These days, it’s as important to understand what’s going on in the accounts as it is on the pitch. Fortunately, Andy Trobe is on hand to help us out and make it all make sense! And contrary to the doom-laden reports in the press, there are plenty of positives to go along with the areas of concern.

***

Newcastle have released their accounts for the year 2022/23, the 4th Premier League club to do so. This was a season where we qualified for the Champions League and reached the Carabao Cup Final.

To many fans, I suspect football finances are as interesting as algebra. But please bear with me. These accounts shine a light on the state of the club, the ambitions of the owners and how likely we’re going to sign M’Bappe in the summer!

Here is a summary of the last 6 year…

… and these are my top ten key takes from them.

1. The accounts show the ambition of the new owners.

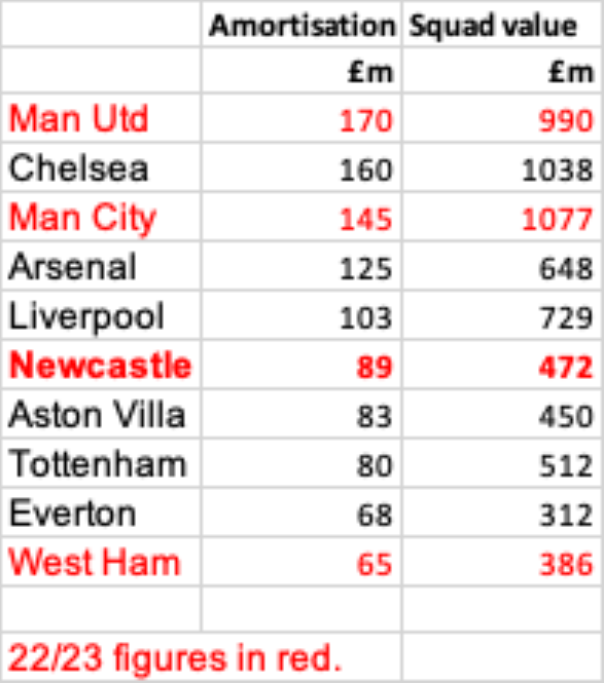

Player amortisation might not be the first thing you look at when analysing a club’s accounts but it’s probably the key indicator of a club’s ambition. Amortisation is essentially an accounting proxy for transfer fees paid. It’s calculated by dividing the transfer fee by the length of the player contract. This means that you do not incur the full cost of the transfer in the year of purchase, it’s spread over 5 years (or whatever the contract length is).

In 20/21, NUFC had the 4th lowest amortisation in the Premier League which beautifully illustrates the level of ambition under Mike Ashley. Watford, Crystal Palace and Fulham all had higher amortisation costs!

Since the takeover, amortisation has increased by 169%. In just two years! £157m was spent on Sven Botman, Nick Pope, Matt Targett, Alexander Isak and Anthony Gordon in 22/23. These are eye-watering figures and should leave no supporter in any doubt how serious NUFC’s new owners are about driving the club forward.

But they’re essentially just catching up after 14 years of neglect. I’m rarely one to agree with Simon Jordan but there’s some justification about his suggestion that when buying a club, new owners should have dispensation of three years to repair the previous owner’s damage with fewer Profit & Sustainability Rule (PSR) restraints.

In 20/21, NUFC’s squad value was lower than Southampton and Wolves. They now have the 6th highest amortisation costs and 7th highest squad value in the Premier League.

A note of caution. The drawback here is that if you “frontload” your transfer expenditure, you end up burdened with subsequent amortisation costs which restrict your ability to buy players in the future.

Everton are the best example of this. They spent heavily in the transfer market when Moshiri bought the club in 2016. They bought poorly which contributed towards their subsequent relegation battles, PSR breaches and point deductions. This is a salient lesson to NUFC.

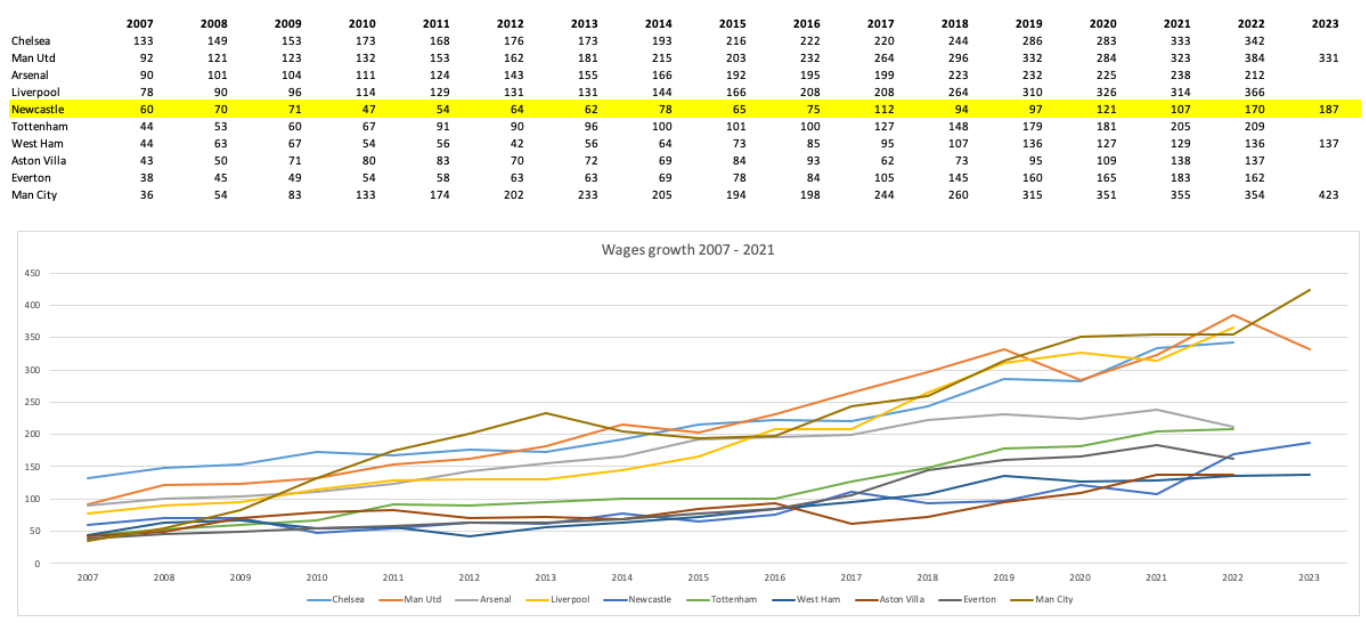

Just as the amortisation increases are testimony to the ambition of the owners, so are the wages. In the 14 years from 2007 to 2021, wages increased by 78%. In the two years since the takeover, they’ve increased by 75%. They now have the 7th highest wage bill in the Premier League.

2. Turnover has rocketed but is still miles behind the “Big Six”

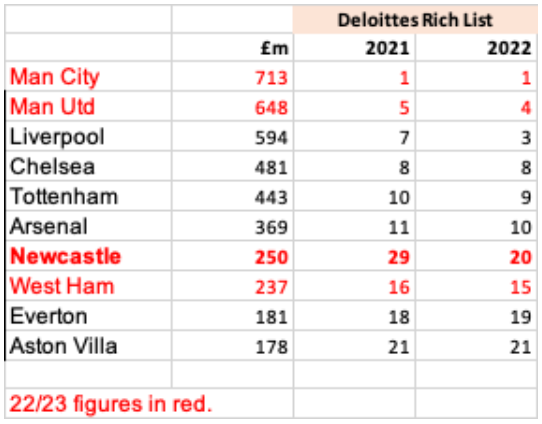

NUFC’s total turnover has risen to £250m, a whopping increase of £70m (or 39%) from 21/22. There has been increases in all three income stands – Broadcasting (£41m), Commercial (£19m) and Match Day (£10m).

Whilst most clubs have not released their accounts for 22/23, NUFC will likely have the 7th highest income in the Premier League behind the “Big Six”. In 21/22, they leapt up from 29th to 20th in the Deloittes Rich List rankings (of the clubs with the highest turnover in the world). I expect another leap up the rankings when Deloitte release the figures for 22/23 (due next week).

Whilst this is undoubtedly impressive, NUFC are still nowhere near that of the “Big Six”. Man City have nearly three times the income of NUFC. Given current Financial Fair Play rules on “fair value” commercial deals, it’s going to be tremendously difficult for NUFC to catch up. Effectively, the drawbridge has been pulled up. The fairness of this is another article altogether!

3. Match Day and Commercial Income has actually started to grow.

One of the many disasters of the Ashley tenure was the club’s inability to grow their Match Day and Commercial income. NUFC fell from having the 14th highest income in the world in 2007 to the 29th highest in 2021.

But this is beginning to change spectacularly under the new owners. The accounts show record Match Day and Commercial revenues in 22/23. The Commercial revenue is key here. It increased by 65% as a result of “a growth in commercial partnerships income together with special events in the year, most notably the Diriyah Cup in Saudi Arabia in December 2022 and two Sam Fender concerts at St. James’ Park in June 2023”.

Despite this increase in Commercial income, you can see that NUFC are still miles behind the “Big Six”. Man City are receiving almost an extra £300m per year in commercial income alone. That pays for an awful lot of Kevin De Bruynes.

4. The future is bright.

Since October 2021, the new owners have been gradually unpicking the horrendous commercial deals that they inherited from the previous administration. This has taken some time and probably has incurred some financial penalties (early release clauses) as a result.

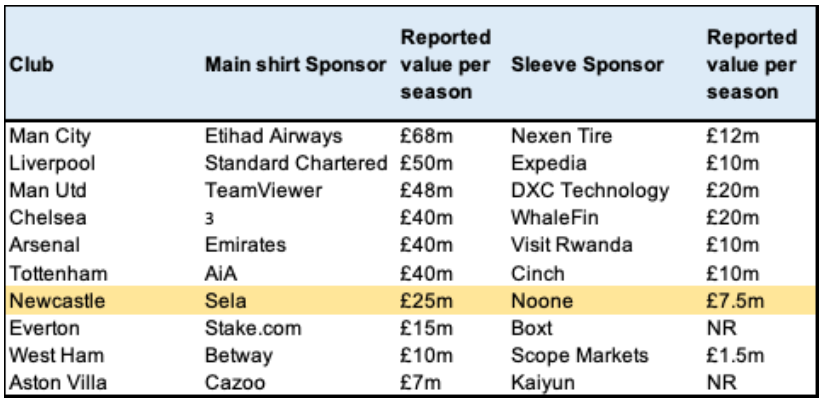

Darren Eales was interviewed following the release of the financial results and was very upbeat about the future. The end of the Castore deal allows NUFC to control their own retail operations. Eales highlighted the commercial deals that were not included in the 22/23 figures but will be included in future accounts. These included the Sela shirt sponsorship (£25m per year from 23/24) and the re-introduction of Adidas as kit manufacturer from 24/25.

But to re-iterate, whilst these commercial deals may consolidate our position as “best of the rest”, they will still not be sufficient to break us into the “Big Six”. That is going to be a long-term mission. But as amortisation and wages rocket, these Commercial deals are essential to the club to enable us to comply with PSR.

5. PSR is becoming ever more challenging

PSR allows for financial losses of no more than £105m over a rolling three-year period.

The accumulated losses over the three years ending 22/23 total £156.3m, more than £40m over the allowable loss threshold. Have NUFC therefore failed PSR? No – clubs are allowed to make deductions for certain expenditure (e.g. training ground improvements). In addition, the PL relaxed the regulations to allow for the negative impact of the pandemic.

NUFC are confident that they will live comfortably within the P&S threshold. But this is going to become increasingly challenging as we go forward. The COVID allowances and lower losses incurred in 20/21 will fall off the calculation in 23/24. The buffer is eroding.

And this is why NUFC are struggling to buy players in January. To comply with PSR, NUFC need to post financial figures in 23/24 which will allow us to offset the £144m losses of the previous two years. The Champions League income and Sela deal will help. But as highlighted above, we’ve front-loaded our transfer spend and that leaves very little flexibility for us to spend in January whilst still complying with PSR.

6. We need to trade players

The first thing to note is that player trading should not be seen as a negative. Every club trade players including the “big six”. Done well, trading players can help clubs comply with PSR and still be successful. In fact, I’d suggest it’s essential.

Take Man City. In 22/23, they generated £121.7m from the transfer of player registrations. Raheem Sterling, Gabriel Jesus and Oleksandr Zinchenko were all offloaded by City in the summer of 2022. In the same summer, they bought Erling Harland. So if NUFC have to sell one or more of their “stars” then so be it. The trick is to invest the profits wisely and improve the overall value of the squad.

Whilst Chelsea may not be blowing the Premier League away, nobody can dispute that they have been backed massively in the transfer market by Todd Boehly. This has been enabled by their player trading particularly the sale of their academy stars. Tammy Abraham, Mason Mount, Billy Gilmore, Loftus-Cheek, Hudson-Odoi have all departed for sizeable fees. These fees are pure profit in the accounts as there’s no residual amortisation to deduct from the fee. NUFC desperately need to improve their academy products to help with this.

In 22/23, NUFC generated less than £4m in player sales (I understand that Wood and Shelvey were transferred after the financial cut-off date and will be included in the 23/24 accounts). Our ability to fund future transfers will be severely curtailed if we cannot generate cash from player sales. We just need to bring better ones in than we sell! Step up Dan Ashworth.

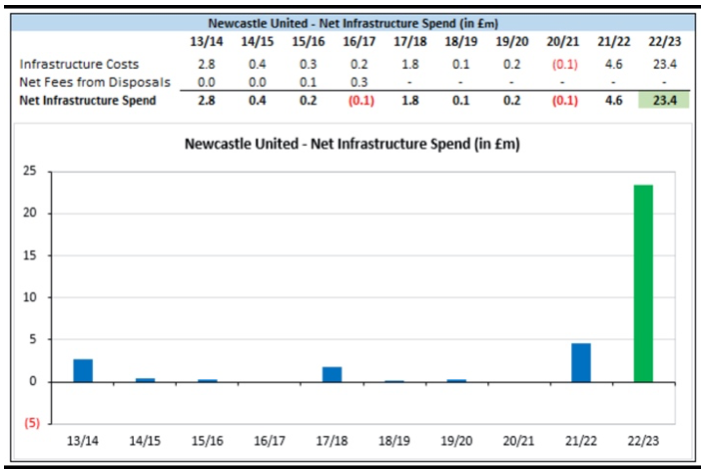

7. For the first time in a generation, the owners have spent money on infrastructure

Capital expenditure (costs related to ground improvements, training facilities etc) had virtually ceased under Mike Ashley. From 2010 to 2020, total capital expenditure was a paltry £7m. To put this spend in context, over the same period Spurs spent £1.4b, Man City £378m, Liverpool £238m and Brighton £181m.

But already, the new owners have invested in upgrades to hospitality & concourse facilities at St. James’ Park, acquired the land at Strawberry Place (that Ashley had sold) and improved the first team training ground. This is likely to ramp up considerably in the future as the club investigate options for increasing capacity either at St. James Park or at a new stadium.

8. Wages to revenue ratio is improving.

Whilst NUFC’s wage bill increased by £43m, the wages to revenue ratio reduced from 95% (21/22) to 75% (22/23). Adjusting for onerous contracts and using underlying wages, the reduction is a less dramatic 87% to 79%. Why is this important?

UEFA have changed their Financial Fair Play restrictions to a “squad cost ratio” model. This links a club’s spending on areas such as player wages and transfer fees (amortisation) to turnover. In 2023/24, this spending must not exceed 90% of turnover and drops further to 70% in 25/26. The Premier League will discuss aligning with the UEFA “squad cost ratio” model in February.

9. Debt is no longer a millstone around NUFC’s neck

When Ashley bought NUFC in 2007, he loaned the club about £100m. This was to pay off previous loans and provide some much-needed working capital. To me, this was essentially the price of buying the club. Much like the current owners paying off Mike Ashley’s loan as part of the £305m purchase price.

For the next decade, the club followed a familiar cycle. NUFC would get relegated due to the owner’s decision making. He’d be forced to loan the club money to mitigate against the costs of relegation. The club got promoted and Ashley would claw some of that loan back starving the club of much needed funding in the process. They’d then get relegated and the cycle started again.

Ashley was almost unique in this respect. Virtually every other owner, not just in the Premier League but in the Championship too, would either write off the loans to the clubs they owned or capitalise them (which essentially amounts to the same thing). Take our nearest rivals. Ellis Short and Steve Gibson wrote off hundreds of millions in loans to Sunderland and Middlesbrough. Ashley was adamant that he’d get back every penny he loaned the club.

That burden has now been removed. The club are effectively debt free.

10. The club is now reported to be worth three times what the consortium paid for it.

The Staveley consortium paid about £305m for NUFC. The latest accounts show that further investment (up to January 2024) amounted to a further £266m. A total outlay of £571m.

But if the club is worth about £1b, as recently reported, then the owners could effectively double their money if they sold the club now.

***

Mike Ashley to note.

A modicum of funding and ambition can double your investment. 14 years of cutbacks, relegation battles and inept commercial deals will barely get your money back (ed: He’s gone man Andy. Just let it go!).

Andy Trobe