The Applied Science & Technology Research Organization of America (ASTRO America) has announced the final federal approval for its AM Forward initiative’s private equity fund, known as the Stifel North Atlantic AM-Forward Fund. The approval was marked by a gathering at the Pentagon, including senior officials from the U.S. Department of Defense (DOD) and the Small Business Administration (SBA). Launched in May 2022 by ASTRO President Neal Orringer and President Joe Biden, the initiative aims to accelerate the adoption of additive manufacturing (AM) technologies among small businesses in key aerospace and defense supply chains across the United States.

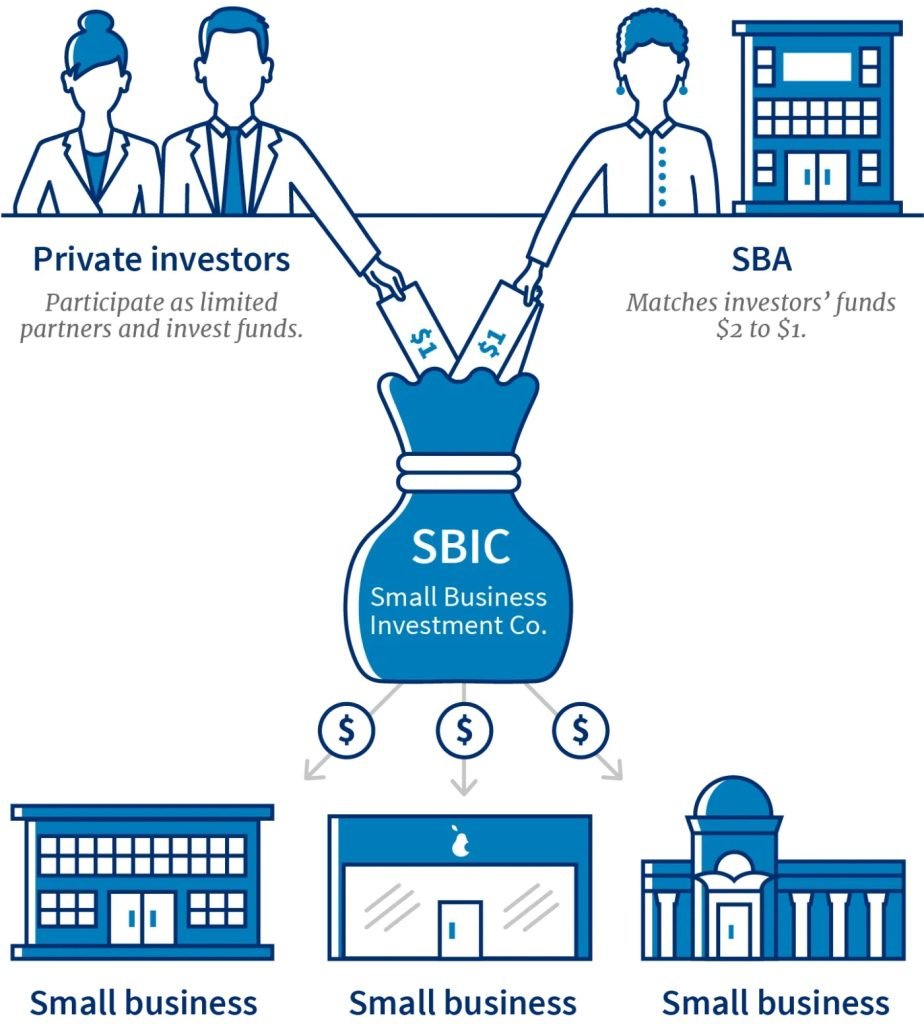

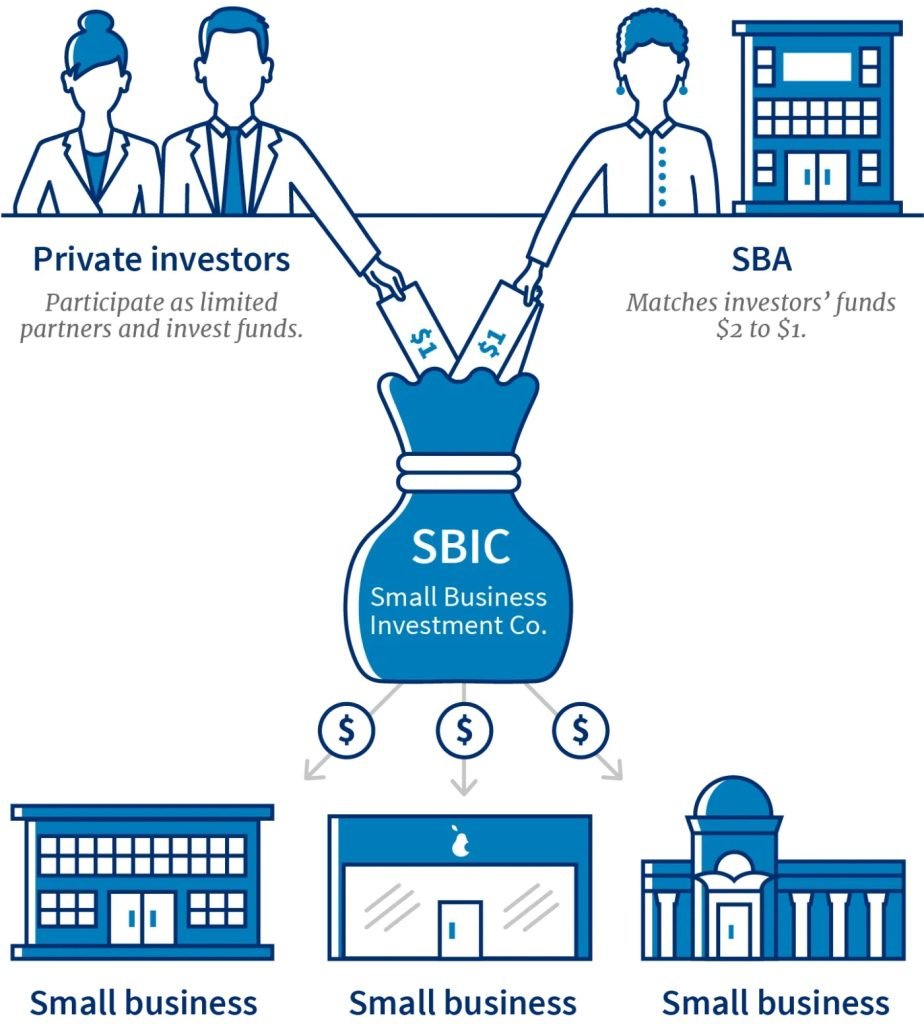

The fund has earned a Small Business Investment Company (SBIC) license under the SBIC Critical Technology (SBICCT) initiative. It plans to use various financing structures tailored to the specific needs of small businesses, focusing on enhancing additive and advanced manufacturing capabilities within the domestic supply chain. Initial investors include industry leaders such as Lockheed Martin, GE Aerospace, and ASTM International.

Neal Orringer, President of ASTRO America, emphasized the importance of the collaboration: “Two years ago, we launched AM Forward to build up resilience in America’s key supply chains. Our partners—most notably, Lockheed Martin and GE Aerospace—have demonstrated what it means to be strong stewards of America’s Defense Industrial Base. Today, we are grateful to have them and two other critical organizations, Stifel North Atlantic and ASTM International, contributing important resources, expertise, and mentorship to support the backbone of America’s economy—small and medium-sized manufacturers.”

Stifel North Atlantic was selected as the financial partner to manage the fund, given its history of supporting small and middle-market companies and experience managing SBIC Funds. Victor Nesi, Stifel Co-President, stated, “We are pleased to receive this license from the SBA. In collaboration with our strategic partners, we are proud to give America’s emerging small businesses the capital and strategic support they need to advance innovation that supports our supply chain, creates domestic jobs, amplifies manufacturing capacity, and importantly, increases national security.”

The AM Forward initiative is a compact of seven leading companies and key federal agencies, focusing on helping small businesses expand their adoption of metal 3D printing technology. The program addresses challenges such as access to capital, machine qualification processes, and workforce development. ASTRO America’s role includes leading the implementation efforts and providing advisory support to the fund’s Technical Advisory Board.

Earlier in the year, ASTRO America and Stifel North Atlantic announced that the fund was the first recipient to receive an initial ‘green light’ to raise private capital under the SBICCT program. This milestone set the stage for the final approval and formal launch of the fund, aimed at bolstering the U.S. manufacturing sector’s competitiveness and resilience.

Expansion of Metal Additive Manufacturing in the Industry

In October 2024, Luxembourg-based AM 4 AM, a supplier of 3D printable metal powders, raised €1.3 million in seed funding to expand its facilities and additive manufacturing capabilities. The company plans to increase production capacity and explore new markets to meet the growing demand for high-performance metal powders in the 3D printing industry. The funding round was led by Luxembourg Space Sector Development and EIT Raw Materials, highlighting the increasing investment in additive manufacturing materials to support industry growth.

Similarly, in September 2024, British engineering firm Renishaw launched five new materials for its RenAM 500 series metal 3D printers, including commercially pure copper, H13 tool steel, and Hastelloy X alloy. These additions enable manufacturers to produce components across a wider range of industries, such as aerospace, automotive, and energy. Renishaw also adjusted powder layer thickness options for existing materials to enhance build rates and efficiency. The expansion of material options reflects the industry’s push toward broader adoption of additive manufacturing technologies.

Nominations for the 2024 3D Printing Industry Awards are closing TODAY!

What will the future of 3D printing look like?

Which recent trends are driving the 3D printing industry, as highlighted by experts?

Subscribe to the 3D Printing Industry newsletter to stay updated with the latest news and insights.Stay connected with the latest in 3D printing by following us on Twitter and Facebook, and don’t forget to subscribe to the 3D Printing Industry YouTube channel for more exclusive content.

Featured images show ASTRO America’s logo for the AM Forward Initiative, an SBA infographic and Metal powder for Renishaw’s RenAM 500 series 3D printing systems. Images and Photo via ASTRO America, U.S. Small Business Administration and Renishaw.