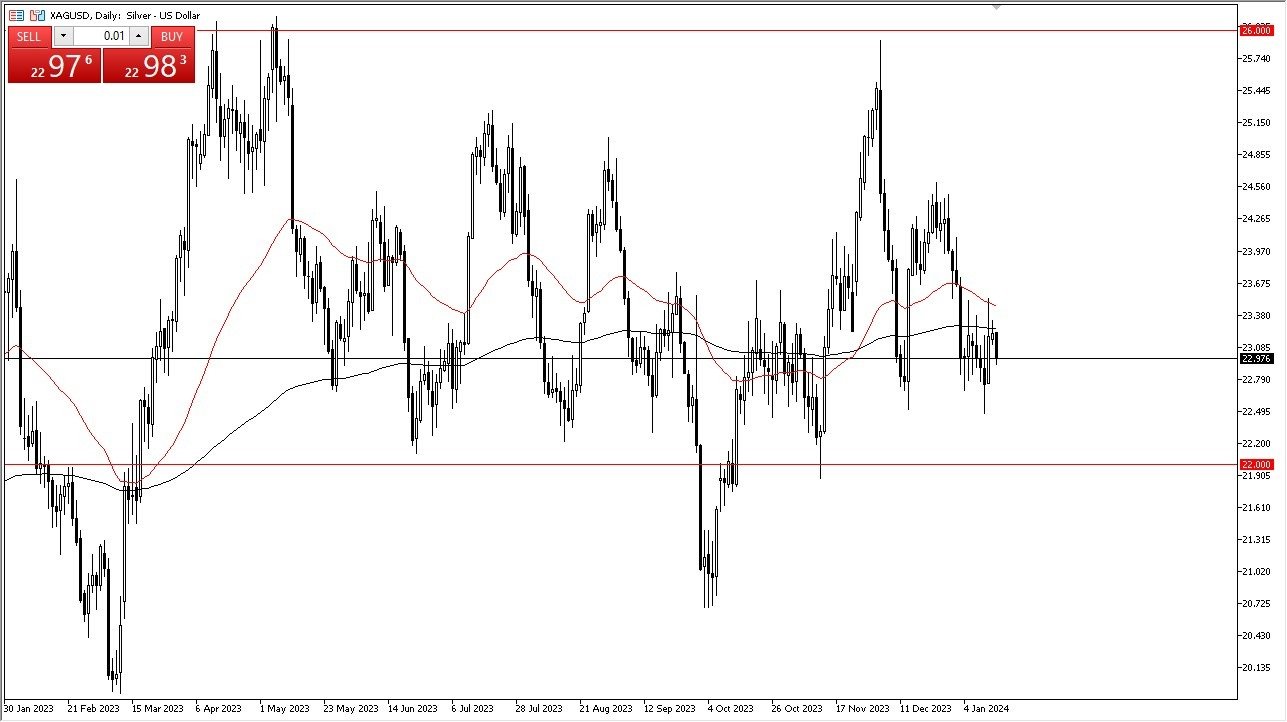

Potential signal: I am a buyer of silver on dips. I like buying anywhere near the $22.50 level, with a stop at $21.89 below. I would aim for $25, but keep in mind that this is a swing trade, so it will take time to get there.

- The silver market witnessed a decline in its performance during the Tuesday session, as traders returned from the holiday period with renewed activity.

- Presently, the market is approaching a crucial support level, specifically the $22 region, which suggests that a potential rebound may be on the horizon.

During the Tuesday session, silver experienced a modest decrease in value, indicating that a period of turbulent price fluctuations is likely to persist. Despite this noise in the market, it is important to note that the $22 level is poised to function as a significant support level. Maintaining a position above this level suggests that the market will remain within a consolidation range.

An immediate obstacle in the market is the 200-day Exponential Moving Average (EMA), which serves as a short-term resistance point. Breaking above this level could pave the way for further upward movement, potentially reaching the $24.50 level and even extending towards the $26 level, which represents the upper boundary of the longer-term consolidation area. It is crucial to acknowledge that the silver market is susceptible to various influencing factors, including fluctuations in interest rates, geopolitical developments, and shifts in central bank policies.

Considering the current circumstances, it is reasonable to conclude that the market is currently in the midst of a consolidation phase that may endure for a significant portion of the year. Given that the market is closer to the lower end of its overall trading range rather than the upper end, the likelihood of an impending rebound becomes more apparent. However, it is advisable to exercise caution and allow for a further pullback before contemplating an entry into the market.

Forex Brokers We Recommend in Your Region

In the grand scheme of things, silver price holds promise as a long-term investment. Nevertheless, its present momentum appears to be struggling, necessitating a prudent approach for potential investors. The multitude of variables currently influencing the marketplace underscores the need for cautious decision-making.

Ultimately, the silver market’s recent performance indicates a potential for a rebound from the $22 support level, although it may require further retracement before an entry becomes attractive. While silver remains an appealing option for the long term, the current market conditions demand vigilance due to the numerous dynamic factors at play.