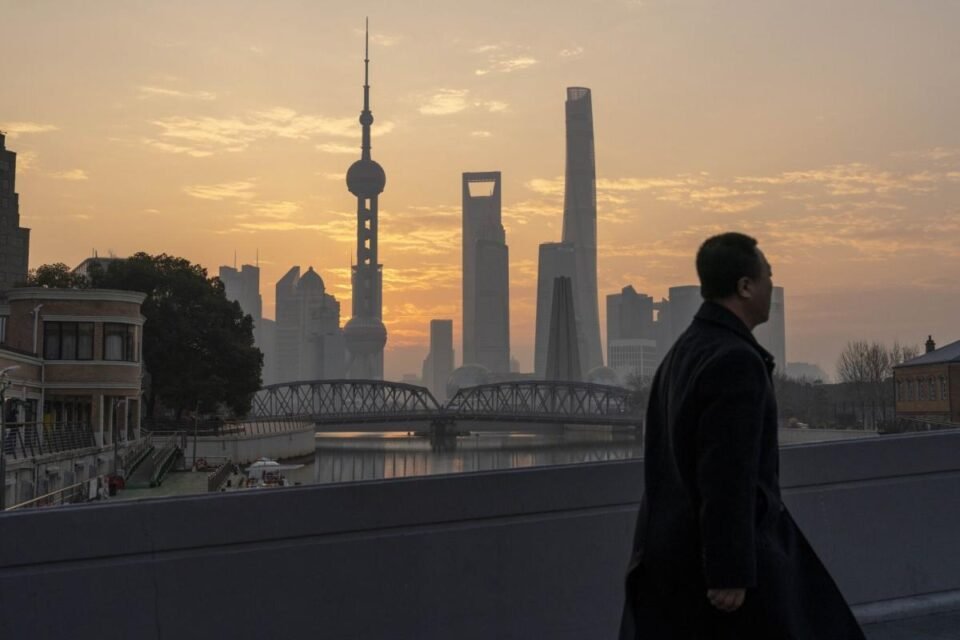

(Bloomberg) — Asian stocks climbed on bets China will be more forceful to prop up markets and as traders shrugged off a slew of cautious remarks from Federal Reserve officials.

Most Read from Bloomberg

A gauge of Asian equities rose to its highest in more than a month. Shares in mainland China rose while those in Hong Kong erased earlier gains as traders weighed whether a string of market stabilizing efforts by Beijing will bear fruit.

“Expectations of official support to China markets is underpinning gains in Asian equities, and the pushback in Fed rate cut expectations seems to have been priced in for now,” said Charu Chanana, head of FX strategy at Saxo Capital Markets. “However, the effect may be temporary as all these are band-aid measures that cannot fix the structural issues that China is facing from property sector to lack of productivity.”

Japanese stocks were muted amid a mixed bag of earnings from major companies including Toyota, Mitsubishi Corp and Daikin.

The yield on 10-year Treasuries slipped two basis points in early Asian trading. Bonds rebounded in the US session as the three-year auction drew solid demand, bolstering sentiment before a record $42 billion sale of 10-year Treasuries on Wednesday.

The dollar steadied following Tuesday’s drop. A drumbeat of Fed officials echoed Jerome Powell’s signals that the central bank will be in no rush to ease policy.

Fed Bank of Cleveland President Loretta Mester said policymakers will probably gain confidence to cut interest rates “later this year” if the economy evolves as expected. Her Minneapolis counterpart Neel Kashkari celebrated the substantial improvement made on inflation, but indicated more progress is needed.

New York Community Bancorp’s credit grade was cut to junk by Moody’s Investors Service less than a week after the regional lender said it was stockpiling reserves to cover souring loans tied to commercial real estate.

In New Zealand, government bond yields rose after the country’s strong jobs report, which suggested the central bank could remain cautious about cutting interest rates. The local currency and the Aussie dollar strengthened for the second day.

In other markets, oil rose for a third day as geopolitical risk in the Middle East was partially offset by a report showing stockpiles expanding in the US.

In the corporate world, Toyota extended Tuesday gains after the world’s No.1 carmaker boosted its operating income guidance for the full year. Mitsubishi Corp. jumped following a share buyback announcement and better-than-expected quarterly earnings. Yum China Holdings Inc. soared following a sales beat. Alibaba Group Holding Ltd. reports later in the day.

Key events this week:

-

Germany industrial production, Wednesday

-

Walt Disney earnings, Wednesday

-

Fed’s Adriana Kugler and Tom Barkin speak, Wednesday

-

China PPI, CPI, Thursday

-

US wholesale inventories, initial jobless claims, Thursday

-

Treasury Secretary Janet Yellen speaks at a Senate banking committee hearing on the Financial Stability Oversight Council annual report, Thursday

-

Pharma CEOs speak at a Senate panel on prescription drug prices, Thursday

-

ECB Chief Economist Philip Lane speaks, Thursday

-

ECB publishes economic bulletin, Thursday

-

US CPI revisions, Friday

-

Germany CPI, Friday

-

President Joe Biden hosts German Chancellor Olaf Scholz at the White House, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 1:05 p.m. Tokyo time

-

Japan’s Topix was little changed

-

Australia’s S&P/ASX 200 rose 0.4%

-

Hong Kong’s Hang Seng was little changed

-

The Shanghai Composite rose 0.9%

-

Euro Stoxx 50 futures were little changed

-

Nasdaq 100 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0758

-

The Japanese yen was little changed at 147.90 per dollar

-

The offshore yuan was unchanged at 7.2014 per dollar

-

The Australian dollar was little changed at $0.6528

Cryptocurrencies

-

Bitcoin fell 0.8% to $42,814.63

-

Ether fell 0.6% to $2,365.07

Bonds

-

The yield on 10-year Treasuries declined two basis points to 4.08%

-

Japan’s 10-year yield was little changed at 0.710%

-

Australia’s 10-year yield declined three basis points to 4.09%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rob Verdonck and Zhu Lin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.