Top financial advisers in 2023

J.P. Morgan Securities LLC, Goldman Sachs & Co. LLC and Morgan Stanley took the lead as the top financial advisers on the largest global private equity and venture capital deals during full year 2023. Each adviser represented seven deals with deal credits of approximately $39.77 billion, $37.73 billion and $30.04 billion, respectively.

J.P. Morgan led the trio with the approximately $10.45 billion acquisition of experience management software company Qualtrics International Inc. by Silver Lake Technology Management LLC and Canada Pension Plan Investment Board.

J.P. Morgan also advised, along with Goldman Sachs and Morgan Stanley, the buyers TPG Capital LP and Francisco Partners Management LP in the roughly $7 billion acquisition of software platform New Relic Inc.

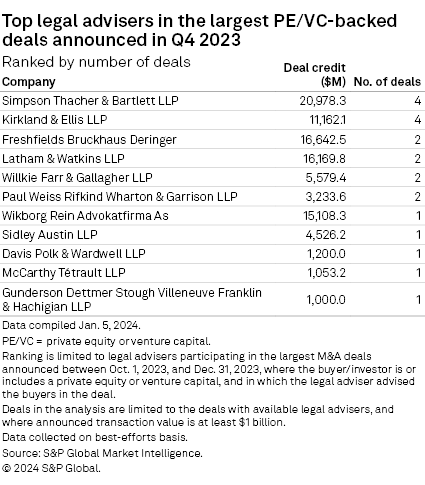

Top legal advisers in 2023

Kirkland & Ellis LLP secured the leading position among legal advisers for the most global private equity deals during full year 2023, working on nine transactions with a total deal credit of about $51.37 billion.

Simpson Thacher & Bartlett LLP secured the second spot, managing six deals with a combined deal credit of about $40.16 billion. Latham & Watkins LLP took the third position, participating in two deals with a total deal credit of approximately $25.55 billion.

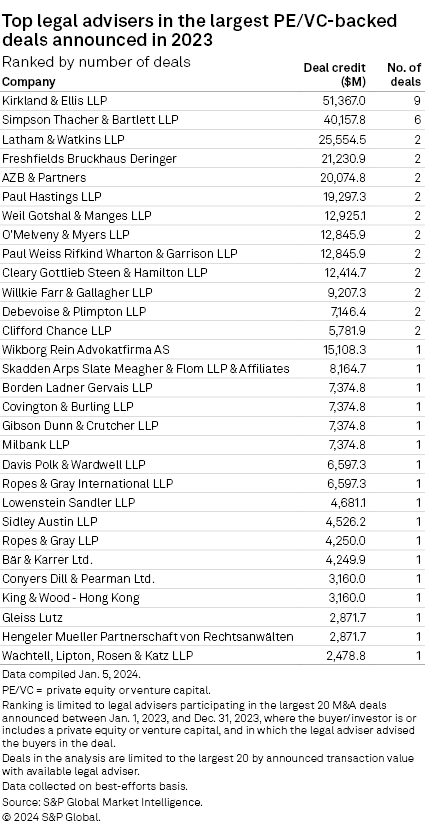

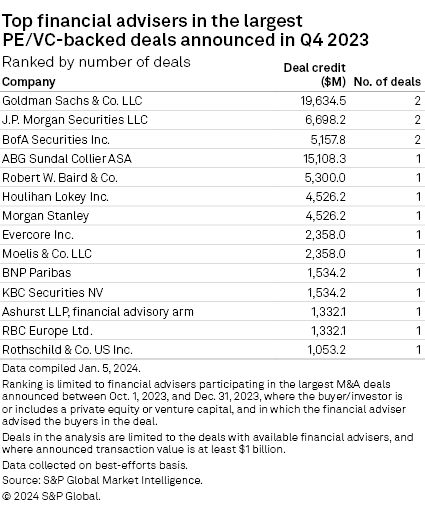

Q4 ranking

Goldman Sachs, J.P. Morgan Securities and BofA Securities Inc. took the lead as the primary financial advisers in the final quarter of 2023, securing two transactions each.

In terms of total deal credit from October to December, Goldman Sachs led the trio with about $19.63 billion. J.P. Morgan and BofA Securities logged deal credits of approximately $6.70 billion and $5.16 billion, respectively.

Goldman Sachs acted as the buy-side adviser of an investor group’s acquisition of online classifieds leader Adevinta ASA for $15.10 billion.

Goldman Sachs also advised, along with J.P. Morgan and BofA Securities, the buyers Clearlake Capital Group LP and Insight Venture Management LLC in the approximately $4.52 billion acquisition of analytic process automation business Alteryx Inc.

– Download a spreadsheet with data featured in this report. – Check out the third-quarter private equity league table story.

– Read some of the day’s top private equity news and insights from S&P Global Market Intelligence.

Simpson Thacher & Bartlett and Kirkland & Ellis were tied as top legal adviser in the fourth quarter, with four deals each. Simpson’s total deal credit was approximately $20.98 billion, while Kirkland’s deal credit amounted to about $11.16 billion.