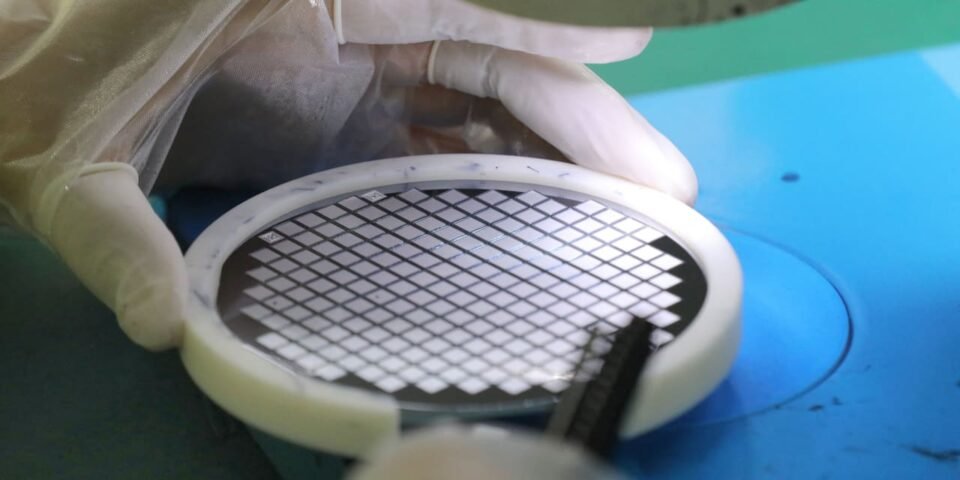

Only one U.S. factory specializes in the sensor and power chips needed to make modern cars. That firm, Polar Semiconductor, announced Monday that it lined up nearly $200 million in government grants to modernize its plant in Bloomington, Minn.

The grants are the latest under the Biden administration’s 2022 Chips Act, which aims to boost jobs and domestic chip supplies by funding U.S. factories for the likes of

Intel

,

and Taiwan’s

TSMC

.

With $120 million from the U.S. Department of Commerce and $75 million from the State of Minnesota—plus over $100 million in investment tax credits—Polar will be able to modernize its factory and double its production.

The deal is also a big win for Chip Schorr, a private-equity veteran who negotiated Polar’s government grants and who’s bringing another $175 million to Polar from private investors. It is the first big investment by his new firm Niobrara Capital, which will control the chip foundry with co-investors Prysm Capital.

The money will position Polar to provide auto makers and other industries with an onshore source of high-performance, low-cost, power semiconductors and sensors, said Schorr, in Monday’s announcement.

Schorr knows Polar well. The foundry played a key role in the rise of the stock of

a chip company controlled by Schorr’s previous employer One Equity Partners.

Advertisement – Scroll to Continue

As Barron’s reported last year, Allegro stock rose from $14, to $53, after it was spun out by

a Japanese company that also owned the Polar foundry. The three related companies continued doing business, and Allegro’s profit margins jumped as its financials left the low-margin factory behind. At the time, Allegro said its dealings with Sanken and Polar were arm’s length.

Allegro’s stock produced big gains for One Equity. where Schorr had led a $291 million investment in SanKen. One Equity got a controlling position in Allegro with the spin out.

Allegro stock fell to a recent $27, from last year’s peak of $53.

Advertisement – Scroll to Continue

Schorr left One Equity in January 2024 to start his own private-equity firm. In April, SanKen and Allegro disclosed that the Polar upgrade investment plan had moved from One Equity to Schorr’s new firm Niobrara and co-investor Prysm.

The private-equity firms will own around 59% of the Polar foundry after their investment, with the rest held by SanKen and Allegro. Fortified by the government grants, Schorr and his investors will then see if they can make the Minnesota factory a competitive—and profitable—supplier of chips for autos and other cutting-edge products.

Write to Bill Alpert at william.alpert@barrons.com