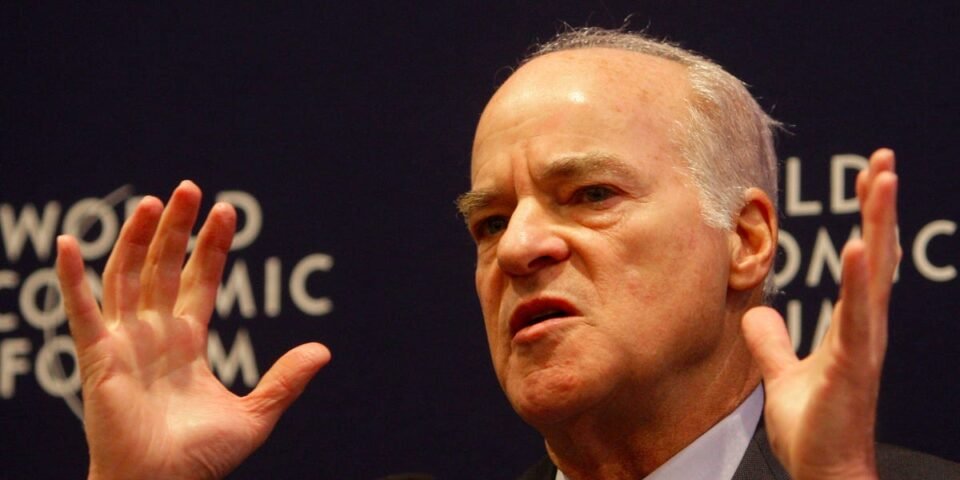

- Henry Kravis warned of sticky inflation and interest rates during an interview aired this month.

- The KKR cofounder and co-executive chairman also flagged economic and geopolitical uncertainty.

- The billionaire investor touted downturns as opportunities and said failure isn’t shameful.

Investors face a tricky mix of stubborn inflation, geopolitical risks, and a clouded economic outlook, Henry Kravis said on a “Goldman Sachs: Exchanges” podcast episode released this month but recorded in October.

KKR’s billionaire cofounder and co-executive chairman advised being prepared to capitalize on the opportunities that emerge during periods of turmoil. He also compared companies to movies, took issue with being called a “barbarian,” and encouraged people to take chances and risk failure.

Here are Kravis’ 10 best quotes from the interview, lightly edited for length and clarity:

1. “You know, it’s really strange. God gave me an eighth sense or something; I’ve always had a pretty good feel for where I thought the economy is going and where it is. I don’t know where it’s going.”

2. “I think inflation stays much higher, longer than most people think. Therefore, I think interest rates will stay higher, longer than all of us had hoped for.”

3. “Whether it be the Middle East situation, whether it’s the Russia-Ukraine situation, whether it’s China and Taiwan, there’s just a lot of uncertainty in a lot of places in the world today. I’m just cautious right now, and I am concerned.”

4. “We thrive at KKR on uncertainty. We like the time when markets are out of kilter because we invest around the world. By doing that, we have the ability to lean in where we see a part of the market that happens to be very strong.”

5. “Everybody looks smart when markets are going up. Just ride the wave and you’ll do just fine. The key for a good investor is how do they do in downturns? George’s view and my view has always been, lean in.” (Kravis was referring to one of his cofounders, George Roberts.)

6. “Don’t forget: Everything that goes up, comes down, and everything that’s down will come back up at some point. If you think we’re going into a bad downturn, just be prepared, okay? Don’t sit and say, ‘Wow, where did this come from? You’ve got to prepare yourself. The other thing is a lot of times when you’re in a downturn, you see cracks in companies. You see that things aren’t quite as good as what a strong economy and a strong market will mask. All of a sudden, you look at it and say, ‘Wow, there’s opportunity here.'”

7. “Don’t congratulate us when we make an investment. Any fool can make an investment — that’s easy, just pay enough. The harder part is what do you do to create value? That’s our focus, like a laser.”

8. “I like to think of corporations very much as an evolving entity. They change. Think of a movie, which is made up of a series of still photos. You as the director of the movie can make it go any which way you want. Well, that’s a little bit of how we invest. If we are able to take control of a company, or even have a very large position in a company, and work with a management team, can we make that business a better business? That’s really our focus. Too many people, unfortunately, are focused on one still photo in that movie.”

9. “I’ve been called worse things. But it’s hard to shake that. The title, unfortunately, really had an impact. We are no more barbarians than the man in the moon. We will not do a deal if the board of directors said, ‘Go away. We have no interest in dealing with you.’ We don’t take positions in companies and go in and rattle the saber and say we’re going to throw your board out. That’s just not what we do.” (He was bemoaning the choice of “Barbarians at the Gate” as the title of a book he appears in.)

10. “I say to my children and grandchildren, take one sentence out of your vocabulary and that’s very simply, ‘I wish I had.’ I hate when I hear, ‘Oh, I wish I had done this or I wish I had gone there.’ Okay, you could have done it. We live in a free world. We live in a wonderful country in America, and you can make mistakes and try again. So I’m very big on pushing people to give it a try. Don’t be afraid. Don’t just talk about it: ‘Oh, I’m going to do this. I’m going to do that.’ No. Go do it. Both feet in and be dedicated. And if it doesn’t work, okay. Pick yourself up, go try it again. Don’t be afraid to fail. There’s nothing wrong with failure.”