- The Bitcoin miners’ reserve has declined significantly.

- Revenue has also plummeted to one of its lowest levels in history.

Bitcoin [BTC] miners faced significant challenges as the Bitcoin hashrate has reached record levels.

These difficulties are compounded by the recent halving event and the substantial price declines BTC has experienced over the past few weeks.

Bitcoin hashrate spikes

Analysis revealed that the Bitcoin hashprice, which measures earnings per unit of hashrate, declined to an all-time low last week.

On the 4th of August, miners earned just $35 per petahash daily, marking the lowest rate recorded historically.

Additionally, the Bitcoin hashrate peaked, achieving an unprecedented level of 673 exahashes per second.

This surge in hashrate signifies increased mining difficulty, making it more challenging for miners to mine new blocks successfully.

This difficulty is exacerbated by recent reductions in transaction fees, adding further financial pressure on miners.

Miners sell holdings as Bitcoin hashrate climbs

AMBCrypto’s analysis of miner revenue revealed a significant downturn following the Bitcoin halving event.

The chart showed daily earnings dropping from approximately $50,000 to $30,000, according to data from Blockchain.com.

This decline was further exacerbated by a recent surge in the Bitcoin hashrate, pushing revenues to around $25,000—a near-historic low for miners.

This reduction in revenue, coupled with the ongoing decline in Bitcoin prices, has also impacted the miner reserve.

Data from CryptoQuant showed a noticeable decrease in reserves since April, at approximately 1.813 million BTCs at press time.

If the hashrate remains elevated, miner reserves will likely diminish in the forthcoming months.

Bitcoin’s feeble climb challenged

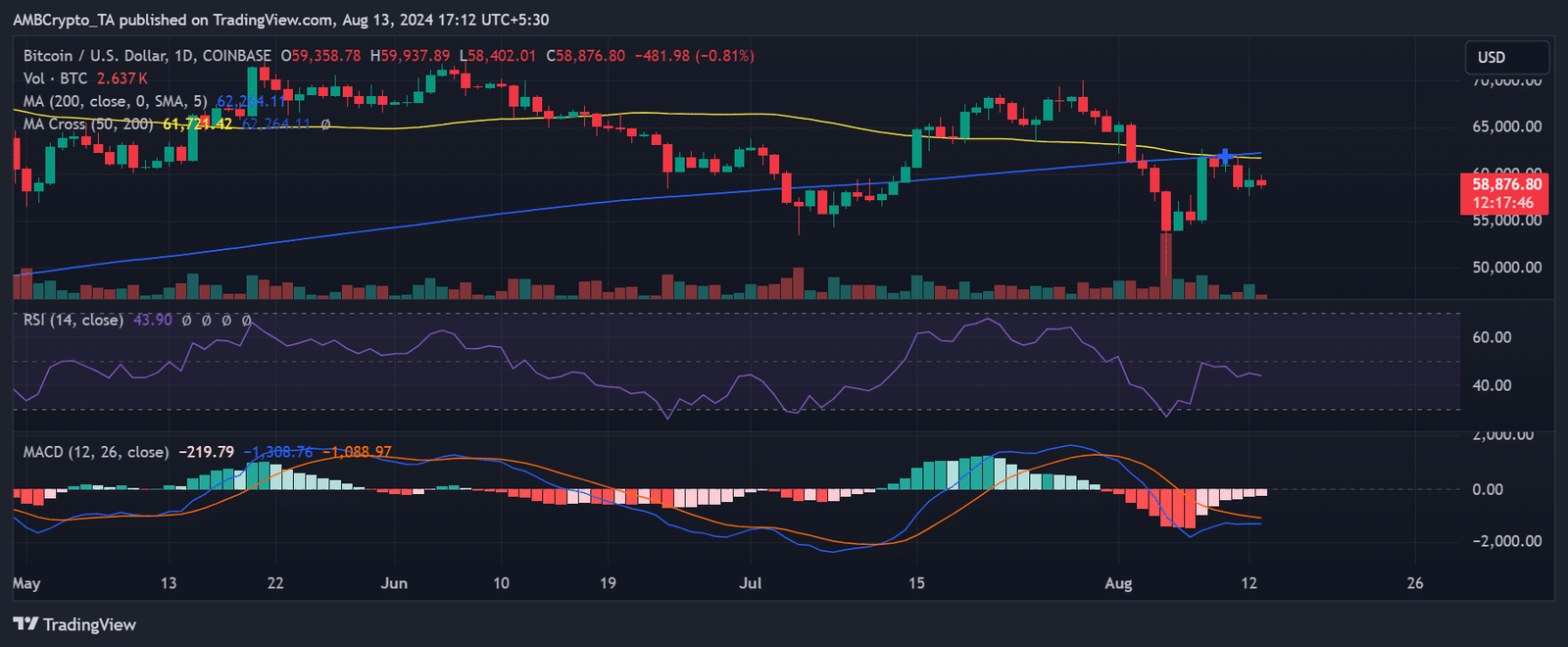

Bitcoin experienced a slight rebound in its last trading session, rising over 1% to around $59,358. However, it has since shed nearly 1% of those gains, trading at approximately $58,800.

This recent price action extends the pattern of volatility seen in recent weeks.

AMBCrypto’s look at Bitcoin’s technical indicators, including the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), indicated a continued bearish trend.

Is your portfolio green? Check out the BTC Profit Calculator

At press time, the RSI remained below the neutral threshold, and the MACD lines, along with the histogram, were positioned below zero, suggesting ongoing bearish momentum.

A shift towards a positive price trajectory could help miners mitigate the challenges posed by the currently high Bitcoin Hashrate.