(Kitco News) – This morning’s hotter-than-anticipated U.S. CPI report for January sparked declines across the broader market, and precious metals in particular took a pounding. According to a video post from Jeff Christian, Managing Director of the CPM Group, a detailed unpacking of the CPI components shows why higher-for-longer rates likely mean lower-for-longer gold and silver prices.

“Gold has moved into a slightly higher range, but it’s basically been trading sideways for several months now,” he said. “It did fall this morning, but it remained within its range.” Christian said gold is stuck in a range of approximately $2,000 and $2,100, and silver between $22 and $23 per ounce, as they await “significant issues to take them out of the range that they’ve been in, either bad economic and political or financial issues that could take gold over $2,100, or better and stronger world economic and political conditions, which don’t seem likely, which could take us below $2,000.”

Addressing the latest inflation numbers, Christian said that January’s annualized reading of 3.1%, which was higher than the consensus forecast of 2.9%, “shows the markets that, as the Fed has been saying, we’re not out of the inflation woods. There are inflationary pressures, not hyperinflationary pressures, but inflationary pressures.”

Christian said the report shows that food and energy prices have been falling faster and have resulted in headline inflation falling well below core inflation, which excludes these volatile sectors. “That’s very important to understand because if you look at that headline inflation, it was 3.1%, which is down sharply from the 9% a year and a half ago, it would give you the impression that the inflation fight is going much better than perhaps it is,” he said. “Core inflation was about 3.9% year-over-year.”

He said that when the report is disaggregated, we learn that while food purchased for consumption at home rose 1.2% in January, restaurant food bought for away from home was up around 5.1%, while the other big declines were in gasoline, heating oil, and natural gas. “Energy as a total fell 4.5%, but you start looking at fuel oil off 14%, natural gas off 17.8%, that’s what caused that headline inflation to be 3.1% while the core is 3.9%,” he said. “You’re seeing lower inflation figures on a very volatile energy market, which is problematic and worrisome because that’ll flood back and forth; it can go back up at a moment’s notice given the uncertain nature of things in Europe in the Middle East right now.”

Christian said failure to understand the relative significance of these numbers “creates a situation where you say ‘well, we can applaud ourselves for having 3.1% inflation,’ but we have to be realistic. The core inflation is really 3.9%, we still have a long way to go to get down to 2% or close to 2% inflation.”

A drill-down into the core components paints a very different picture, as the things that remain stubbornly high are not discretionary or flexible spending, and they do not correct quickly.

“If you look at that core inflation, goods in the consumer pricing, they were 2%, pretty good,” he said. “But services were 5.4%, and specifically you had a 6% increase in shelter, rent and mortgage payments and other costs of your shelter, your home, very high. And transportation services were 9.5%, so that’s where you’re seeing your inflationary pressures, transportation services and shelter.”

Christian said that today’s CPI report, where even the headline surprised to the upside, combined with the Federal Reserve’s focus on core inflation, which remains nearly double their 2% target, means precious metals investors should expect persistent weakness in gold and silver for much of 2024.

“It’s interesting because some people think of gold and silver as inflation hedges, and they are broadly, but they don’t move tick for tick,” he said. “Financial markets are looking at the high inflation and saying, ‘this is going to keep interest rates higher longer than we would have liked, or hoped, or prayed for,’ and that it means that financial assets, including gold and silver, probably could see weaker prices and maybe even lower prices for a longer period of time.”

Christian said CPM Group sees higher inflation as “a negative for gold and silver in the short term,” but they still expect “that will change as the year progresses.”

Spot gold slid precipitously from $2030 per ounce just before the 8:30 am EST CPI release to a session low of $1,990.15 shortly after 10 am. It last traded at $1,993.28, down 1.32% on the session.

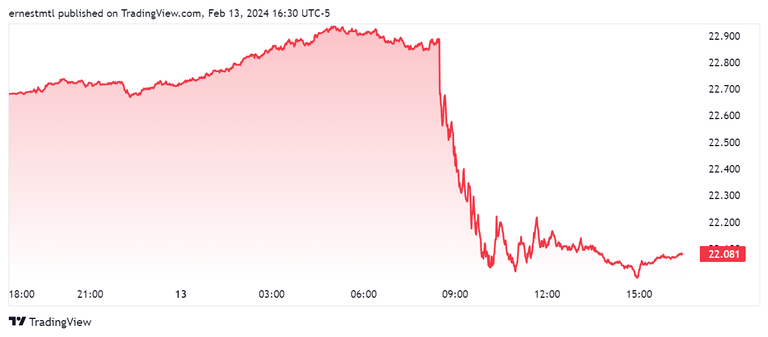

As it so often does, silver mirrored and magnified gold’s decline, with the gray metal losing 2.71% on Tuesday to trade at $22.08 at the time of writing.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.