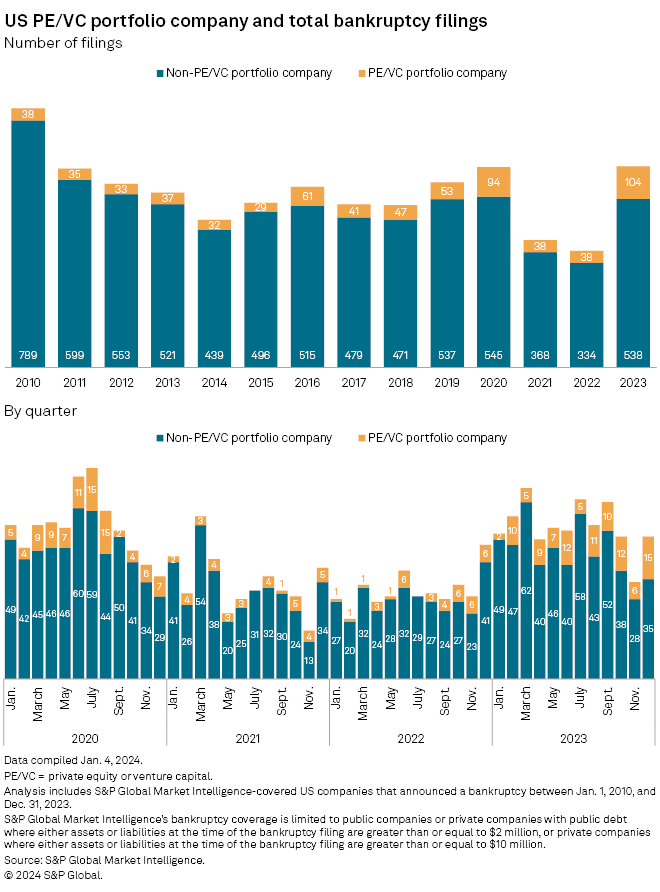

Bankruptcy filings by private equity- and venture capital-backed companies in the US surged to 104 in 2023, the highest annual total on record, according to S&P Global Market Intelligence data.

The total represents 174% growth over the 38 US portfolio company bankruptcy filings in 2022.

The overall bankruptcy rate for US companies also rose to 642 filings in 2023, a 73% increase over the prior-year total of 372, as businesses grappled with the combined effects of inflation, higher interest rates and the fading impact of pandemic-era stimulus spending.

“It’s no secret that there’s been economic headwinds after the Covid bump,” said Kris Herrmann, a partner in the private equity group for law firm Proskauer, referring to the stimulus-fueled economic rebound after COVID-19 lockdowns in 2020. That stimulus may have allowed owners or financial sponsors of distressed businesses to “kick the can,” Herrmann said, suggesting the full backlog of bankruptcies has yet to hit the courts.

“I wouldn’t be surprised if, even when the economy kicks up again, you’re still going to see some of those residual bankruptcies happening for those businesses whose time maybe should have run out three years ago,” Herrmann said.

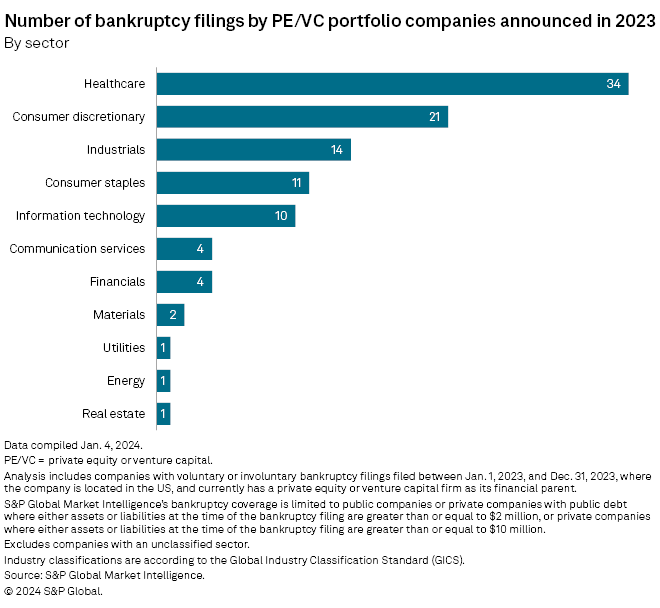

Sector focus

Portfolio companies of private equity and venture capital firms accounted for more than 16% of all US bankruptcy filings in 2023, their largest share of the annual bankruptcy rate going back to at least 2010, Market Intelligence data shows.

Fifty-five, or just over half of the 104 US portfolio company bankruptcies in 2023, were filed by healthcare and consumer discretionary businesses. That data point hints at specific economic pressures squeezing those sectors.

“Consumer discretionary is certainly going to be impacted in any sort of recessionary moment,” Herrmann said, adding that recent stressors, like the impact of higher labor costs on business margins and inflation-related reductions in consumer spending, are likely blending with longer-term shifts in the sector, including the transition away from brick-and-mortar stores in favor of online shopping.

– Download a file of raw data from this story.

– Read our latest Data Dispatch on US public sector risk.

– Catch up on private equity headlines.

In the healthcare sector, some private equity-backed businesses are dealing with restrictions on raising prices in response to rising costs, Herrmann said. The 2022 No Surprises Act, a law designed to shield patients from unexpected costs related to emergency or out-of-network care, cut into the margins of some healthcare businesses and factored into the Chapter 11 filing of American Securities LLC-backed Air Methods Corp., a helicopter ambulance business.

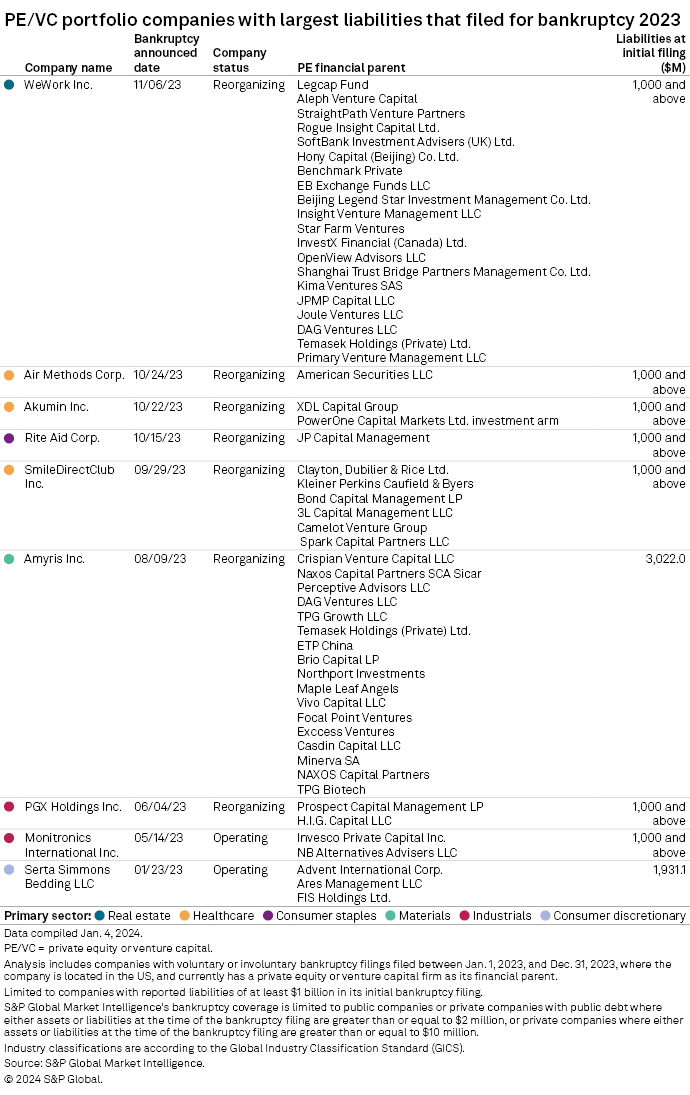

Largest portfolio company bankruptcies

The November filing for Chapter 11 bankruptcy protection by coworking space operator WeWork Inc. was among the largest bankruptcies of private equity- or venture capital-backed businesses in 2023. The listed company’s largest shareholders include SoftBank Investment Advisers (UK) Ltd., BlackRock Inc. and Vanguard Group Inc.

Akumin Inc., which alongside Air Methods ranks as one of the largest private equity portfolio company bankruptcies in the healthcare sector in 2023, filed for a prepackaged Chapter 11 bankruptcy in October that will result in the outsourced radiology and oncology business being taken private by alternative investment firm Stonepeak Partners LP.

The deal will convert $470 million in debt held by Stonepeak into equity, and Stonepeak agreed to invest an additional $130 million into the business.