Savills Research shares that investment sales for the first three quarters this year totalled S$18.85 billion, a 32.6% year-on-year (YoY) increase over the S$14.21 million recorded for the same period last year.

Investment sales increased for a second consecutive quarter, climbing 22.7% quarter-on-quarter (QoQ) in Q3/2024. Private investment sales, boosted by a few mega deals such as the sale of a 50% interest in ION Orchard (S$1.85 billion) and a portfolio of industrial assets (S$1.6 billion), accounted for 70.9% of Q3’s total investment value. The remaining 29.1% of total investment sales for the quarter comprised of five state sites sold under the Government Land Sales (GLS) Programme, which fell by 25.9% QoQ from the previous quarter to S$2.34 billion.

Investment sales in the commercial sector recorded a sharp quarterly increase of 51.7%, reaching S$2.45 billion in Q3/2024. Sales activity of strata title offices in Singapore rebounded rapidly in the second quarter and the momentum carried on into the third, with nine transactions (each priced at S$10 million and above) totalling S$286.3 million.

The largest strata deal was the purchase of two levels of office units in Tong Building by luxury watch retailer The Hour Glass for S$68.5 million, or S$4,987 psf based on the strata area. Keen interest from buyers is seen for freehold office projects such as Solitaire On Cecil, 108 Robinson Road, and 6 Raffles Quay in Singapore’s CBD, as well as Tong Building and Visioncrest along Orchard Road. The limited supply of these properties supports capital preservation and appreciation, enhancing their appeal to long-term investors.

Savills Research believes that while the financial markets are grappling with predicting interest rates and economic directions, the property market at this juncture is driven more by other factors. These include a relative scarcity of prime investible assets and non-economic considerations such as capital safety.

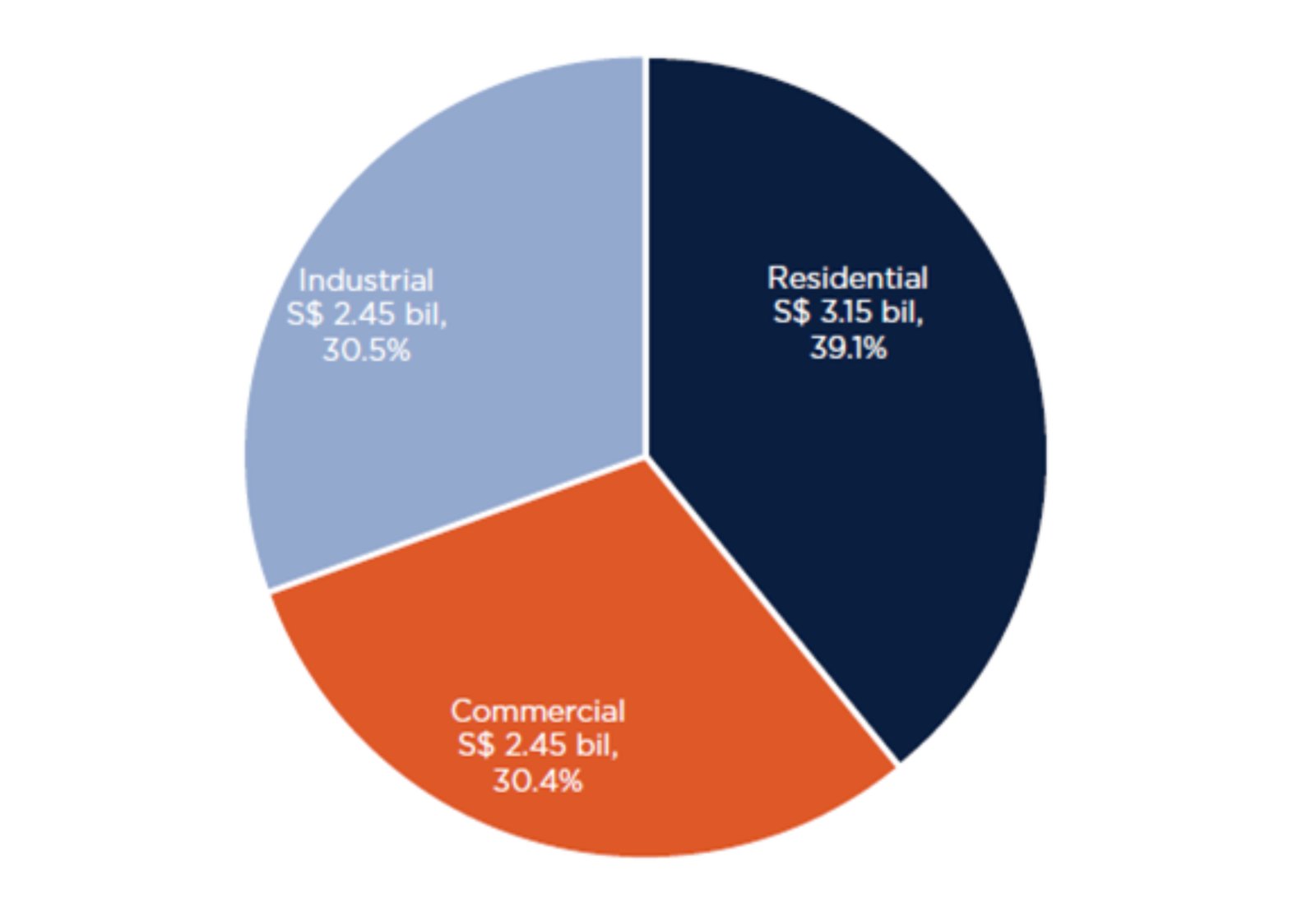

Investment Sales Transaction Volumes By Property Type, Q3/2024

For many institutional buyers, a price gap exists across many asset classes which could take a few quarters to work through. Non-institutional investors are often less sensitive to the yields versus interest rate trade-off, focusing instead on the desire for capital preservation or the need to buy for own use. Ultra-high net worth investors seem to be returning to the market, particularly for non-residential properties – strata offices, hospitality and conservation shophouses.

Alan Cheong, Executive Director, Research & Consultancy, Savills Singapore adds, “Given that the big-ticket items transacted in the third quarter are unlikely to be repeated in Q4, along with the rejection of the Jurong Lake District land bid by the authorities, we maintain our forecast of S$22 to S$23 billion for the full year.

Although interest rates have fallen, there is still a large spread between net yields and total borrowing costs. We may see one or two mega deals conclude in the coming quarters, but it is our opinion that investment sales would generally be driven by the return of ultra-high net worth individuals. This will set the narrative for 2025.”

Download Singapore Sales and Investment Briefing Q3 2024 here.

For further information, please contact Alan Cheong, Executive Director, Research & Consultancy, Savills Singapore as the details below.