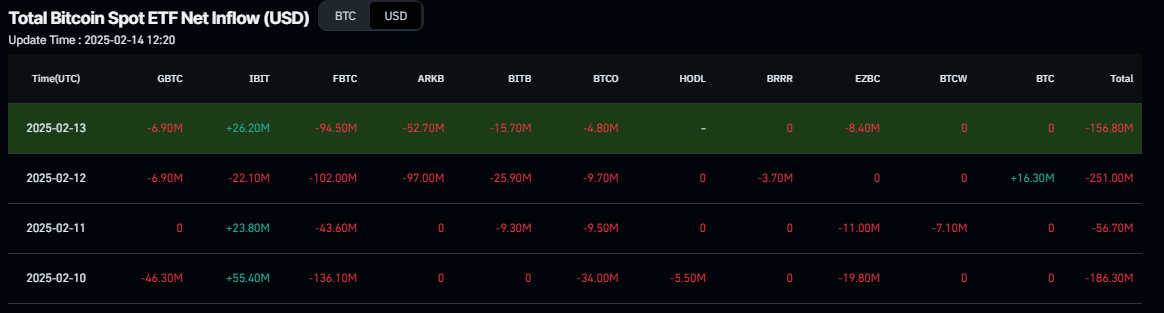

Bitcoin’s (BTC) price has been consolidating between $94,000 and $100,000 for the last ten days, and, when writing on Friday, it hovers around $97,000. Despite this consolidation, US Bitcoin spot Exchange Traded Funds (ETFs) data recorded a total net outflow of $650.80 million until Thursday, hinting signs of weakness among institutional investors. Moreover, this week, US macroeconomic data and Trump’s push for a Russia-Ukraine peace deal affected Bitcoin prices.

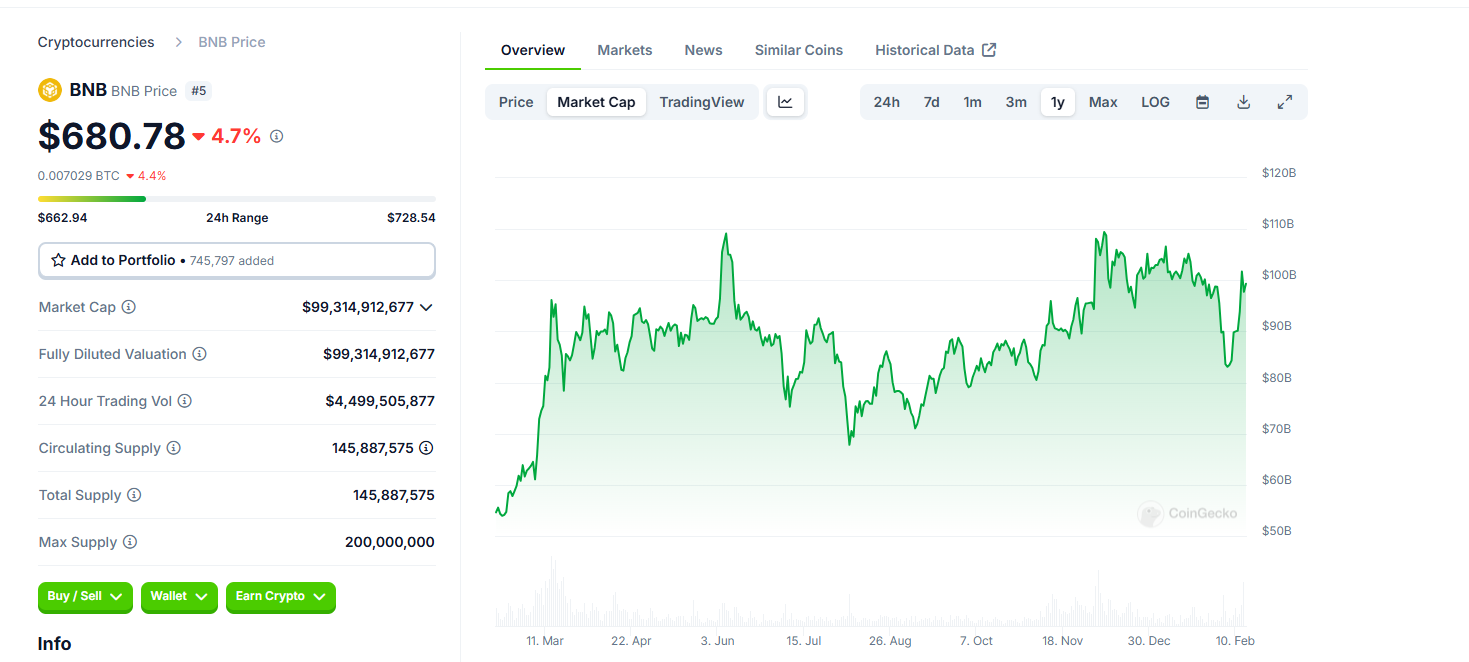

BNB (BNB) price trades around $680 on Friday after rallying nearly 11% this week. On-chain data paints a bullish picture as BNB trading volume reaches 5.13 billion, and the long-to-short ratio reaches the highest level over a month. Moreover, Santiment data shows that Broccoli is trending due to its association with a meme coin linked to the dog owned by the former CEO of Binance Changpeng Zhao (CZ).

Over $2.5 billion in Bitcoin and Ethereum options expire today, sparking fears of market volatility as traders watch for price movements.

Over $2.5 billion in Bitcoin and Ethereum options will expire today, which could lead to increased volatility in the crypto market. Traders are closely watching how this event might impact prices over the weekend, especially after recent US economic data influenced market sentiment.