holding steady on Monday morning. It last traded at $2,158.50 per ounce and is up 0.12% at the time of writing.

Turning to silver prices, the analysts said the gray metal remains historically undervalued compared to its yellow counterpart, but the gold-to-silver price ratio may soon show sign of moderating.

“The gold:silver ratio has trended higher so far this year, to 85.6 according to Friday’s closing prices, against 87.03 on 1 January,” the analysts wrote. “Much of this has been due to initial gold price appreciation beating silver before both took off on 29 February. Since 2006, the gold:silver ratio has averaged 60.09 during previous gold all-time-high peaks. At that ratio, the recent peak in gold implies a silver price of $35.85/oz, 47% higher than the silver price on 11 March when gold peaked. This would suggest silver is currently undervalued versus gold.”

“Gold tends to be the go-to safe-haven metal for institutions, with retail investors favouring ‘cheaper’ silver,” they said. “Secondly, the industrial component of silver demand could be holding it back if demand has been relatively sluggish early this year.”

Heraeus noted that the ratio doesn’t generally hold above the 90 level for extended periods of time, so they believe this period could see it begin to fall.

“With gold consolidating in a new trading range, this time a decline in the ratio could be a result of silver closing the gap higher,” they said.

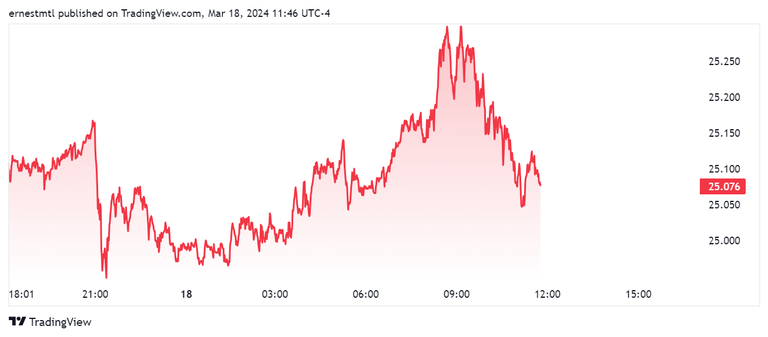

The analysts pointed out that silver prices managed to continue their climb last week despite gold’s retracement. “By the end of the week, the silver price stood at $25.21/oz,” they said. “$25.90 is the next higher zone of resistance for the silver price, being the intra-day high reached in December, and the level at which rallies were stopped in April and May 2023.”

Spot silver is holding above the $25 per ounce level, but is still down on the day, last trading at $25.079 for a loss of 0.37% on the session.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.