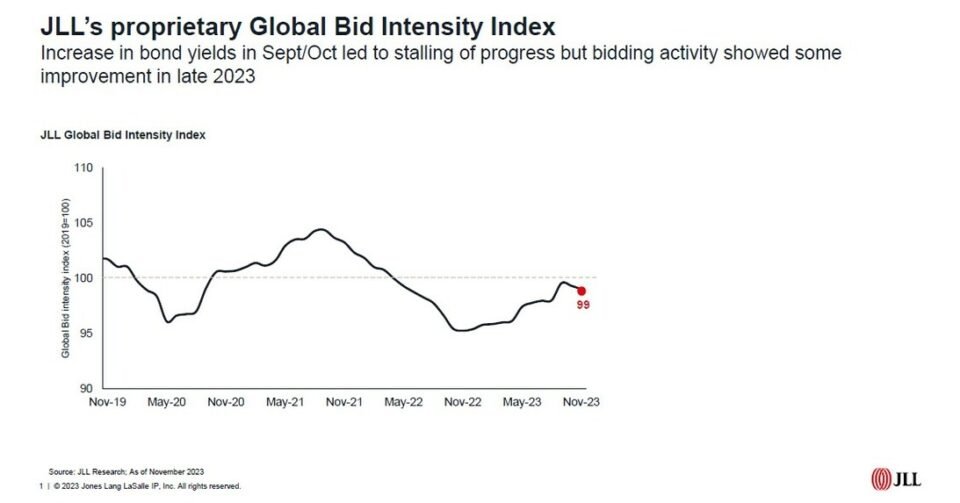

Currently, substantial liquidity exists, with dry powder for commercial real estate (CRE) totalling $402 billion sitting on the sidelines. However, a clearer picture is already emerging as real estate has seen a growing number of bidders re-enter the market according to JLL’s proprietary Bid Intensity Index. This movement is being driven particularly by activity from private investors and select institutional capital with the U.S. being furthest along in its price adjustment cycle, followed by Europe and Asia Pacific.

JLL’s proprietary Bid Intensity Index shows improved market trends since year-end 2022, despite the late summer run up in bond yields. Bidding activity was on the rise in late 2023, with the average number of bids per deal increasing by 16%, narrowing the bid-ask spread.

“This reset in values will both challenge capital and catalyze liquidity,” said Richard Bloxam, CEO, Capital Markets at JLL. “There is absolutely uniform understanding that pricing has changed. Given the quantum of dry powder, there will be a considerable first-mover advantage for capital that can deploy quickly and mobilize around opportunities as market fundamentals improve.”

While the current nature of the markets remains fragile – as evidenced by the recent volatility in bond yields – the long-term attractiveness of CRE investments remains largely intact. From a 10-year return perspective, real estate has held up consistently well against other asset classes.

“In our view, while the current higher-rate environment has created a cooling effect on real estate’s attractiveness in the short-term, strategic allocation targets into real estate are expected to remain stable and, in some cases, trend higher, especially in the long run,” noted Bloxam. “We anticipate this will materialize initially in sectors, such as living and logistics, and in markets with strong rental growth expectations where values also appear to be bottoming out.”

As was the case for many trends, the COVID-19 era was an accelerant, but not a catalyst for portfolio diversification strategies – which began shifting in the decade leading up to the pandemic. Collective exposure to the logistics and living asset classes across the largest core funds has grown by $138 billion, an increase of 263%, since 2016. These sectors now account for around 62% of core fund exposure in the U.S, 52% in Asia Pacific and 46% in Europe.

“While we will continue to see this reallocation of capital as investors reengage with the market, it’s important to note that it is more about diversification of portfolios than wholesale shifts,” said Bloxam.

Bloxam expects to see growth in emerging sectors as well. “Looking beyond these more established sectors, alternative assets should also be in focus for investors. Technological and societal changes will create longer term opportunities in areas such as renewable energy, infrastructure and advanced manufacturing, to name a few.”

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.9 billion and operations in over 80 countries around the world, our more than 105,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit jll.com.

Contact: Abigail Goldsbrough

Phone: + 447902115887

Email: [email protected]

SOURCE JLL