- Bitcoin Spot ETF could launch as early as the day following SEC’s key vote on pending application decisions.

- The SEC needs to grant two sets of approvals, 19b-4s and S-1s filed by Spot Bitcoin ETF applicants.

- Bitcoin price eyes recovery to the psychologically important $45,000 level.

Bitcoin Spot ETFs are likely to receive the US financial regulator’s approval as early as this week, according to a Bloomberg report. BTC holders are awaiting the Securities and Exchange Commission’s (SEC) greenlight on the securities product with the upcoming deadline on January 10.

Bloomberg reports that insiders speculate the regulator will use the January 10 deadline to announce their decision on several Spot Bitcoin ETF applications at once. Nearly a dozen applicants are awaiting the SEC decision and have lined up seed capital and marketed their Spot BTC ETF product.

Also read: Bitcoin spot ETF approval could come as soon as Tuesday, new filings hint

Daily Digest Market Movers: Bitcoin Spot ETF could see greenlight as early as Wednesday

- Bitcoin Spot ETFs could be approved if two technical requirements are met.

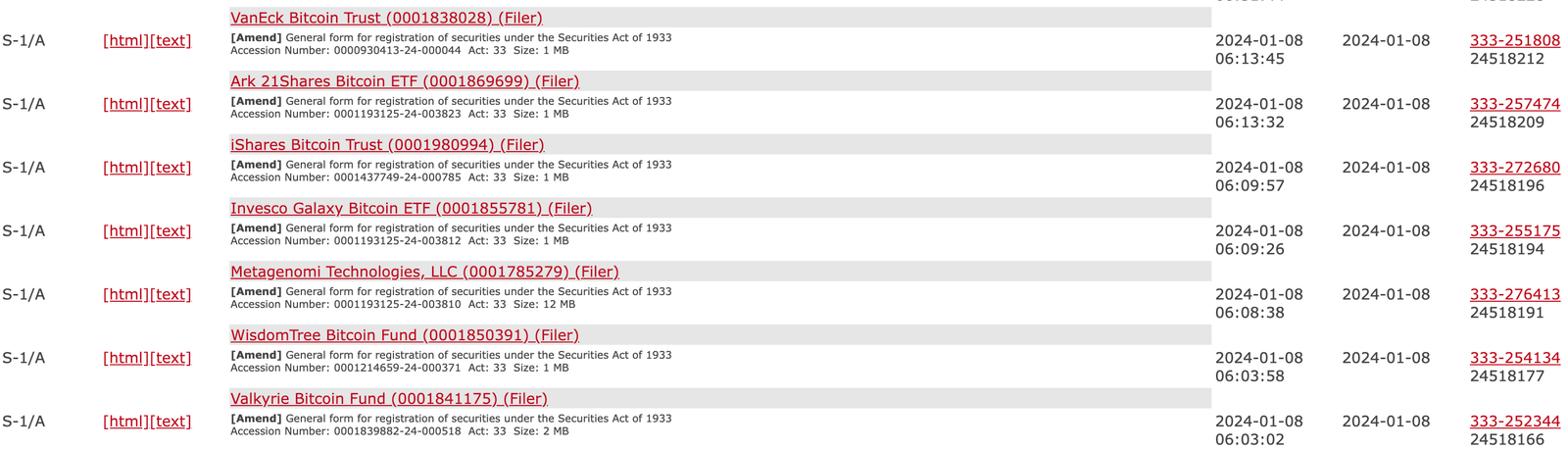

- The SEC has set a deadline for 8 AM ET (1300 GMT) on Monday for issuers to file their amended S-1 forms. For a Bitcoin Spot ETF to start trading the SEC requires: 19b-4 filings from exchanges and S-1 forms from issuers. The amendment to S-1 forms and 19b-4s are in, according to the latest update on the SEC website.

S-1 filings updated by issuers. Source: SEC website

- The regulator needs to sign off on these two to kickstart ETF trading, as early as a day after.

- The SEC has to approve the amended S-1 forms from issuers and a potential approval is likely as early as Tuesday or Wednesday this week.

- According to a Reuters report, a source indicated that the SEC Commissioner vote will likely take place on Wednesday, marking this week as key for Bitcoin holders and market participants.

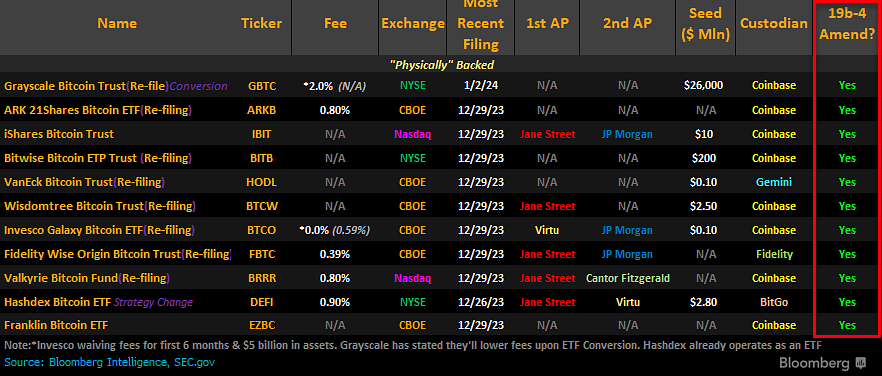

- All 11 ETF issuers have amended their 19b-4 and S-1s are awaiting approval for Bitcoin Spot ETFs to hit the market.

Bitcoin Spot ETF application status. Source: James Seyyfart’s tweet on X.

- Monday to Wednesday this week are key dates for issuers and market participants to watch out for updates and changes in the SEC’s decision on the new securities product.

- Bloomberg reports that BTC ETF approval would usher a watershed moment for the digital asset industry as there are billions of dollars at stake.

- Both retail and institutional investors are expected to pour their capital in the new securities product and crypto experts like Michael Anderson of Crypto Venture firm Framework Ventures believes that the market is underestimating the potential impact of an ETF approval.

Technical analysis: Bitcoin price could find its way back to $45,000

Bitcoin price is in an uptrend that started on September 11, 2023. BTC price has consistently formed higher highs and higher lows with the exception of December 2023 where prices traded sideways below the $45,000 mark for a large part of the month.

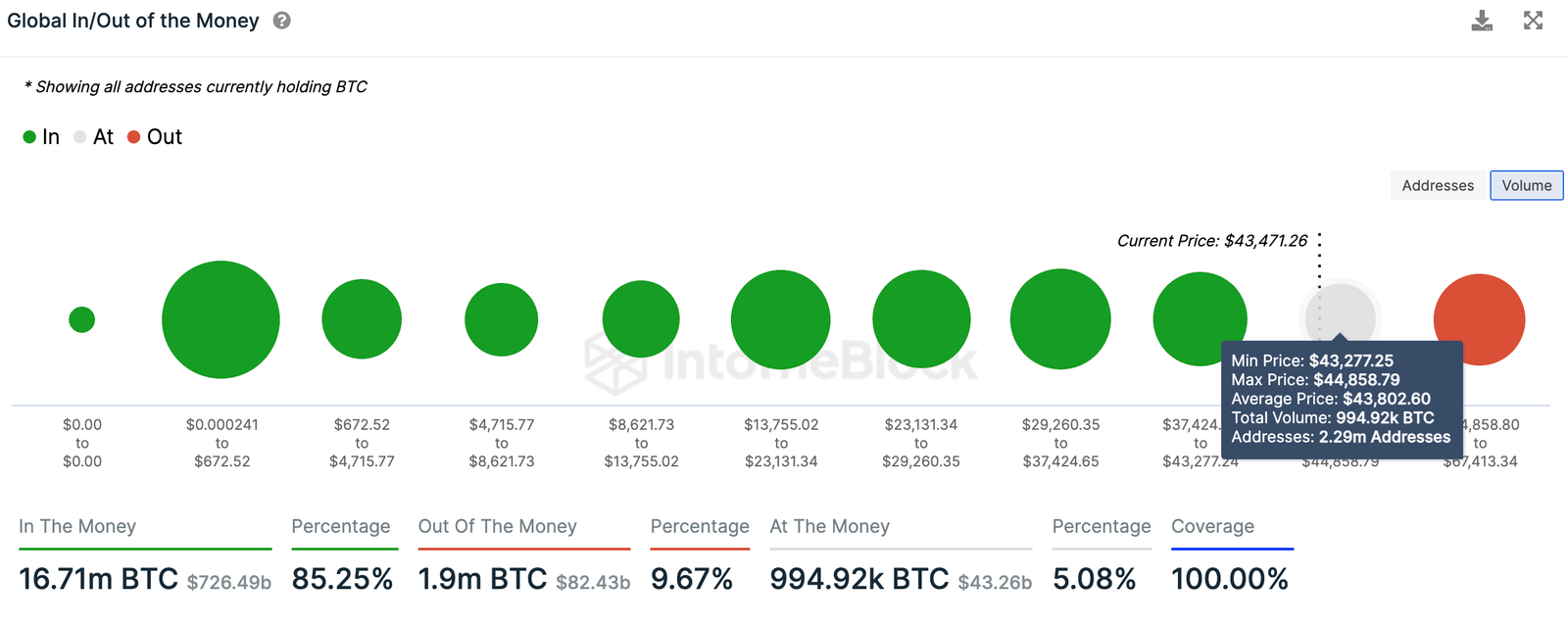

For Bitcoin holders, $45,000 is a psychologically important level as between $43,277 and $44,858, 2.29 million wallet addresses bought 994,920 BTC worth approximately $43.57 billion (at an average price of $43,802, as seen on IntoTheBlock).

Bitcoin Global In/Out of the Money. Source: IntoTheBlock

Between November ‘21 and November ‘22, Bitcoin price nosedived from its peak of $69,158.74 to low of $15,541.05. BTC price has sustained above the 50% Fib level ($42,349.89) of this drop in January 2024, and the largest cryptocurrency eyes a recovery to $45,000.

Bitcoin price is currently above its two long-term Exponential Moving Averages at 50-day and 200-day at $41,337.99 and $34,211.52 respectively.

The next key resistance for Bitcoin price is the 61.8% level at $48,676.78.

BTC/USDT 1-day chart

A daily candlestick close below the 50% Fib level at $42,349.89 could invalidate the bullish thesis for Bitcoin price. BTC could find support at $41,338.66, its 50-day EMA, in its downtrend.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.